A new round of pricing deals between the White House and pharmaceutical companies will have negligible effects on sales and profits for the industry while offering relief from government threats, Wall Street analysts said.

On Friday, President Trump announced agreements with nine more drugmakers that he said would significantly lower the prices of prescription medicines.

The companies each made separate deals to offer discounts on specific drugs, many of which were already heavily rebated or nearing the end of their exclusivity. In return, the companies will receive three years of relief from Trump’s tariffs.

The deals amount to “another round of pandering on carefully selected drugs,” William Blair analyst Matt Phipps wrote in a note to clients. While the medicines will be offered at discounts for those who pay cash, there’s unlikely to be a significant difference in net prices, he said. The cash prices will likely be well above typical co-pays, meaning people with insurance will buy drugs the same way as in the past.

Indeed, one of the companies involved in the latest round of negotiations, Gilead Sciences, said it expects “the financial impact to be manageable in 2026 and beyond.” That’s likely true of all nine deals, Phipps said, telling clients he does not expect “significant impacts on the companies’ growth prospects.”

For their part, investors continue to push pharmaceutical and biotech stocks higher. Pharma and biotech indexes have been on the rise most of the year, since dipping in April as Trump threatened the industry with “major” tariffs. The threats led to a flurry of announcements of planned investments in U.S. manufacturing, but in the end the tariffs came with exemptions that significantly blunted their impact.

The latest deals are part of Trump’s push to bring “most-favored-nation,” or MFN pricing to pharmaceuticals. The idea is to align costs for U.S. consumers with those in countries that have price controls. In July, Trump sent letters to 17 large drugmakers giving them 60 days to lower prices or face government action.

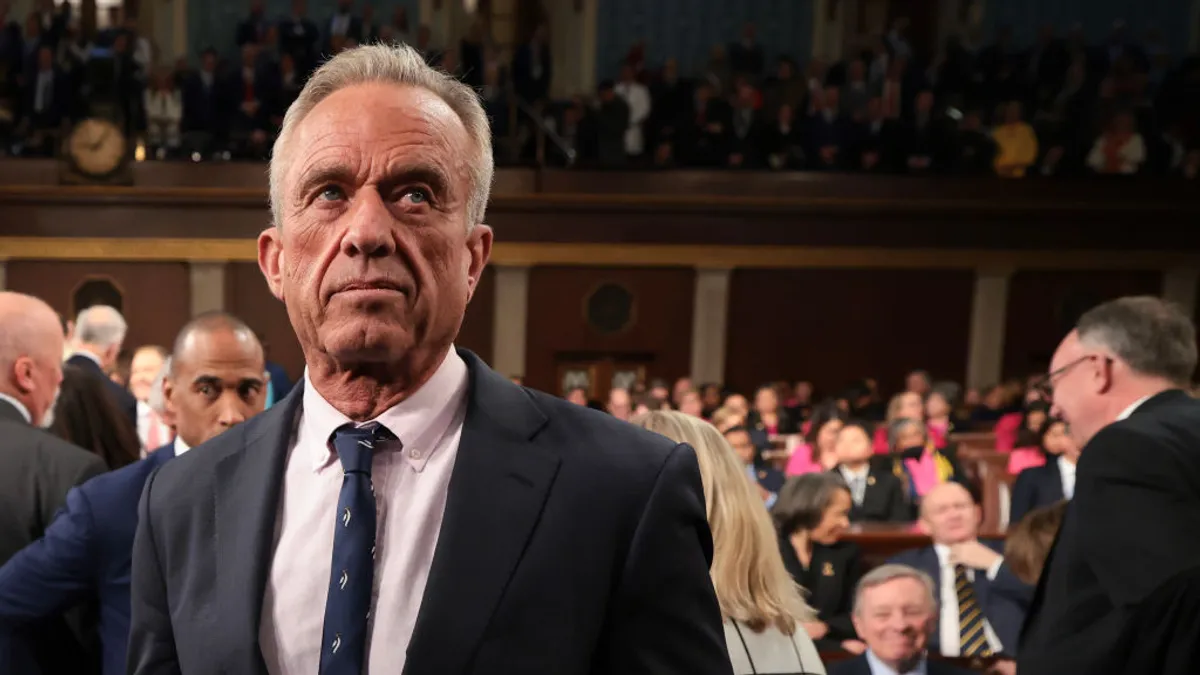

Pfizer, AstraZeneca, Eli Lilly, Novo Nordisk and EMD Serono all struck deals with the White House in recent months before Friday’s batch of agreements with Gilead, Merck & Co., Amgen, Bristol Myers Squibb, GSK, Novartis, Sanofi, Genentech, and Boehringer Ingelheim. Three companies remain – Johnson & Johnson, AbbVie and Regeneron – and analysts expect them to fall in line soon.

In addition to specific drug pricing deals, the White House claimed the agreement will “ensure foreign nations can no longer use price controls to free ride on American innovation by guaranteeing MFN prices on all new innovative medicines the nine companies bring to market,” the White House said.

It’s unclear how that provision will be enforced. And at least one company, Bristol Myers, said its deal means it “will not be subject to future pricing mandates.” The agreements also appear to have offered additional special enticements, with the Food and Drug Administration announcing national priority vouchers for speedy reviews for two Merck experimental drugs on the same day.

The lack of transparency on the negotiations has led Democrats to cry foul. Four top lawmakers last week sent letters to AstraZeneca, Lilly, Novo and Pfizer seeking information. “Skepticism and scrutiny are warranted as the Trump Administration has repeatedly made announcements that fail to meet their stated goals and instead only increase costs on the consumer,” they said.