Bluejay Therapeutics, a biotechnology startup making a treatment for hepatitis D, is set to be acquired by rare disease drugmaker Mirum Pharmaceuticals in a deal that could be worth as much as $820 million, the companies announced Monday.

Under the terms of the deal, Mirum will pay $250 million in cash and hand Bluejay equity holders $370 million worth of its common stock at about $71 per outstanding share. Bluejay’s backers, which include Frazier Life Sciences, RA Capital Management and others, could receive another $200 million in sales-based milestones.

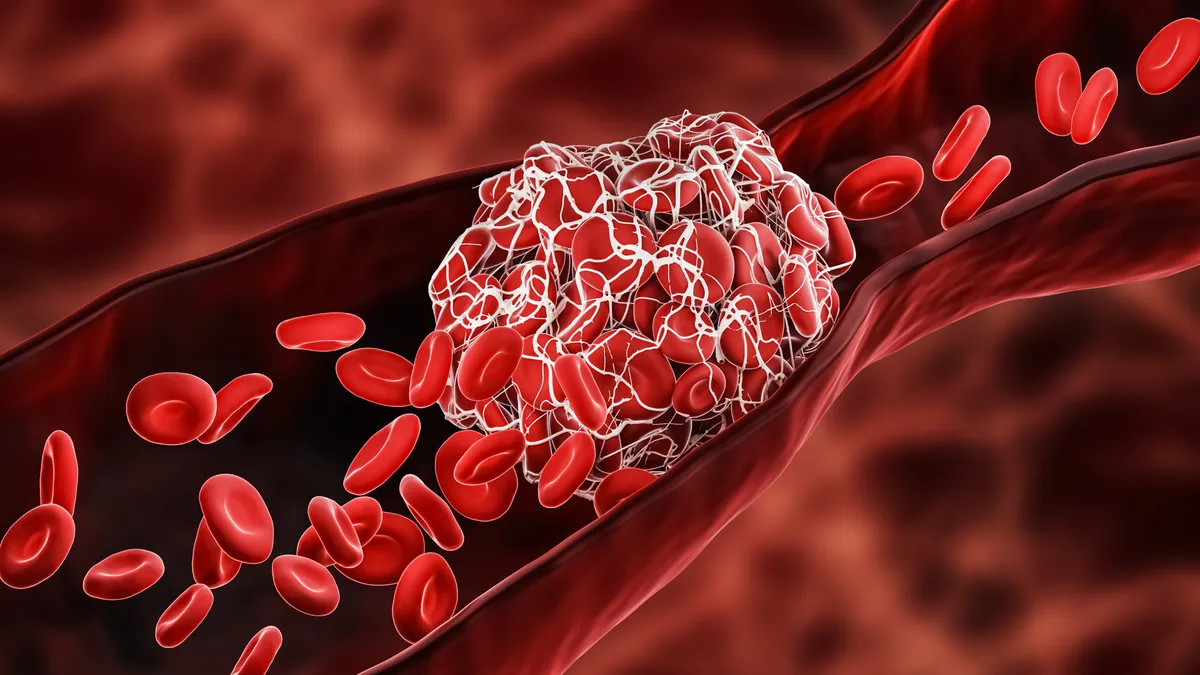

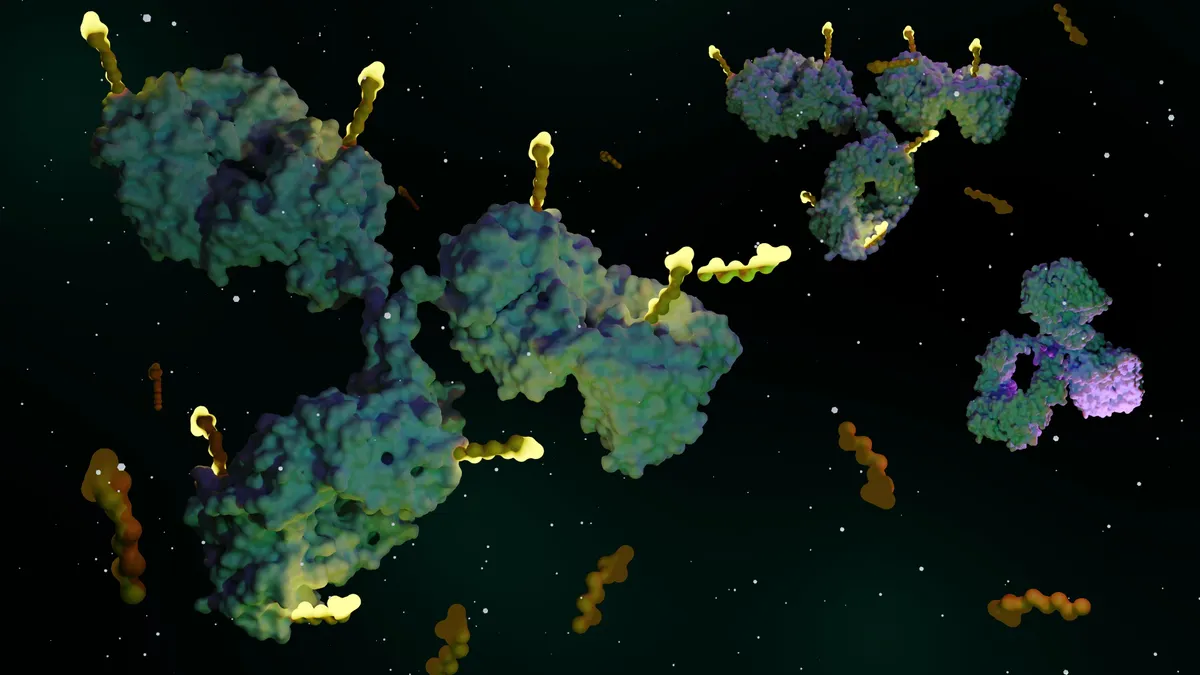

At the center of the acquisition is brelovitug, an antibody drug Bluejay brought into human testing for chronic hepatitis B and D infections. Brelovitug targets the surface antigen both viruses use to access liver cells, helping effectively clear them and other infectious particles from the body. Bluejay initially prioritized developing the drug for hepatitis B, and advanced that, as well as a few other prospective “functional cures” for hepatitis B, into a mid-stage trial. But therapy is now further along as a possible treatment for hepatitis D, the most severe form of viral hepatitis. Results from a Phase 3 study are expected in the second half of 2026.

“Brelovitug has the potential to redefine HDV treatment, and Mirum’s rare disease leadership, commitment to rare liver communities and commercialization expertise make it the right company to carry this program forward globally,” Keting Chu, Bluejay’s founder and CEO, said in a statement.

Mirum will “evaluate strategic options” for Bluejay’s other programs, which include a preclinical prospect for the liver disease MASH, after the deal’s close. It’s raising $200 million in a private stock offering alongside the acquisition.

Mirum brought its first drug, Limvarli, to market in 2021 for a kind of itching associated with a rare liver disease. It’s since added to its portfolio through a 2023 deal with Travere Therapeutics that involved the drugs Cholbam, Chenodal and Ctexli, the last of which was approved by regulators in February. Mirum has another liver disease treatment called volixibat in testing for primary sclerosing cholangitis and primary biliary cholangitis.

In a Monday note to clients, Leerink Partners analyst Mani Foroohar wrote that the Bluejay deal “lands in [Mirum’s] sweet spot of late-stage/commercial rare liver disease assets,” and called it “good capital deployment” by the company.

Bluejay, meanwhile, raised $61 million across a pair of venture capital rounds in 2020 and 2022 and added another $182 million via a Series C last year.