Eli Lilly is deepening its investment in inflammatory diseases, spending $1.2 billion to buy Ventyx Biosciences for an experimental drug that has the potential to treat an array of immunological conditions.

The Indiana-based manufacturer of obesity drug Zepbound announced Wednesday it will spend $14 per share to buy Ventyx, which in October reported promising data for an oral immune disease drug code-named VTX3232.

The per-share figure represents a 62% premium to Ventyx’s average trading price for the 30 days ending Jan. 5. News of the pending acquisition was first reported by the Wall Street Journal on Tuesday, sending shares close to the value Lilly ultimately paid.

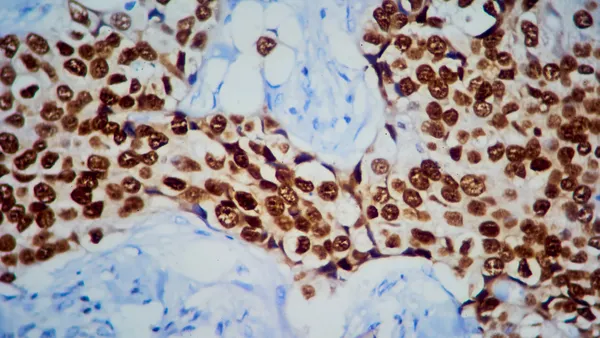

Ventyx’s drug is part of a class of medications that Lilly doesn’t have. Known as NLRP3 inhibitors, these drugs block proteins that stimulate inflammation in a variety of tissues, making them potentially helpful in treating cardiometabolic, neurological and immunological disorders.

In October, for instance, Ventyx released data suggesting VTX3232 could reduce biological markers of inflammation, fat levels and liver illness in people with obesity and cardiovascular risk factors who’d been treated with Novo Nordisk’s Wegovy. Ventyx is also testing the therapy in Parkinson’s disease and has a second, similar drug in testing for pericarditis.

"There is increasing evidence that inflammation is a key driver of many chronic diseases," said Daniel Skovronsky, Lilly’s chief science and product officer, in a statement. “Ventyx's clinical-stage pipeline addresses a critical need for better treatment options across diseases mediated by chronic inflammation and further strengthens our ability to deliver meaningful advances for patients living with challenging diseases across focus areas of cardiometabolic health, neurodegeneration and autoimmunity.”

The acquisition will help Lilly build out its obesity and metabolic business, which in addition to Zepbound and the similar diabetes drug Mounjaro, includes 21 drugs in various development stages. It also bolsters ongoing efforts to address immune diseases with the help of oral, rather than injectable, medications. One of those deals, for Dice Therapeutics, involved drugs blocking an inflammatory protein called IL-17. Lilly has scrapped one asset from that acquisition and the other hasn’t yet advanced past a Phase 2 trial.

Significantly, the acquisition also fills a potential competitive hole in its ongoing rivalry with Novo Nordisk, which is testing NLRP3 inhibitors in cardiovascular diseases and conditions in Phase 1 trials. Roche has shown interest in the space, and multiple other biotechs, including BioAge Labs, Neumora Therapeutics and startup NodThera have advanced prospects as well.

"While we continue to see some uncertainty around the ultimate application of NLRP3 inhibitors across a range of inflammatory diseases as well as differentiation among programs (17 programs by our last count), we think this outcome obviously provides validation that NLRP3 and adjacent targets within the innate immune system ... should be further explored," wrote Stifel analyst Alex Thompson in a note to clients. "[Lilly] has the resources to fully interrogate the breadth of indications."

The October results supporting VTX3232 showed that the drug reduced levels of a biological marker of heart disease by 64% over 12 weeks, compared with a 3% rise for those who got a placebo. Administered with semaglutide, the active ingredient in Novo’s Wegovy, the combination also significantly decreased signs of liver inflammation as well as other cardiovascular markers.

The buyout is one of a series of small, bolt-on deals Lilly has used to bolster its pipeline. The company’s biggest acquisition since 2018 is its $8 billion deal for cancer drug specialist Loxo Oncology, according to BioPharma Dive data.

Editor’s note: This story has been updated with analyst commentary.