The world’s largest pharmaceutical companies mostly steered clear of billion-dollar acquisitions in the early months of this year, perhaps indicating how a tumultuous U.S. political environment has led would-be buyers to view bigger deals as too risky for the time being.

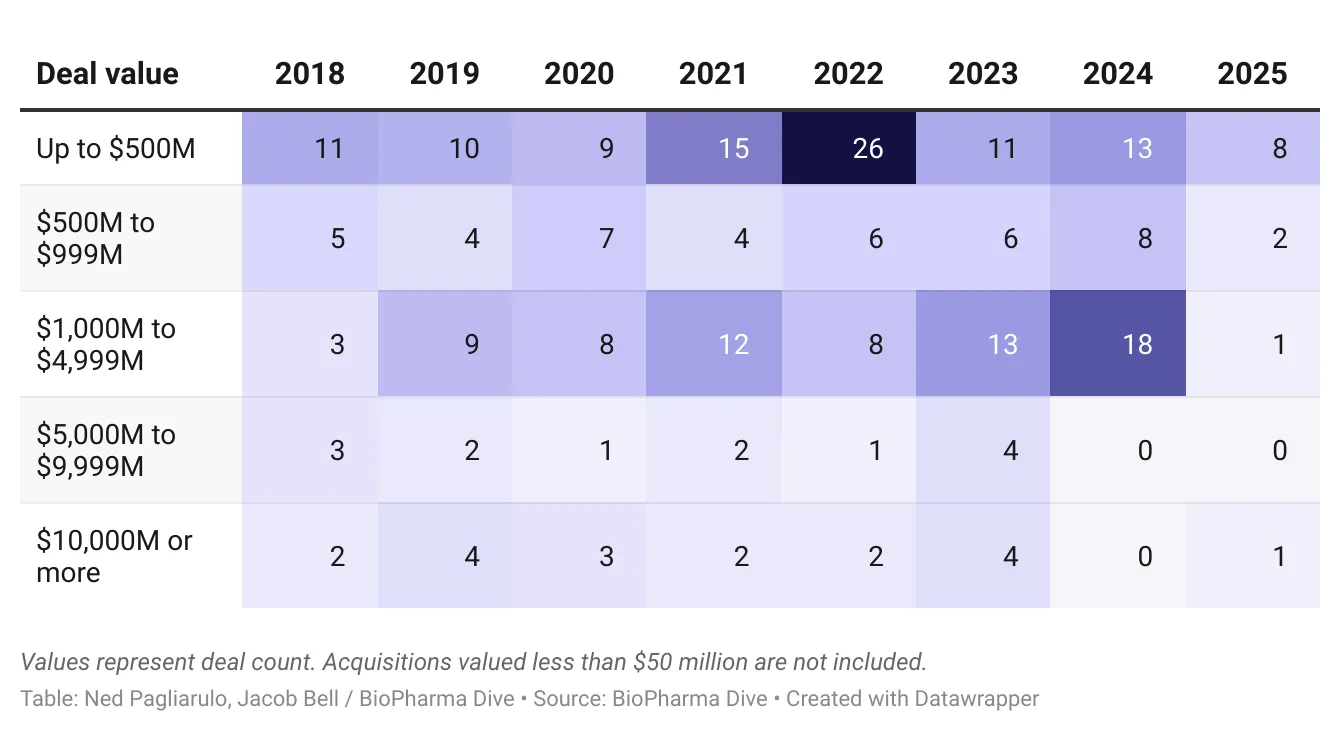

Two acquisitions worth $1 billion up front or more — that of psychiatry drugmaker Intra-Cellular Therapies and cancer specialist IDRx — were announced between January and March, according to BioPharma Dive data on the industry’s more sizable transactions.

By comparison, six billion-dollar-plus deals were inked during the same three-month period in 2024, though this year’s tally is not much lower than the average seen across the starts of the last five years.

It’s not just the first quarter, either. Big-ticket biotech buyouts have been getting scarcer for months now. Only four that met BioPharma Dive’s criteria were struck across the second half of 2024, which, for the first time in at least seven years, featured no deals worth more than $5 billion.

"We really had a hard time getting through 2024 with regards to deals. It was a depressed environment. Companies were being very, very skittish," said Kristin Ciriello Pothier, Global Deal Advisory and Strategy Leader for KPMG's Healthcare and Life Sciences division. The hope is this year might be different, but "we haven't seen that" yet.

In the first quarter, big pharma was behind five of the 12 deals tracked by BioPharma Dive. The deals included Johnson & Johnson’s $14.6 billion purchase of Intra-Cellular; GSK’s $1 billion buy of IDRx; Novartis’ $925 million acquisition of Anthos Therapeutics; and a couple smaller, cancer-centric offers from AstraZeneca and Bristol-Myers Squibb.

The rest came from less prolific dealmakers, and ranged in size from $83 million to $935 million.

Oncology has been the hottest area of biopharma research and business development over the last decade, and that trend is continuing into 2025. Of those dozen deals, a majority were aimed at cancer assets. Just one focused on the immune system, marking somewhat of a departure from last year, when a spurt of interest brought five acquisitions in the first quarter alone.

Bankers reportedly had expected a boon in biotech M&A activity with President Donald Trump back in the White House. So far, though, the opposite has happened.

Reuters recently spoke to four bankers with expertise in healthcare transactions, who said the Trump administration’s economic policies have become a major distraction for dealmakers and have even pushed the timelines of some deals out by months.

The policy changes appear to be hurting an already down stock market. The Nasdaq Biotechnology Index, often considered a litmus test for the health of the biotech sector, has plummeted 15% since early November. It fell further this week amid mass layoffs at the Department of Health and Human Services, which oversees the Food and Drug Administration and National Institutes of Health, and sweeping new tariffs imposed by the Trump administration on foreign imports. (Pharmaceuticals are, for now, exempt.)

According to Bloomberg, the turbulence has caused some companies to pause or walk away from certain deals. “The year has started more slowly than anticipated,” Tom Miles, global co-head of M&A at Morgan Stanley, told Bloomberg. “M&A is by definition a long-term decision, and you need some stability in order to be in a position to make that type of decision.”

Conversely, Andrew Goodman, a partner in the M&A practice at law firm Paul Hastings, argued that workforce reductions at the FDA and other health agencies could ignite more M&A in the months to come.

In a recent note to clients, Goodman and other members of the Paul Hastings team wrote that layoffs will “stretch the FDA's already limited resources and delay approvals of drugs and related products.” As such, “M&A may increasingly become a financing solution for smaller biotechs facing funding challenges from these delays.”