Paragon Therapeutics, a biotechnology company creator with a web of spinouts, is taking a new startup public to develop an emerging type of cancer immunotherapy.

The startup, Crescent Biopharma, on Tuesday announced a reverse merger with GlycoMimetics, a struggling, publicly traded developer of oncology and inflammatory disease drugs. In support of the deal, the combined company has raised $200 million in financing from 17 major investment firms — among them Fairmount and Venrock Healthcare Capital Partners — and expects that money to keep it operating through 2027.

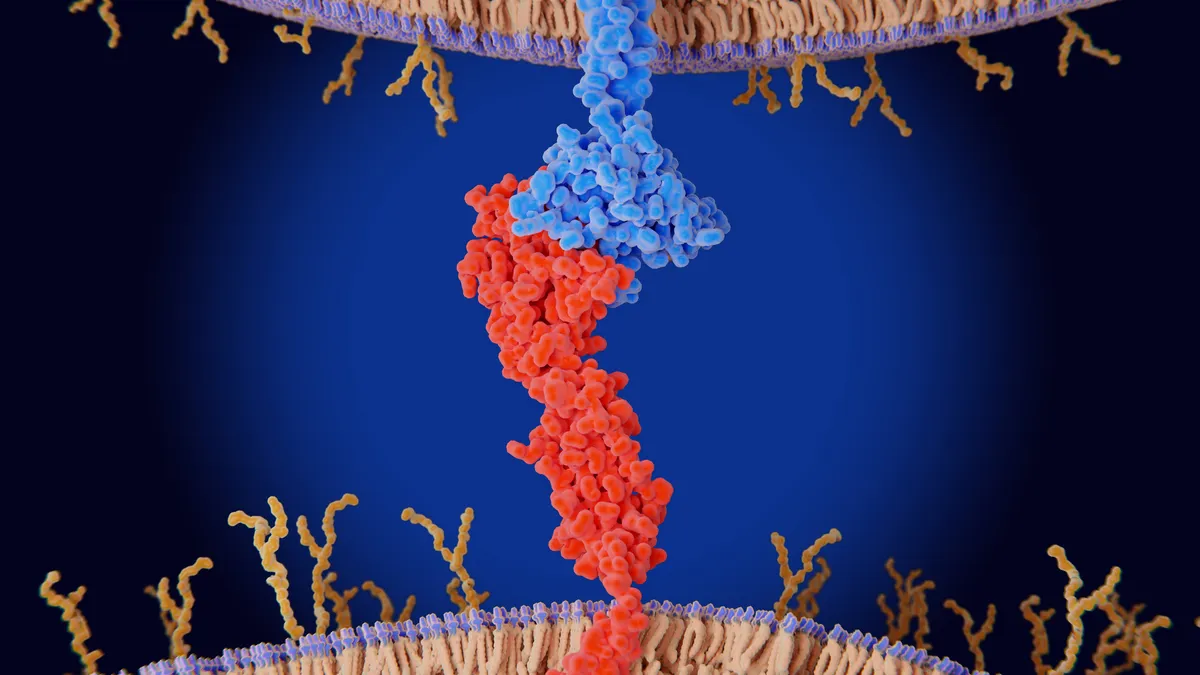

The new company will take the Crescent name, be about 97% owned by Crescent stockholders, and be led by the startup’s interim CEO and Fairmount venture partner Jonathan Violin. Its chief goal will be to advance a group of cancer medicines led by a dual-pronged immunotherapy that simultaneously targets the proteins PD-1 and VEGF.

Study results in September showed that approach could improve upon standard immunotherapy treatments, like Merck & Co.’s Keytruda. Drugs targeting PD-1 and VEGF have since drawn the interest of an array of biotech companies, of which Crescent is the latest to emerge.

Crescent’s drug originated from Paragon, a “hub-and-spoke” biotech with a handful of offshoots developing biologic medicines for different diseases. One of those startups, Apogee Therapeutics, is working on a long-lasting eczema drug. It raised $300 million in an initial stock offering last year and is currently one of the best performing biotech IPOs since 2018, according to BioPharma Dive data.

Two other Paragon companies, Oruka Therapeutics and Sypre Therapeutics, are working on medicines for inflammatory conditions. Both have merged with the shells of distressed, publicly traded companies, rather than pursue an IPO, to quickly get to Wall Street. They’re currently trading well above their debut prices. (Another immune-focused startup, Jade Biosciences, raised $80 million in private funding in August.)

Crescent aims to be next. The company is combining with GlycoMimetics, the share price of which plummeted in May after regulators told the biotech it would need to run an additional trial of its leukemia drug uproleselan before filing for approval. Crescent said it will evaluate the “potential paths forward” for uproleselan. But its pitch largely revolves around the PD-1 and VEGF-targeting therapy, which is dubbed CR-001 and is expected to deliver initial data from a solid tumor study in the second half of 2026.

On a conference call Tuesday, Crescent CEO Violin said CR-001 was specially made to be an optimized version of ivonescimab, the Akeso and Summit Therapeutics drug that bested Keytruda in a Phase 3 trial in lung cancer. Crescent’s drug, he claimed, is a “purpose-built molecule designed to recapitulate precisely the pharmacology of ivonescimab,” while enhancing its “stability and manufacturability.”

Crescent is well behind Summit and other competitors such as BioNTech and Instil Bio. Even so, the company aims to show early data from a few dozen patients can “connect the dots” back to results Summit and Akeso accrued in larger trials. From there, Crescent intends to advance trials in indications for which it has the chance to be the first to market with a PD-1 and VEGF drug. It also intends to incorporate results obtained by rivals into strategies for potential combination regimens.

“When something beats the leader of such a large and important drug class, we expect competition,” Violin acknowledged. But “we believe we have the advantage of strategic molecule design.”

Crescent is working on two other antibody-drug conjugates, a type of targeted cancer medicine, that are in preclinical testing. It didn’t disclose specifics about their development plans.

The merger should close in the second quarter of 2025.