Biotechnology startup Diagonal Therapeutics has added $125 million to its coffers, the company said Thursday, in a Series B round that will propel its first drug prospect into the clinic this year.

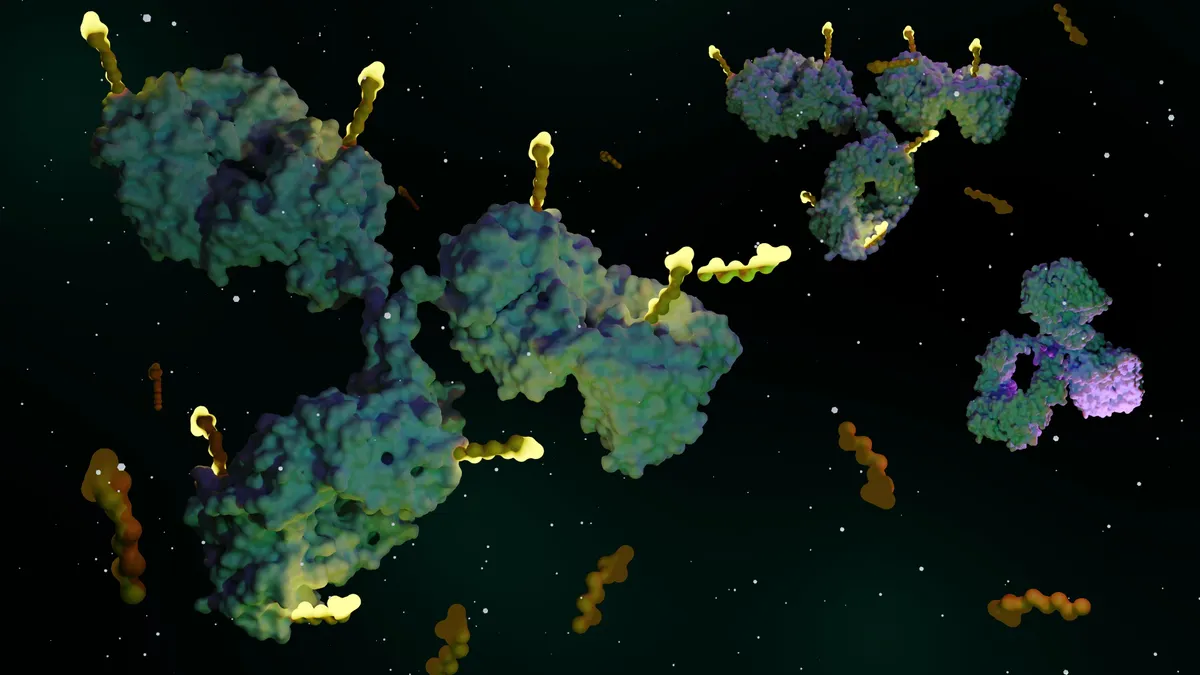

Many antibody drugs are designed to block signaling pathways implicated in the progression of diseases, such as tumor growth in cancer or inflammation in immunological disorders. Diagonal is working on specialized kinds of multi-pronged “clustering” antibodies that bind to cellular receptors and force them together in a specific shape. These contortions result in different signals that may be able to switch on a pathway that’s been disrupted by disease.

The company’s first attempt at the concept is DIAG723. With it, the company is homing in on two conditions: a rare genetic disease called hereditary hemorrhagic telangiectasia and pulmonary arterial hypertension, a disorder that affects the lungs and heart. The company had originally sought to develop separate drugs for each disease, but found that a singular “clustering” antibody might impact both of them by reactivating a signaling complex called ALK1, said Alex Lugovskoy, the biotech’s CEO.

“Given that we are addressing the foundational defect in these diseases, that gives us a lot of confidence that it would be a mechanism that could be beneficial in patients,” Lugovskoy said.

Hereditary hemorrhagic telangiectasia affects an estimated 150,000 people in the U.S. and Europe. The disease triggers the development of abnormal blood vessels that can rupture and lead to bleeds as well as chronic anemia. Treatments only help with symptoms, leaving room for a therapy that, like DIAG723, might be able to address the condition’s root cause.

There’s more competition in pulmonary arterial hypertension, for which Merck & Co.’s Winrevair recently approved and other options like Johnson & Johnson’s Opsumit and Uptravi and United Therapeutics’ Tyvaso can alleviate symptoms. But Lugovskoy sees DIAG723 as a potentially complementary therapy to treatments like Winrevair.

Behind DIAG723 in its pipeline are unnamed prospective treatments for iron overload and chronic kidney disease.

Sanofi Ventures and Janus Henderson Investors co-led Diagonal’s Series B round, which involved more than a dozen investors in total. Those two firms, he said, were particularly attractive because of Sanofi’s “vibrant hematology franchise,” and Janus Henderson’s “level of understanding of a medicine development path when we go forward.”

Other participating firms included Deep Track Capital, Atlas Venture, RA Capital Management, Frazier Life Sciences and Viking Global Investors. The company has now raised more than $250 million since emerging from stealth in 2024.