Dive Brief:

- Swedish pharmaceutical company Sobi has reached a deal to acquire Arthrosi Therapeutics, a biotechnology startup developing a medicine for gout, in a deal worth as much as $1.45 billion.

- Sobi said on Saturday that it will pay $950 million in upfront cash, or about 9.1 billion Swedish kronor, for Arthrosi. It could add another $550 million to the deal if Arthrosi’s top drug candidate, named pozdeutinurad or AR882, hits a variety of clinical, regulatory and sales-based milestones. The buyout will be funded by new and existing debt facilities and should close in the first half of 2026.

- Arthrosi is developing pozdeutinurad for progressive and severe, chronic forms of gout, a form of arthritis caused by a harmful accumulation of uric acid in the body. Two Phase 3 trials are fully enrolled, with results expected in the second quarter of 2026. In a statement, Sobi president and CEO Guido Oelkers said Arthrosi’s drug could become “the therapy of choice” for people whose symptoms persist despite initial therapy.

Dive Insight:

Gout is believed to affect about 56 million people around the world and is best known for the sudden flare-ups of joint pain, or “gout attacks,” it causes.

For decades, patients with the disease have initially relied on a drug called allopurinol to lower the levels of uric acid in their bodies and alleviate symptoms. But allopurinol doesn’t help everyone, and there are few options behind it, such as an infusible drug called Krystexxa and currently sold by Amgen.

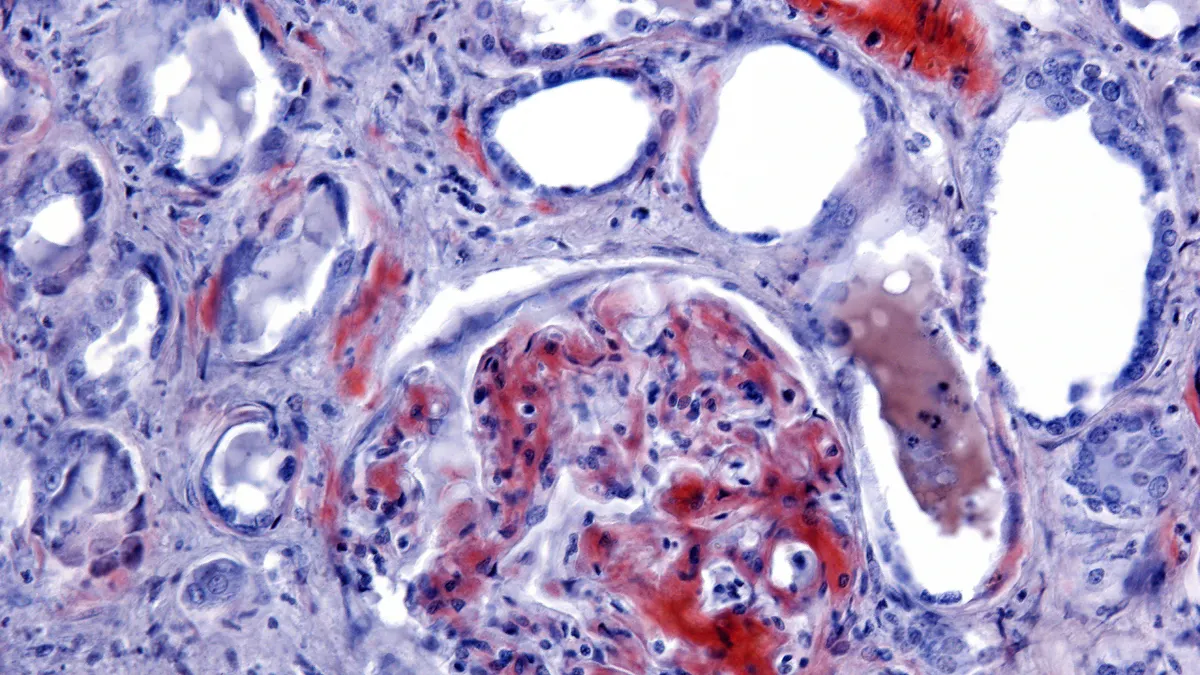

Arthrosi is one of several companies hoping to show that newer so-called URAT1 inhibitors will prove to be powerful alternatives. URAT1 is a transporter protein that regulates uric acid levels, making it a popular target for gout medicines. But an earlier URAT1 inhibitor called Zurampic and sold by AstraZeneca, was linked to kidney damage and pulled from the market four years after its 2015 approval.

By comparison, newer URAT1 inhibitors are supposed to be more specific to their targets and sidestep some of those safety issues. Arthrosi, for example, has described pozdeutinurad as a “highly potent and selective next generation” URAT1 inhibitor with the chance to become “best-in-class.” Dotinurad, a drug that’s marketed in multiple Asian countries and is partly owned by startup Crystalys Therapeutics, was designed to better protect the kidneys. Multiple China-based drug companies have newer URAT1 inhibitors in testing as well.

Sobi already has one treatment for uncontrolled gout that’s currently a pair of late-stage studies. Arthrosi’s drug “allows us to expand our gout pipeline with a highly differentiated new asset,” Oelkers said, adding that pozdeutinurad could “materially accelerate” the company’s growth until the mid 2030s “and beyond.”

Arthrosi was formed in 2018 and is backed by Prime Eight Capital, CR Biotech, HighLight Capital and a handful of other investors. It raised a $153 million Series E round in October.

Guangzhou, China-based ApicHope Pharmaceutical holds rights to pozdeutinurad in Greater China through a longstanding agreement with Arthrosi.