Large employers are bracing for a substantial increase in healthcare costs next year, driven by higher spending on medicines like the popular GLP-1 drugs for obesity, according to the Business Group on Health’s annual survey of its members.

The predicted 7.8% spending increase is the highest projection in more than 15 years, per the group, which this summer surveyed large employers that collectively cover about one-tenth of the more than 160 million Americans who receive insurance through their job.

The survey results are the latest evidence employers are preparing for a major jump in healthcare costs next year.

“A lot of pressure will be coming down on employers,” said Brenna Shebel, a vice president for the Business Group on Health, or BGH, in a Tuesday briefing with reporters.

Projected and actual health costs have regularly ticked higher, despite some fluctuations during the pandemic. Last year, the actual cost growth was higher than employers and their consultants predicted — something that, outside of 2021, hasn’t happened recently, according to BGH CEO Ellen Kelsay. That may bode poorly for this year and next.

Projected health cost rise is highest in recent years

Spiking pharmacy spend

The projection for a sharp increase next year is mostly due to pharmacy costs.

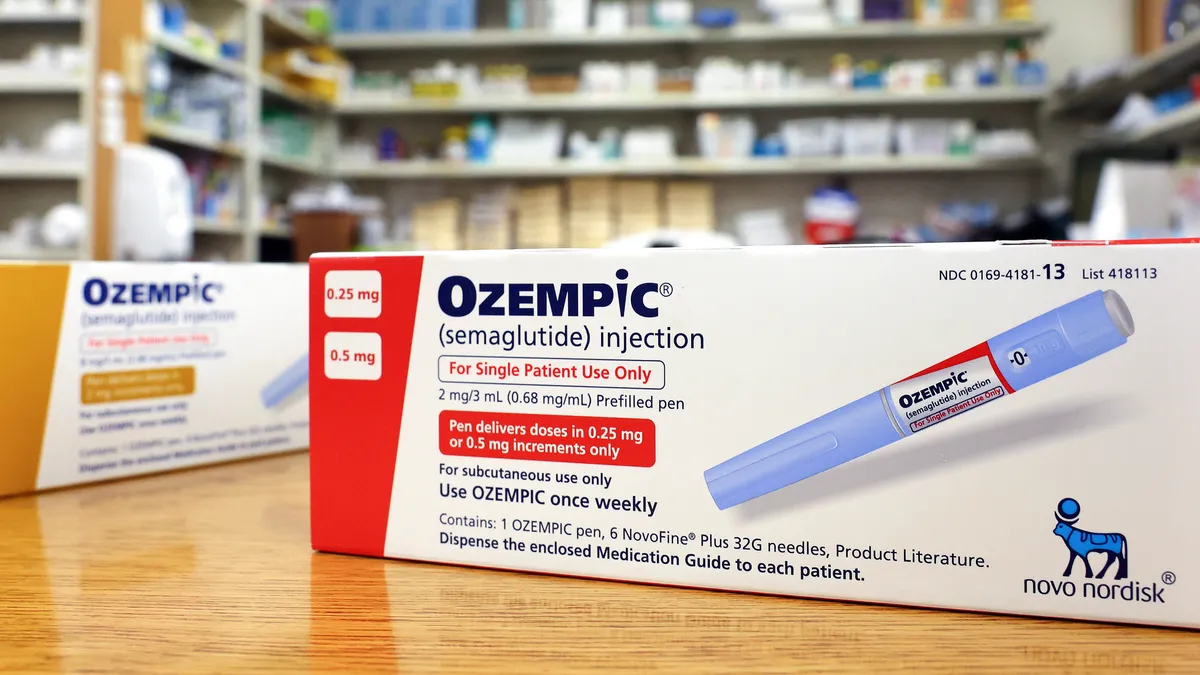

From 2021 to 2023, the median amount of healthcare spend on pharmacy rose from 21% to 27% — a “staggering” figure, Kelsay said. In particular, high demand for GLP-1 drugs from Novo Nordisk and Eli Lilly, is increasingly pressuring employer budgets.

The medicines, which sold for diabetes as well as obesity, are powerfully effective at reducing weight and have proven beneficial for a range of other conditions, from heart failure to sleep apnea.

Employers have grappled with coverage decisions for the drugs, which carry list prices between $1,000 and $1,400 per month. (Rebates given by manufacturers mean the net price charged to payers is lower.) The cost is amplified by the significant — and rising — demand for the medicines. By 2030, an estimated 30 million people in the U.S. could be on GLP-1 drugs, according to investment bank J.P. Morgan.

A majority of employers surveyed by BGH said GLP-1s are impacting healthcare costs to a “very great” or “great” extent. The next highest factors were spending on high-cost therapies and mental health conditions.

The contribution of GLP-1s is “relatively surprising” given how quickly demand for the drugs has grown, Kelsay said.

More than three-fourths of employers report being “very concerned” about overall pharmacy cost, BGH found, while a majority expressed concerns about business practices in the pharmaceutical supply chain.

Pharmacy benefit managers, the powerful middlemen that negotiate drug rebates, loomed large. To critics, PBMs favor high-cost drugs so they earn larger rebates and therefore higher profits. They have also been attacked for hidden fees, self-dealing and complex contracts that health insurers and employers say leave them in the dark.

Their practices has drawn scrutiny from Congress and the Federal Trade Commission. Antitrust regulators have zeroed in on how the three largest PBMs — UnitedHealth’s Optum Rx, CVS’ Caremark and Cigna’s Express Scripts — could be wielding their market power to stifle competition.

Most employer respondents to the BGH survey called for reforms, whether by the government or through the private sector. Employers are also interested in “transparent” pharmacy benefit models that give them a clearer line of sight into how drugs are priced.

Twenty-five percent of employers had a transparent PBM program in place this year, while another 40% are considering implementing one in the next few years, according to the survey.

Most employers say they’re concerned about PBM practices

Employers are also exploring new PBM partners. Next year, one-third of employers will reassess their current pharmacy benefits provider or request new bids from other vendors, BGH found.

Major PBMs have already lost some big clients. They’ve responded by standing up new models they claim are lower cost and more transparent, including Caremark’s TrueCost, Optum Rx’s Clear Trend and Express Scripts’ ClearNetwork.

“Some of the more traditional PBMs and partners do offer, and have expanded their offerings to offer, some of the things employers are looking for like greater transparency,” Kelsay said. “They’re all being considered and I think it’s all fair game.”

Employers aren’t sparing drugmakers, either. Just 1% of employers said the prescription drug market is competitive enough to keep drugs affordable, per BGH.

Other findings

Employers cite cancer as the medical condition driving the most spending. Cancers among young people are rising, as are the cost of cancer treatments, according to BGH’s survey. As a result, employers are focused on boosting prevention efforts like screening.

This year, the estimated total cost of healthcare per employee is $18,639, up $1,438 from last year, the survey found.

Employers told BGH that they won’t reduce benefits and plan to absorb most of the costs instead of passing them to their employees.

However, that claim contradicts typical employer practices and recent research. For example, the consultancy Mercer found 45% of employers are likely or very likely to shift rising expenses onto workers.

Employer respondents to the BGH survey said they plan to leverage other cost management strategies, like prior authorization for GLP-1s and other drugs.