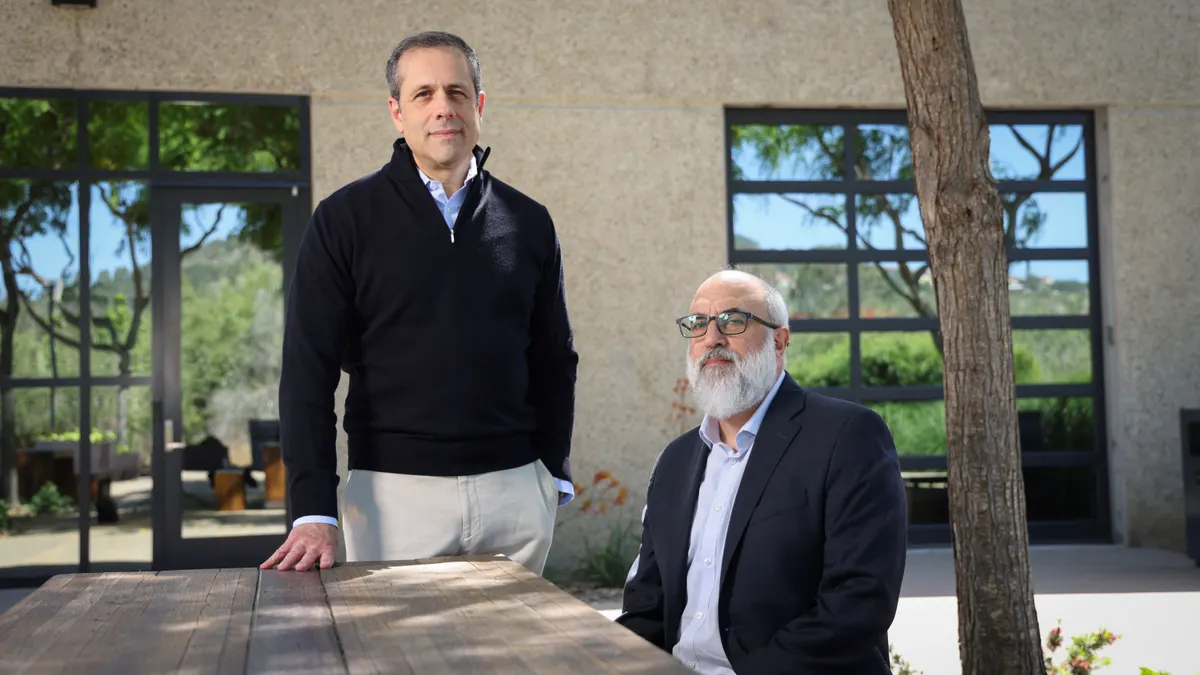

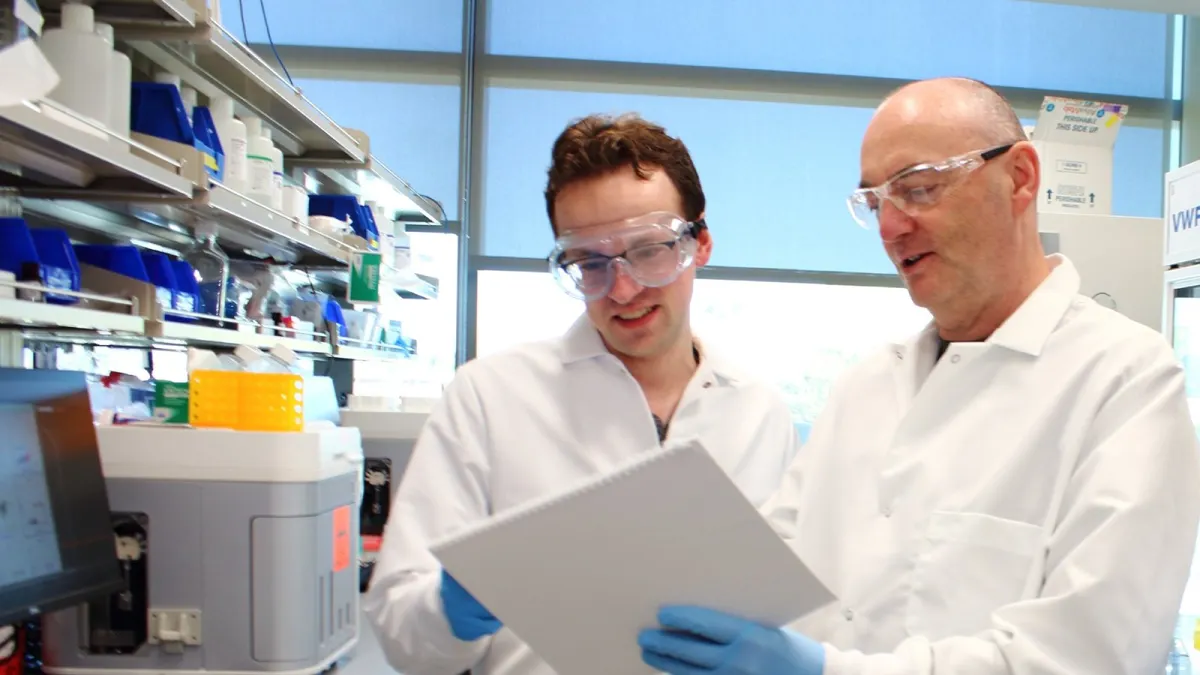

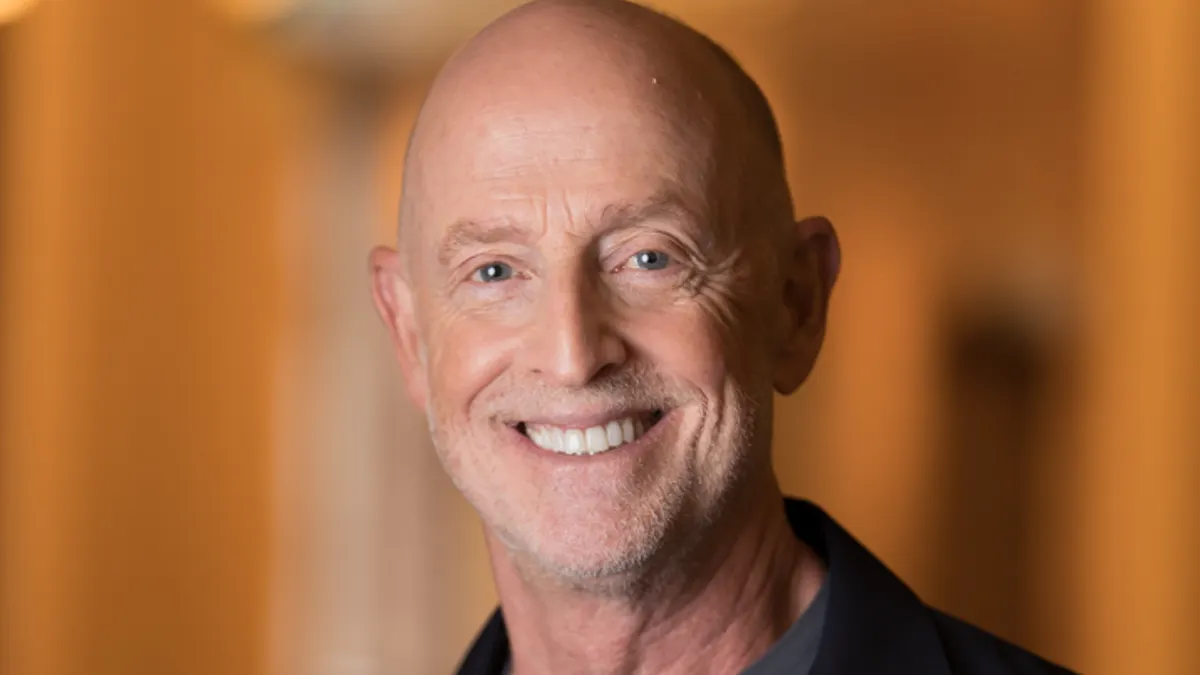

Going from an idea to a Phase 3 trial is a rare feat in biotechnology. And yet, under Ron Renaud, obesity drug developer Kailera Therapeutics has managed that.

