CHICAGO — Hiroyuki Okuzawa holds an enviable position. The veteran Daiichi Sankyo executive took over as the Japanese drugmaker’s new CEO two months ago and inherited a company whose cancer medicines have, over the past half-decade, won it three of the pharmaceutical industry’s largest licensing deals.

One of those medicines, the antibody-drug conjugate Enhertu, again took the spotlight at the American Society of Clinical Oncology’s annual meeting here, showing potential to become part of standard therapy for the frontline treatment of advanced breast cancer. It did the same in 2022 and 2024.

Okuzawa can point to Enhertu and four other antibody-drug conjugates Daiichi Sankyo’s developing with AstraZeneca and Merck & Co. as proof of the strength of its research laboratories. By 2030, the company plans to have these five “ADCs” approved across more than 30 tumor types, which would allow it to treat nearly 400,000 cancer patients each year.

“We’d like to become one of the most important players in oncology,” said Okuzawa, noting aspirations to crack the top 10 companies by cancer drug sales. “Our senior leaders are now talking about not only top 10, but maybe top 5. We’re very much confident in our ADCs.”

But, current success notwithstanding, the task ahead of Okuzawa is among the most difficult in corporate management. Daiichi Sankyo has one hit drug platform; he must figure out what comes next.

“In the coming five years, our growth will be driven by these five programs,” he said in an interview at ASCO. “But at the same time, we would like to establish the next growth driver.” Identifying that driver will be a big part of the company’s next five-year plan, which it will launch for the fiscal year beginning next April.

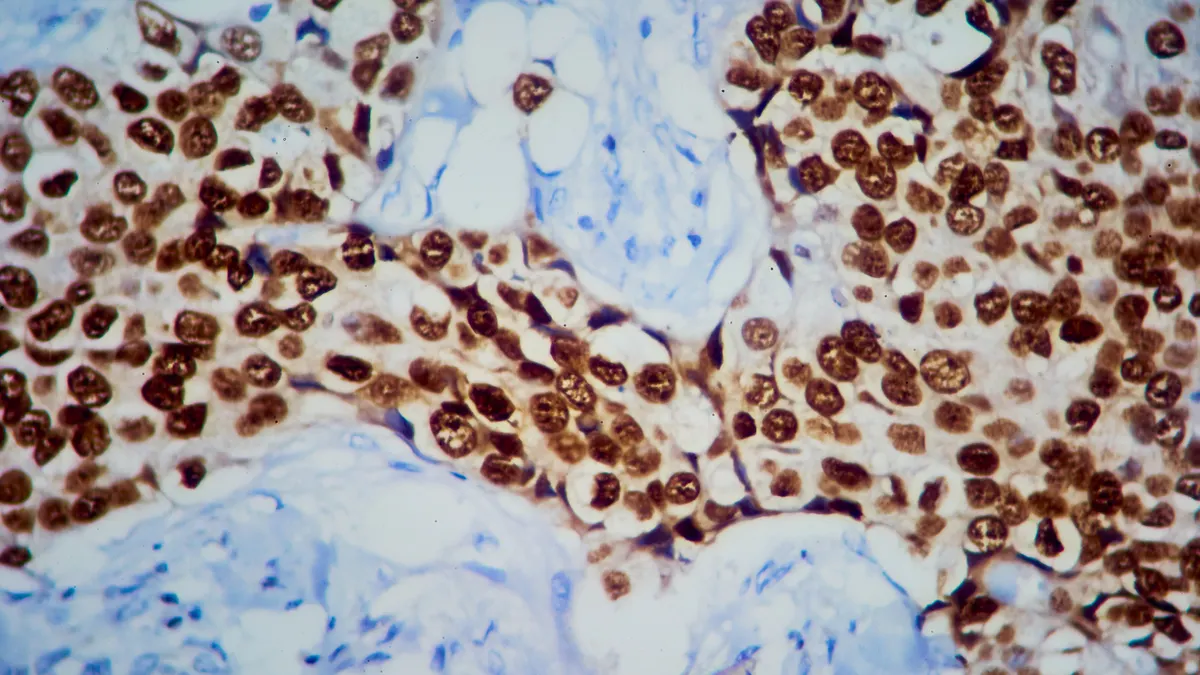

Daiichi Sankyo’s current ADCs are built around a technology known as DXd that the company’s scientists have fine-tuned since inventing it 15 years ago. It is the backbone for Enhertu, as well as the recently approved breast cancer medicine Datroway and three other ADCs that remain experimental.

