Arbor Biotechnologies on Tuesday announced a new $74 million fundraise that comes as many of its peers in genetic medicine struggle to secure venture investment.

The Series C round led by Arch Venture Partners and TCGX will help Arbor advanced its lead program into clinical testing. Arbor is developing the gene editing therapy, dubbed ABO-101, for a rare kidney condition called primary hyperoxaluria type 1. A Phase 1/2 trial enrolling about two dozen volunteers is listed in a federal database, but hasn’t yet begun recruiting patients.

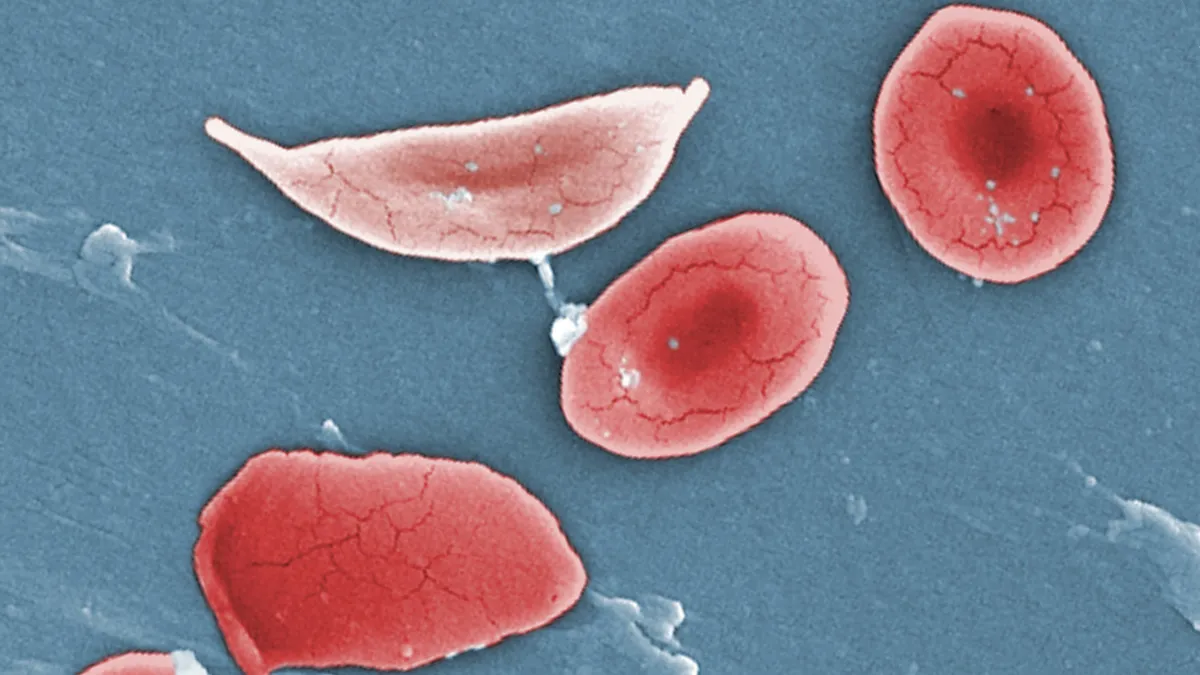

Primary hyperoxaluria type 1, or PH1, occurs when the body produces too much of a substance known as oxalate, which can lead to kidney stones and organ damage. The condition is rare, with some estimates holding that it affects between 1 and 3 out of every million people in the U.S. and Europe.

Since 2020, two RNA-based medicines — Alnylam Pharmaceuticals’ Oxlumo and Novo Nordisk’s Rivfloza — have won U.S. approval to treat PH1. They each disrupt oxalate production by blocking expression of a liver enzyme.

Both Alnylam and Novo’s therapies involve monthly or quarterly injections. ABO-101, by comparison, is meant to be a “one-and-done” treatment, said Arbor CEO Devyn Smith. It intends ABO-101 to durably reduce oxalate levels by knocking down a gene called HAO1. The medicine contains nucleic acid encoding for a type of CRISPR enzyme, wrapped in a so-called lipid nanoparticle.

At least so far, developers of genetic medicines have had a difficult time proving their therapies can win market share on convenience. In hemophilia, for which many effective medicines are available, multiple gene therapies — working via a different technology — have struggled to sell.

Smith says that, in the case of PH1, a curative therapy could address problems patients have with the available medications, though. Children with the disease, as well as their caregivers, have expressed concerns to Smith about the burden and cost of chronic injections. A single treatment that could last a lifetime “makes a lot of sense for them,” he said.

Beyond that therapy, Arbor is also working on treatments for an undisclosed, rare liver disease and amyotrophic lateral sclerosis. It has formed cell therapy-focused collaborations in recent years with Vertex Pharmaceuticals, Allogene Therapeutics and Edigene.

Arbor’s funding comes during a tough stretch for gene and cell therapy developers. Private funding has slowed down since the sector’s peak as investors have flocked towards safer bets. Among the roughly two dozen venture firms tracked by BioPharma Dive, only $1.4 billion went into gene and cell therapy startups last year, the lowest total since at least 2022.

The funding crunch has led companies to lay off employees or shift their strategy. Arbor was one, having cut staff and trimmed early-stage research last year. Smith said the restructuring was a reflection of the company’s maturation from “platform discovery work” to developing products.

“We were in that natural spot to evolve,” he said. “We felt very comfortable with the toolbox that we had, and it was time to double down and focus on the portfolio.”

Still, Smith hopes the sentiment surrounding genetic medicine change in the near term. It’s a “pivotal year” for gene editing, he said, with an array of trial readouts coming that could help rekindle investment interest.

"That will help build the safety database, as well as demonstrate the clinical benefit this technology can have for patients, and that's going to be a big boost,” he said.