Kailera, of course, had important help in progressing so quickly. The company is among a deluge of startups venture investors have recently formed around ready-made drug prospects discovered in Chinese laboratories. Its backers, prominent investors Bain Capital, Atlas Venture, RTW Investments and Lyra Capital created the firm and licensed three drug candidates from Hengrui Pharma in 2024, two of which were already in mid-stage testing. They and other investors then went on to pour $1 billion in private funding over the following year to progress its pipeline.

That head start has put Kailera on a fast track towards potentially selling its own drugs. With data in hand from a late-stage trial of its lead program ribupatide in China, and an international study just underway, Kailera could be ready to seek a product approval in the U.S. by the end of the decade and compete against blockbuster drugs from Eli Lilly and Novo Nordisk.

Challenging dominant pharmaceutical companies like Lilly and Novo would be daunting for any startup. But Renaud, a biotech veteran who has led and sold three drug companies — Idenix Pharmaceuticals in 2014, Translate Bio in 2021 and Cerevel Therapeutics in 2024 — still sees space for upstart obesity drug developers like Kailera to compete. “Good data can cut through all the noise,” he said.

In an interview with BioPharma Dive, Renaud discussed Kailera's ambitions and how he sees the company fitting into the future landscape for weight loss medicines. The following interview has been lightly edited and condensed for clarity.

BIOPHARMA DIVE: Obesity is one of biotech’s most competitive areas. What sets Kailera apart?

RON RENAUD: We stay completely focused on our pipeline, which is led by ribupatide. We have an injectable version which is now in a comprehensive Phase 3 program, and two oral programs behind it. Then, we have a [GLP-1/GIP/glucagon] program.

What we try to stay ahead of is where we need to position our programs, how we think our programs can be successful. And I still think what the data-driven aspect of this is all about, is what are the products that are going to give you the greatest weight loss with a matching tolerability profile? That's what drives prescriptions, patient demand, and ultimately over time, desire to switch. There's a lot of noise out there, but you can cut through it all with good data.

You're going to want to have a toolbox that has multiple tools in it. Most everything will be built in combination therapies.

These assets came from a deal with Hengrui Pharma. What promise did you see in the portfolio when you joined Kailera?

RENAUD: Kailera was early to the game. But there had been a company that Bain Capital and Atlas had created before that called Aiolos Bio, and that provided very strong validation that this model could and does work. So when they went back to Hengrui and saw that there was this really nice portfolio of metabolism assets, it made a lot of sense that another company could be created.

I went to look at the background of these assets. Back in 2024, we were still somewhat in the early days of the focus and attention on the obesity market. The more I talked to the team at Bain and Atlas, the more that I looked at the data behind the portfolio of assets here, I thought to myself, “how could I not do this?”

We’ve seen a frenzy for obesity programs and a bidding war for Metsera, which was eventually sold to Pfizer. What are your takeaways from that?

RENAUD: Some might say the market is locked up with two players today, and it's going to be really hard to enter that marketplace. There's been no therapeutic area where that's ever been the case.

If you think about statins, immuno-oncology and inflammation, most of the time it was the third, fourth or even the fifth entrant that had the most significant success. So when you see some of these bidding wars play out, it shows you how high the demand is for a total addressable market that is significant, and I think widely perceived to be underserved by existing approaches. That's great for us. It's even better for patients.

You’ve sold three biotech companies. What are some of the lessons that apply here?

RENAUD: I don't build a company thinking about the exit. You build the company thinking about what is the best company that I can build here.

I learned this from Gordon Binder at Amgen. One of the first jobs I had in my career was in investor relations at Amgen, and I had the opportunity to learn from one of the best CEOs our industry has ever had. He taught me that the most important asset you can have in a company is people.

