Pfizer and other large pharmaceutical companies are taking seriously President Donald Trump’s demand that drugmakers make more of their medicines available direct to consumers in the U.S. at lower cost, Pfizer CEO Albert Bourla said Tuesday.

“We have serious discussions in the industry,” Bourla told investors on a conference call Pfizer held to discuss its earnings for the second quarter. “I’m connected very often individually with all the major companies and they are all ready to roll up their sleeves and execute something like that.”

Pfizer and partner Bristol Myers Squibb recently announced plans to offer their widely-used blood thinner Eliquis at a discounted cash price through an online service. The company previously launched a direct-to-consumer service that allows patients to book telehealth appointments, schedule vaccinations and fill prescriptions for certain medicines, such as those Pfizer sells for migraine and COVID-19.

“We think it is a fantastic way to go ahead, so we will work collaboratively to do it,” Bourla said.

Obesity drugmakers Eli Lilly and Novo Nordisk have also recently opened up more ways for cash-paying patients to access their weight loss medicines directly. Other companies are signaling interest, too, in exploring ways to sidestep pharmacy benefit managers. These drug-purchasing middlemen extract from drugmakers rebates that insurers say they use to lower overall costs, but not necessarily in ways that are obvious to a prescription-filling patient.

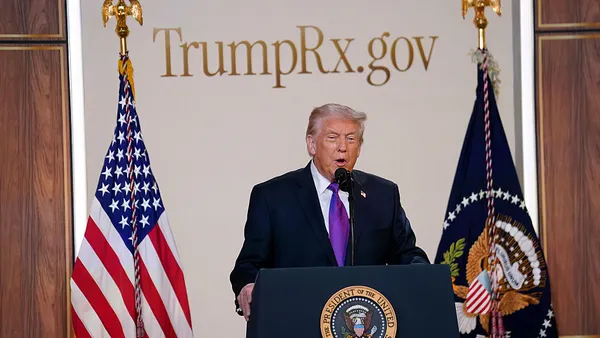

Expanding direct-to-consumer options was one of four demands Trump made of the pharmaceutical industry last week in letters issued to 17 drugmakers, including Pfizer.

In those letters, the president threatened to use “every tool” the U.S. government has available if the companies don’t take steps to lower the cost of their products to the prices paid in other industrialized countries. Such a “most favored nation” policy could be a major blow to the industry, although analysts are divided on how sweeping its impact would be if limited only to Medicaid, as Trump indicated.

On Tuesday’s call, Bourla said he is in “active discussions” at the “highest levels of the U.S. government,” including conversations with Trump, Health and Human Services Secretary Robert F. Kennedy Jr., and Centers for Medicare and Medicaid Services Administrator Mehmet Oz. In addition to leading Pfizer, Bourla is the current board chair of industry lobbying group PhRMA.

“The letter asks a lot from us,” Bourla added. “But we are engaged in productive discussion with them and in general I’m happy with the way that they listen to us.”

Pricing threats aren’t the only challenge drugmakers face in the U.S. The Commerce Department is nearing the end of an investigation into pharmaceutical imports expected to result in sector-specific tariffs. On Tuesday, Trump told CNBC that his administration will initially impose a small levy on pharmaceuticals that could later rise as high as 250% over time.

Such duties would be costly for drugmakers, but analysts believe a phase-in period would allow many companies to adjust their supply chains in such a way that the worst financial hit could be mitigated. Already, most of the largest drugmakers have announced major manufacturing investments in the U.S.

Pfizer anticipates that it can absorb the impact of tariffs this year, as well as any changes it makes to its products’ prices, while still meeting its financial forecast of $61 billion to $64 billion in revenue. On Tuesday, the company raised its guidance for adjusted diluted earnings per share by 10 cents.

Shares in Pfizer rose by nearly 4% by midday Tuesday.