Tucked into its latest earnings report, Eli Lilly disclosed that it has removed from its research pipeline an experimental drug for pain.

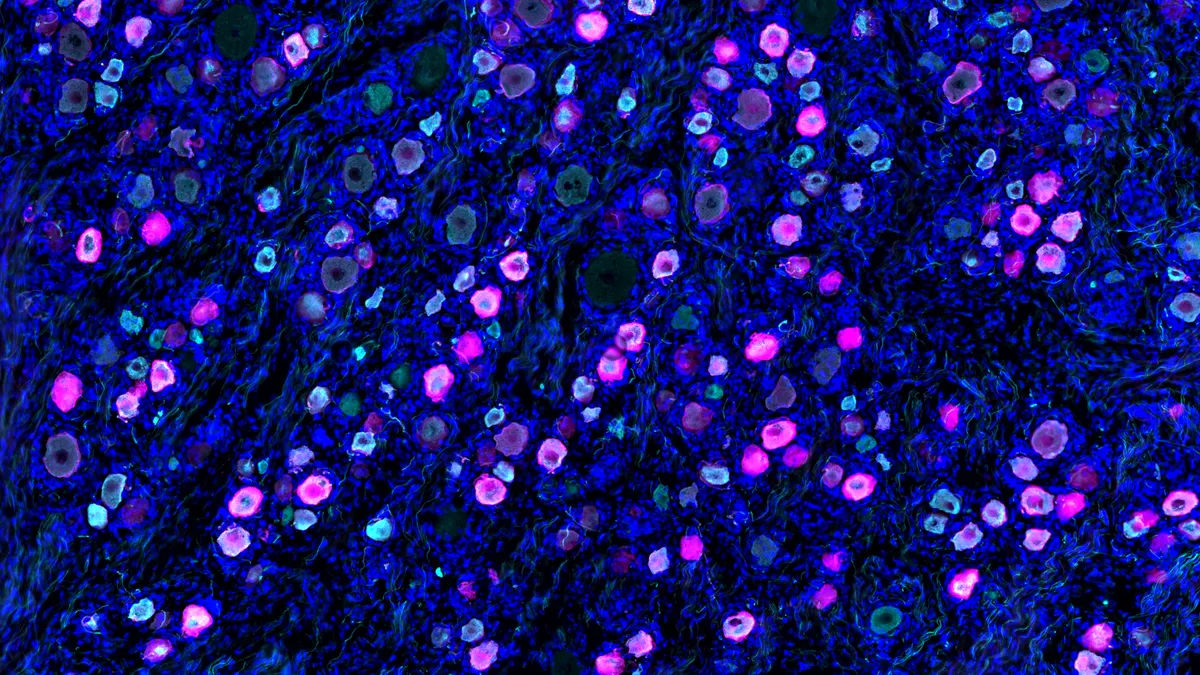

The drug, which Lilly in-licensed several years ago, works by inhibiting a protein called P2X7. This protein helps regulate molecules that trigger inflammation and amplify pain signals. Blocking P2X7, Lilly had hoped, would be an effective way to treat conditions like osteoarthritis, chronic lower back pain and the nerve pain that often accompanies diabetes.

However, data from mid-stage tests “did not meet our high internal bar for success,” according to Lilly spokesperson Ashley Hennessey. While the company is “assessing next steps for the program, including possible additional indications,” for now, the drug is out of its pain pipeline.

It’s at least the second Lilly pain program to get axed this year. A drug named mazisotine, designed to boost a pain-relieving protein known as SSTR4, was shelved this summer.

These cuts underscore just how incredibly difficult pain drug research continues to be, even for deep-pocketed companies with extensive experience studying the nervous system. Lilly’s biggest rival in pain, Vertex Pharmaceuticals, lost billions of dollars in market value a few months ago, after reporting a potential successor to its pioneering pain medicine Journavx had failed a key mid-stage trial.

Alongside that disclosure, Vertex said it would not start a late-stage study of Journavx in a form of sciatica, derailing plans to expand use of the drug into peripheral neuropathic pain.

