The Food and Drug Administration has approved another medicine for a rare condition that arises after a bone marrow or stem cell transplant, when donor cells treat the new body they’ve been placed into as a world of foreign pathogens and start attacking its healthy tissues.

The condition, known as graft-versus-host disease or GVHD, is a leading cause of death from bone marrow transplants, which are used to treat certain blood cancers, solid tumors and immune disorders. By some estimates, close to one-third of those who undergo this procedure experience GVHD.

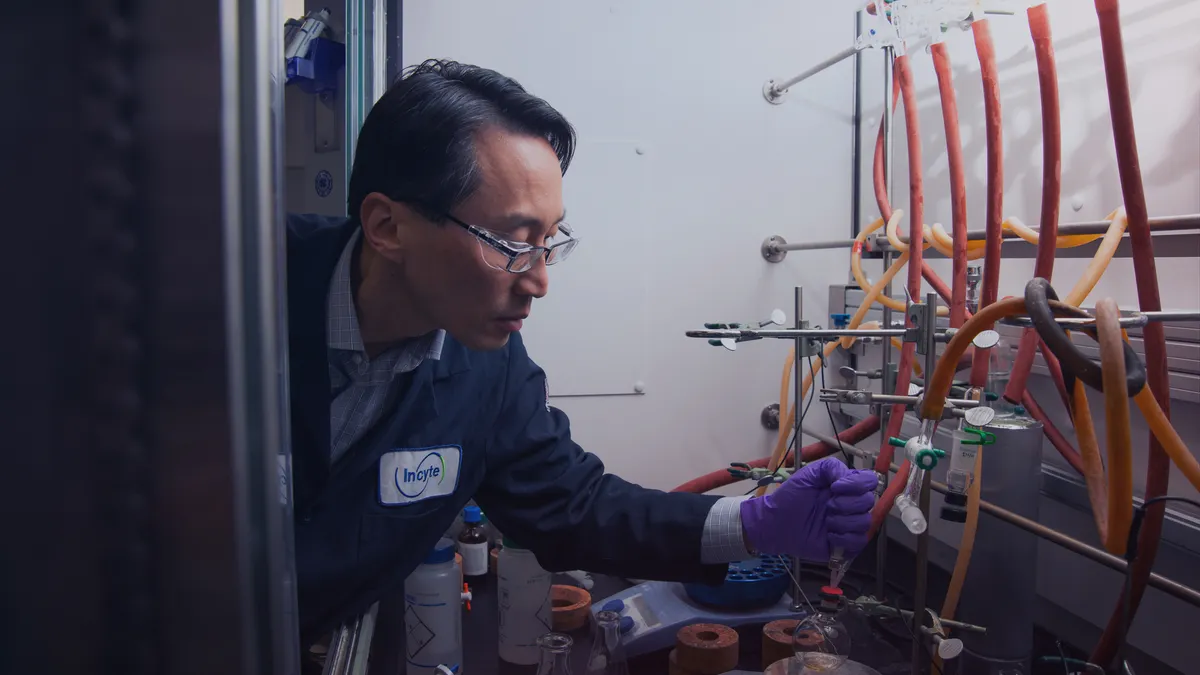

In 2017, the FDA cleared Imbruvica, an AbbVie and Johnson & Johnson drug mostly used to beat back blood cancers, as a treatment for chronic GVHD. Since then, the agency has approved a few more therapies, including Incyte’s Jakafi and Sanofi’s Rezurock, the latter of which was acquired through a buyout of biotechnology company Kadmon Holdings. Now, the latest addition is Niktimvo, which was developed through a partnership between Incyte and Syndax Pharmaceuticals.

Niktimvo doesn’t work like its predecessors. An antibody-based drug, it targets and blocks a protein involved in the development and survival of certain kinds of white blood cells. The FDA cleared Niktimvo for chronic GVHD, in patients who meet a weight requirement and whose disease wasn’t addressed after at least two prior systemic therapies.

Usually, the initial treatments for GVHD are steroids. But roughly half of all patients don’t respond, so they advance to more targeted drugs. Analysts at the investment bank Jefferies say they’ve spoken to medical experts in this space, and learned Jakafi is often chosen over Imbruvica in this setting for safety and efficacy reasons. In cases where Jakafi doesn’t adequately work, the go-to treatment is Rezurock, which last year hit $310 million in sales.

The experts said Niktimvo could be used for the significant portion of patients who require a fourth line of therapy, according to Jefferies analyst Kelly Shi. In a note to clients, Shi wrote that her team’s conservative forecast is that annual Niktimvo sales will reach $324 million by 2035.

Sales could grow higher if the FDA clears Niktimvo for use earlier in the treatment process. To that end, Incyte is sponsoring a mid-stage study that will evaluate the drug in combination with Jakafi. The trial aims to enroll around 120 participants and produce results in 2027. Incyte and Syndax also plan to launch sometime this year a late-stage study pairing Niktimvo with a steroid.

The approval granted Wednesday “will serve as a cornerstone” to Niktimvo eventually securing a broader label, according to Shi.

A spokesperson for Incyte said Niktimvo’s price will be disclosed when the product becomes available for commercial sale. In a note to clients, RBC Capital Markets analyst Brian Abrahams wrote that the drug should be launched early next year, once two smaller vial sizes of it are approved.

The analyst added that Incyte and Syndax have hinted at Niktimvo carrying a slight premium to Rezurock, which costs about $20,000 to $25,000 a month on average. The RBC team assumes a Niktimvo list price of $21,500 per month.