Incyte has run into development hurdles with two drugs it acquired earlier this year, setting back the biotechnology company’s plans to branch out from its top-selling medicine.

Incyte said on Monday it will pause enrollment in a Phase 2 study testing a drug codenamed INCB000262 in a chronic form of hives, or urticaria. Incyte stopped the trial because of new results from a toxicology study in animals. The company didn’t detail those findings, but said it’s shared them with the Food and Drug Administration and will work with the regulator to determine the program’s next steps.

Incyte has already completed enrollment in other proof-of-concept studies of INCB000262 in atopic dermatitis and inducible urticaria. Data from those trials will guide future development of the drug as well as “back-up molecules,” the company said.

Incyte also revealed it’s scrapping another drug, INCB000547, due to Phase 2 results in a type of itching associated with liver disease that “don’t support further development.”

The announcement is a step backwards in Incyte’s long-running effort to solve its “single-asset syndrome,” a heavy reliance on the myelofibrosis drug Jakafi that still earns the bulk of its revenue. In the first nine months of the year, Jakafi accounted for nearly 80% of the company’s roughly $2.6 billion in net product sales. But the drug is facing increasing competition and could lose patent protection later this decade.

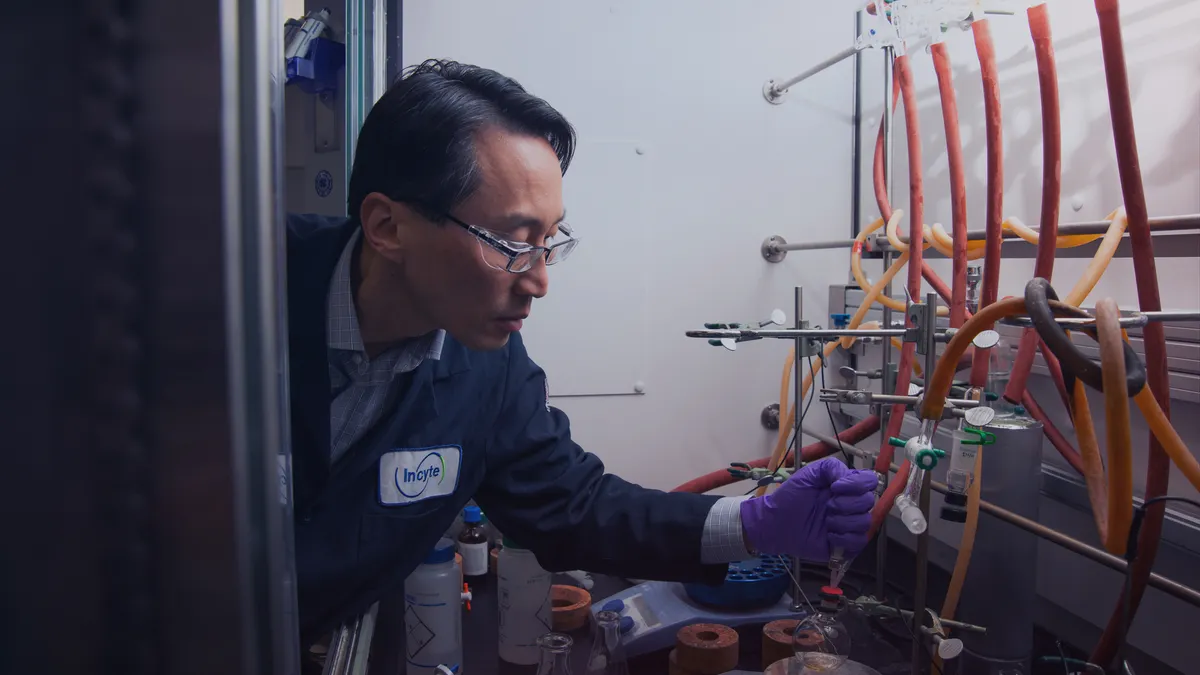

Incyte has been attempting to lessen its dependence on Jakafi by branching out into dermatology, immunology and some rare blood cancers. While it’s had some success with in-house research — bringing to market a cream form of Jakafi it sells for a pair of skin conditions — dealmaking has become a focus over the last few years. A partnership with Syndax Pharmaceuticals yielded a drug for graft-versus-host disease it now sells as Niktimvo. The lymphoma drug Monjuvi was acquired from biotech MorphoSys. The company has also acquired a pair of startups, buying the dermatology focused biotech Villaris in 2022 and striking a deal for privately held immune drug developer Escient Pharmaceuticals in April.

The Escient buyout was the largest of those bets — a $750 million deal that gave the company what Wall Street analysts viewed as a high-profile drug candidate. INCB000262 is a potential oral treatment for urticaria, a common condition that’s a target of several drugmakers. It’s one of at least two programs in development that blocks a protein called MRGPRX2 that’s expressed on the mast cells thought to drive the disease. The drug “has the potential to be transformative, if successful,” wrote RBC Capital Markets analyst Brian Abrahams on Monday.

Yet, after speaking with Incyte executives, Abrahams noted there is still uncertainty on what the next steps are for INCB000262. Should development continue, results from all three proof-of-concept studies could come in early 2025. If not, Incyte won’t disclose data, though backup drugs could enter human testing “relatively shortly” thereafter, he wrote.

The study pause puts “a significant $1.8 billion [revenue] opportunity at risk,” and “risks impairing the growing enthusiasm on the rest of the pipeline,” Abrahams added.

Investors will now pay even closer attention to a Phase 3 readout next year for a drug, povorcitinib, in the autoimmune condition hidradenitis suppurativa, wrote William Blair analyst Matt Phipps.

Incyte shares fell more than 10% in early trading Tuesday.