Dive Brief:

- Novo Nordisk is expanding its pipeline of obesity medicines, announcing Monday it will pay China-based United Laboratories International Holdings $200 million upfront to license an experimental “triple agonist” weight loss shot that could take on Eli Lilly’s retatrutide.

- Per deal terms, Novo will have commercialization rights to the drug outside of China and nearby marketing territories, and could owe up to an additional $1.8 billion based on achievement of certain milestones by the drug, called UBT251. Novo would also pay royalties on sales in its marketing territories.

- Novo had a big head start in obesity, getting the GLP-1 drug Wegovy to people with obesity five years ahead of Eli Lilly and its medicine Zepbound. But Lilly is catching up quickly, showing in testing that Zepbound helps people lose more weight than Wegovy and closing the sales gap, which stands at $4.9 billion in 2024 to Wegovy’s $8.4 billion.

Dive Insight:

Both Novo and Lilly struggled to meet demand for their obesity drugs, forcing them to spend billions of dollars to boost their manufacturing capacity. With that issue now largely resolved, Novo is turning its attention to the competitive landscape, where it is facing a stiff challenge from Lilly and other potential rivals like Amgen, Pfizer, Zealand and Viking Therapeutics.

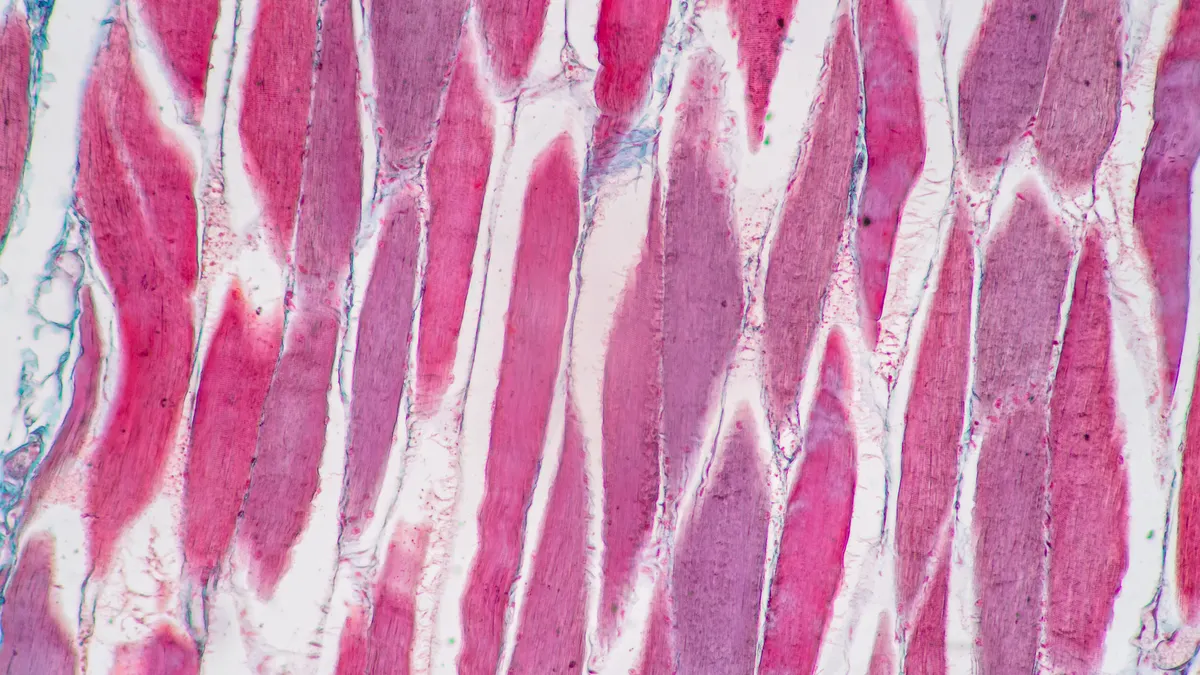

Novo pioneered the use of drugs stimulating a gut hormone called GLP-1 to help people with obesity lose weight. Lilly showed that, by acting on a second one called GIP, Zepbound could improve GLP-1s’ efficacy. Now drugmakers are experimenting with the use of other related pathways called glucagon and amylin — although Novo’s initial effort in that area, combining GLP-1 and amylin, has underperformed expectations.

Lilly is leading in triple-acting drugs, too, with an experimental shot it calls retatrutide that could have Phase 3 results next year. Novo advanced a tri-agonist into Phase 1 trials last year, but with the deal announced today it would have a drug that has already completed a Phase 1 dosing trial

“The addition of a candidate targeting glucagon, as well as GLP-1 and GIP, will add important optionality to our clinical pipeline, as we look to develop a broad portfolio of differentiated treatment options that cater to the diverse needs of people living with these highly prevalent diseases,” said Martin Holst Lange, Novo’s executive vice president for development, in a statement.

Novo said United’s medicine had a similar side effect profile as Wegovy, Zepbound and drugs in the class, and helped people who completed the trial lose 15.1% of their body weight over 12 weeks, compared with a 1.5% increase for people who got placebo.

The new tri-agonist will join an already beefy pipeline, which includes the GLP-1/amylin drug CagriSema, for which Novo still has high hopes, a version of its GLP-1 diabetes pill Rybelsus in obesity and various combinations of GLP-1, GIP and amylin.