Dive Brief:

- Johnson & Johnson has added to an autumn upswing in pharmaceutical acquisitions, announcing Monday it will spend $3.05 billion to acquire biotechnology startup Halda Therapeutics and its pipeline of medicines designed to “hold and kill” tumors.

- The acquisition hands J&J a technology that emerged from discoveries made in the Yale University lab of serial biotech entrepreneur Craig Crews and could yield a new type of targeted cancer therapy. Halda presented early-stage data for the first of those medicines, an experimental prostate cancer treatment, at a medical meeting in October.

- Halda emerged from stealth in 2023 and has since raised more than $200 million to help develop its technology, which spurs an interaction between proteins that kills cancer cells.

Dive Insight:

Johnson & Johnson had already made the year’s biggest acquisition with its $14.6 billion buyout of Intra-Cellular Therapies, a company that had already brought to market a medicine for psychiatric conditions. Monday’s deal is a multibillion-dollar bet on a less established commodity, a biotech with a promising but unproven method of developing cancer treatments.

J&J has a well-stocked portfolio in oncology and in prostate cancer specifically, for which it sells the drugs Zytiga, Akeega and Erleada. In Halda, though, it sees the potential for medicines that might help overcome resistance to those kinds of drugs.

Halda’s treatments are based on a technology known as “RIPTAC” that’s designed to essentially smother a protein essential to a cancer cell’s survival. This approach could be used to precisely target overexpressed proteins within a tumor, while sparing healthy tissue, and potentially sidestep a mechanism tumors use to develop drug resistance.

“Many therapies lose effectiveness over time due to resistance. Halda’s innovative technology is designed to work even when cancers no longer respond to standard treatments using a novel mechanism that enables the selective killing of cancer cells,” said John Reed, J&J ‘s executive vice president for innovative medicine R&D, in a statement.

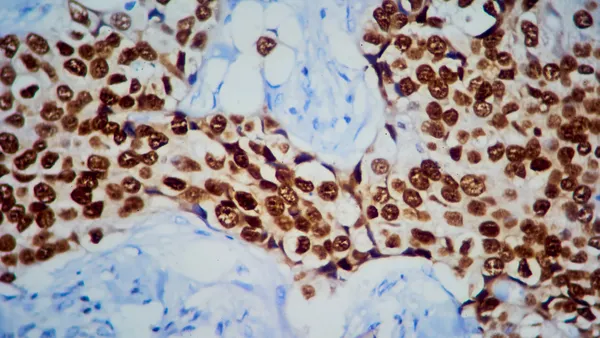

The first-in-human data Halda presented in October came from a Phase 1 trial testing a therapy called HLD-0915 in 31 people with advanced prostate cancer. Among the patients receiving at least two cycles of the highest dose recommended for further testing, four saw a 90% drop in prostate-specific antigen levels, a marker associated with improved outcomes.

HLD-0915 will join four novel prostate cancer drugs in J&J’s pipeline, including a bispecific antibody called pasritamig that’s in Phase 3 testing.

J&J said it expects the deal to close “within the next few months.” It will reduce its expected per-share earnings by 15 cents in 2026 due to short-term financing and a payout to Halda employees. J&J said it will provide additional details when it outlines its 2026 guidance in January.

The acquisition is the third drug company buyout announced since last week and the 13th since the start of October, one of the most active dealmaking stretches in years, according to BioPharma Dive data.