ADCs like these contain three main components: a targeting antibody, a cancer-killing toxin and a linking molecule that can tightly hold onto the drug’s payload while it’s transiting through the body, but then release it upon arriving at the tumor. The concept is simple, but the details make the difference in balancing efficacy with safety.

Both AstraZeneca and Merck are convinced Daiichi Sankyo has struck the right balance. The former company gave Daiichi Sankyo $1.35 billion in 2019 to license rights to what became Enhertu and then one year later paid another $1 billion upfront for the drug the two companies now sell as Datroway. Then, in 2023, Merck bought rights to the three experimental ADCs for $5.5 billion in payments spread over two years.

Daiichi Sankyo’s next big thing might end up being more ADCs.

Okuzawa highlighted two as particularly promising. The first, dubbed DS-3939, combines an antibody licensed from Glycotope with the DXd backbone. It could be an opportunity for Daiichi Sankyo to take on independently, said Okuzawa. The other, DS-9606, uses a new payload technology Daiichi Sankyo hopes will yield other medicines in much the same way DXd has.

Yet Okuzawa, who has been at Daiichi Sankyo since 1986 and previously held several senior leadership positions, noted that the company’s research may take it in new directions, too.

“There are a lot of opportunities in the ADC space. On the other hand, [our scientists] are also pursuing discovery research outside of ADCs,” he said. “We have rich ideas for new modalities.”

In the meantime, Daiichi Sankyo needs to execute on the partnerships it already has in place with AstraZeneca and Merck. Combined, those deals promise up to $27 billion in conditional fees due upon Daiichi Sankyo’s medicines reaching certain regulatory and sales milestones. While some of those payments have already been made, the bulk remains unrealized.

Enhertu, which earned some $3.7 billion in sales last year, is well on track to meeting expectations. However, the path forward for Datroway and the lead program being developed with Merck may be steeper. While Datroway won an important U.S. approval in January, AstraZeneca and Daiichi Sankyo have narrowed their development plans in lung cancer after obtaining mixed study results. And late last month, Merck and Daiichi Sankyo withdrew an approval application for another ADC in lung cancer after it failed to extend survival in a study they presented Sunday at ASCO.

“Further biomarker analyses of the [study] are being conducted to determine if certain patient populations might differentially benefit as we explore the path forward for patritumab deruxtecan in lung cancer,” a spokesperson for Daiichi Sankyo confirmed by email, using the ADC’s generic name.

“However, we remain confident in the broad clinical development program of patritumab deruxtecan, which includes multiple clinical trials across 15 types of cancer.”

Development setbacks may be partly to blame for Daiichi Sankyo’s stock price, which in U.S. over-the-counter trading has fallen by one-quarter over the past year. Shares now trade at just under $26 apiece, about what they were worth at the start of the current five-year planning cycle in 2021.

Turning that around may require Okuzawa to navigate Daiichi Sankyo through broader economic challenges, too. The Trump administration is currently investigating whether U.S. importation of pharmaceuticals poses national security risks, a probe that is expected to result in tariffs levied against drugs shipped in from abroad. It’s not clear, however, which countries may be targeted.

“I’m concerned that the tariffs could disrupt the global supply chain and may cause drug shortages for U.S. patients,” said Okuzawa. “We would like to avoid such a situation.”

Daiichi Sankyo is responsible for supplying both Enhertu and Datroway, and does some of the drugs’ manufacturing outside of the U.S. The company plans to invest $350 million in building out a plant in Ohio that will be used in ADC production and is considering spending more, according to Okuzawa.

“We also started internally further discussion to expand the capacity of that New Albany plant to accelerate our ADC manufacturing,” he said.