Epigenetic editing startup Chroma Medicine is merging with Nvelop Therapeutics in a deal that will also bring in $75 million in funding to develop in vivo genetic medicines, the two companies announced Wednesday.

The combination will bring together technologies the companies describe as complementary: epigenetic editors from Chroma and non-viral particles from Nvelop capable of delivering those editors into the body. The new firm, dubbed nChroma Bio, will be led by Nvelop’s CEO Jeff Walsh.

Conversations about merging Chroma and Nvelop began in earnest a few months ago, at a dinner in late September between Walsh and Chroma CEO Catherine Stehman-Breen.

“We periodically get together to talk about the joys and challenges of building a next-gen genomics company,” said Walsh. “The topic of bringing together a cargo and delivery company came up and, as the dinner went on, we gained more and more conviction that it made sense for use to explore a combination.”

The companies already had several investors in common, including Arch Venture Partners, Atlas Venture and GV. Both were founded by the gene therapy pioneers David Liu and Keith Joung, among others.

“It's a combination of common vision, the complementary aspects of the companies and the commonality of people that really drove an accelerated discussion and ultimately culminated in the deal,” said Walsh.

The merger marks a rapid evolution for Nvelop, which emerged from stealth in April with $100 million to advance research from the laboratories of Liu and Joung. And it’s a change in course for Chroma, which laid off an undisclosed number of people in May, less than a year after raising $135 million in early 2023.

In an email response to BioPharma Dive’s questions, Walsh said there would be some reduction in the combined headcount of the two companies as a “necessary step” to “streamline operations and position nChroma for long-term success.”

NChroma plans to continue studying Chroma’s lead drug program, CRMA-1001, which is meant to be a “functional cure” for chronic hepatitis B and D. The company expects to begin a clinical trial in 2025, with early data to come as soon as 2026, said Jenny Marlowe, nChroma’s chief development officer.

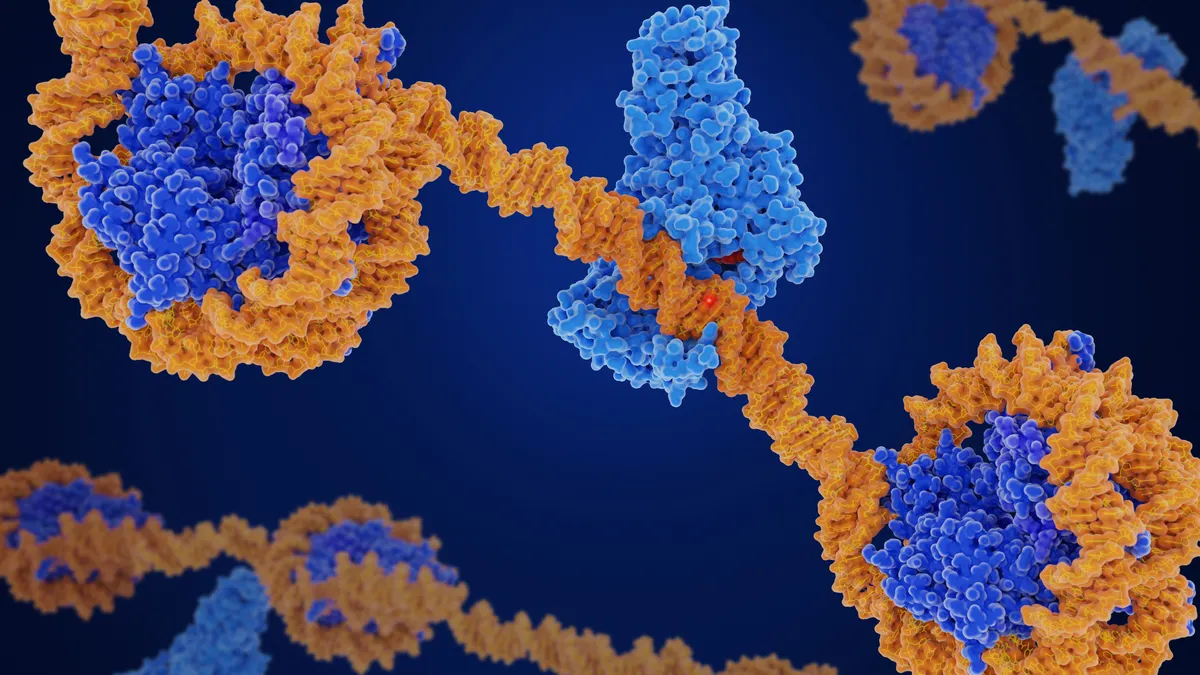

Chroma designed CRMA-1001 to change gene expression in the liver by using epigenetic editing. Unlike gene editing tools such as CRISPR, epigenetic editing focuses on the proteins and chemicals that can turn genes “on” or “off.” Chroma, as well as several other biotechs, have been advancing the technology as a genetic medicine alternative that doesn’t require changing DNA directly, which may trigger unwanted side effects.

“With epigenetic editing, we can effectively silence the expression of all viral antigens from hepatitis B without actually cutting the DNA, which is likely to be a challenge from a safety perspective,” said Marlowe.

While CRMA-1001 targets the liver, nChroma hopes to take aim at other tissues using Nvelop’s tools — a goal that’s proved challenging to many developers of other gene therapy technologies.

The $75 million in new funds should help nChroma identify multiple product candidates over the next several years, Marlowe and Walsh said. And it’s that “engine” they think may prove attractive to potential partners across the industry.

“With the tools and technologies that now are under one roof, we do have real opportunity to expand the reach of what we could do just ourselves,” said Walsh. “We think this is going to be a catalyst for future partnerships going forward.”

NChroma’s funding came from 19 venture firms, an expansive syndicate that included many of the same firms that previously invested in Chroma or in Nvelop. Cormorant Asset Management, Arch, Atlas and Newpath Partners led the round.

“This has been a more challenging market, in general for biotech but then specifically for the genetic medicine space,” said Jeff Marrazzo, the former CEO of Spark Therapeutics who served on the boards of both Chroma and Nvelop. “I think people understand there's complexity and challenges that need to be overcome with both delivery as well as in the unique set of cargoes that can be applied in different diseases.”

Investment in cell and gene therapy makers has stuttered in recent years as some of those challenges have become more apparent. So far this year, more than $1.3 billion has been invested in cell and gene therapy companies by 23 venture firms tracked by BioPharma Dive, compared to $1.8 billion in both of the two years prior.

Marrazzo will chair nChroma’s board, while executives from both companies will fill out the new firm’s leadership. Stehman-Breen will serve as an adviser.