Novo Nordisk is challenging Pfizer in a chase to acquire obesity drug developer Metsera, announcing Thursday a competing, unsolicited proposal to buy the company for $6.5 billion in upfront consideration.

With non-guaranteed, contingent payments, Novo’s bid could reach as much as $9 billion. In a statement, Metsera said it had notified Pfizer that Novo Nordisk’s offer was a “superior company proposal,” triggering a four-day window for Pfizer to counter.

Pfizer, in its own statement, called Novo’s bid “an attempt by a company with a dominant market position to suppress competition in violation of law by taking over an emerging American challenger.” Metsera had previously rejected a Novo offer “due to ‘a variety of risks’ in its deal structure,” Pfizer said.

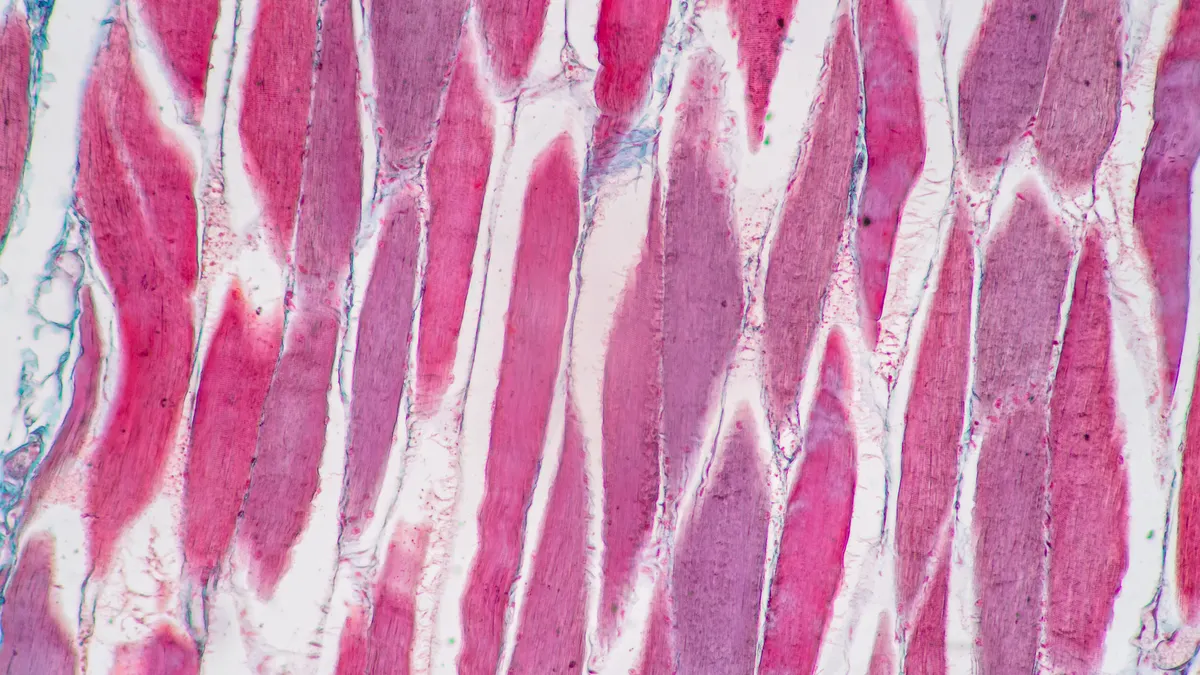

The bid comes a month after Metsera reported promising Phase 2 data on an experimental weight loss drug, and one week after Novo’s largest investor proposed a board overhaul to install members that will more quickly react to changes in the competitive obesity drug market.

Novo is offering $56.50 per share in guaranteed cash, with an additional $21.25 per share payout possible if certain deal targets are met. Pfizer, by comparison, bid $47.50 a share upfront plus $22.50 in future payouts.

Both companies are jostling for better positioning in an obesity market forecast to reach $100 billion a year in sales by 2030.

Novo was first to the market by launching two GLP-1 targeting drugs, Victoza and Wegovy, before any of its competitors. But it’s since ceded ground to rival Eli Lilly.

On Thursday, Lilly announced that sales of its obesity drug, Zepbound, tripled to $3.6 billion in the third quarter of 2025 over the same period in 2024. With Mounjaro, the diabetes drug that contains the same active ingredient as Zepbound, Lilly recorded more than $10 billion in third-quarter sales, officially surpassing Merck & Co.’s Keytruda and becoming the world’s best-selling medicine.

Novo’s efforts to follow up Wegovy, meanwhile, have stumbled. A combination obesity shot fell short of expectations in Phase 3 clinical trials, prompting the company to prioritize an oral version of Wegovy. Even there, Lilly is closely trailing Novo with a GLP-1 pill of its own, however.

Pfizer, meanwhile, was hoping that it would be among the first to launch an oral obesity medication, but scrapped two candidates because of safety concerns. Bidding for Metsera, which has a GLP-1 shot nearing Phase 3 testing and an oral prospect in Phase 1 trials, would allow Pfizer to re-enter the obesity chase in a relatively advanced position — and Novo to add to its already broad portfolio.

Novo is taking a risk with its bid, though. It’s offering $6.5 billion at signing in exchange for 50% of Metsera’s non-voting shares — regardless of whether the deal closes — and then paying the contingent fees later on in exchange for the remaining stock. This deal structure is “basically offering a 50% termination fee,” Evercore ISI analyst Umer Raffat wrote in a note to clients.

In responding to Novo’s bid, Pfizer appeared to invoke issues around American industrial competitiveness that could appeal to trade regulators in the Trump administration. Pfizer alleged the deal is “structured in a way to circumvent antitrust laws and carries substantial regulatory and executional risk.”

“The proposal is illusory and cannot qualify as a superior proposal under Pfizer’s agreement with Metsera, and Pfizer is prepared to pursue all legal avenues to enforce its rights under its agreement.” its statement read.

Moreover, Raffat wrote, Pfizer may believe its offer is superior because it won’t be subject to regulatory issues, meaning the big drugmaker may see the risk of the U.S. government blocking a Novo bid as more likely than Metsera’s board does.

A regulatory filing outlining Metsera’s deal talks may provide insight into that stance. In that filing, Metsera revealed that its attorneys — which were antitrust specialists — favored a deal structure that looked similar to what Novo has now offered.

Editor’s note: This story has been updated with additional details and analyst commentary.