Despite such setbacks, the immense number of people suffering from pain has encouraged some companies to keep pushing forward. Lilly, for one, has gradually deepened its investments over the past few years. In May, it wagered up to $1 billion on an acquisition of SiteOne Therapeutics, a private biotechnology company working on new, non-opioid pain medicines that may one day compete with Journavx.

“Lilly has had a persistent interest in pain in recent years ... but with little tangible success,” Carter Gould, an analyst at the investment firm Cantor Fitzgerald, wrote in a note to clients shortly after the acquisition was announced. “Given the deal terms and the clear strategic interest, this seems like a reasonable move,” even with the outstanding commercial and clinical questions for the class of drugs SiteOne specializes in.

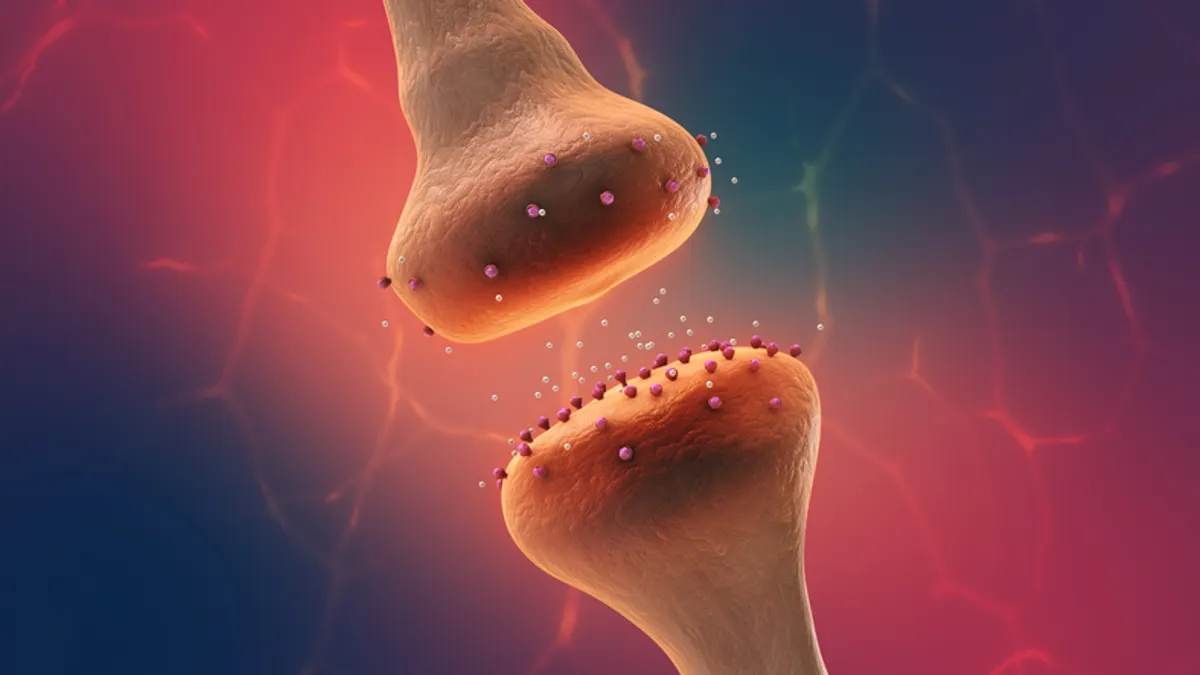

That deal handed Lilly a drug which had already gone through Phase 1 testing and, like Vertex’s molecule, targets a type of cellular signaling channel known as “Nav1.8.”

Beyond that program, Lilly has a another non-opioid, early-stage candidate targeting a protein, “AT2R,” tied to neuropathic pain.

And on the more advanced end, Lilly is evaluating whether an antibody that impedes the “epiregulin” protein can be a treatment for chronic pain. The company is also seeing if two of its most closely watched experimental therapies for diabetes and weight loss — orforglipron and retatrutide — could also be useful against osteoarthritis or chronic lower back pain.