As I think about building Kailera, this is one of the most experienced teams of people I've had the opportunity to work with. It is a little bit different than other companies that I've worked at in the past, because we've really built this from the ground up, and we are exclusively focused on obesity. We are an obesity-first company.

Will you plan to partner with pharma when the time comes?

RENAUD: In a very short amount of time, we've been able to bring this forward to a very comprehensive Phase 3 program. Phase 3 is the final step before you think about commercialization. If all goes according to plan, we're thinking about commercialization somewhere in the 2029 timeframe. That's not that far away. We have a terrific chief commercial officer, somebody who launched Zepbound for Eli Lilly.

We've got a chief medical officer who has developed blockbuster cardiovascular drugs in the past. We have that experience internally. So the idea is to take this as far as we can with the skill sets that we have.

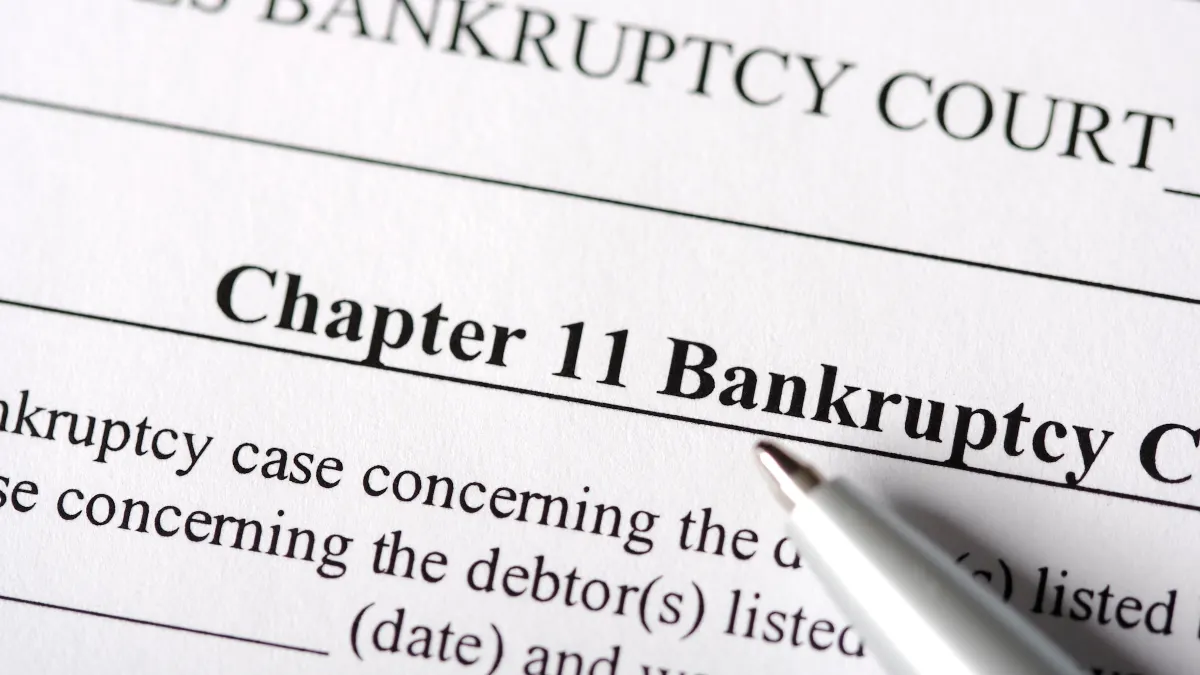

We've recently seen other examples of companies, like BridgeBio Pharma and Madrigal Pharmaceuticals, that have successfully launched their own drugs. Do you see a world where Kailera does the same?

RENAUD: You just raised two perfect examples. Madrigal has one product, and a very specific disease focus. A couple years ago, would you think that a company could cross that Rubicon and have commercial success? Now here we are looking at Madrigal — the last report they had was that the drug is annualizing at a billion dollars. So it demonstrates that with the right team, it can be done.