Prime Medicine will streamline research in a bid to focus on what its executives believe to be its most high-value programs, the company said Monday.

In a pair of announcements, Prime revealed plans to trim its pipeline as well as partner with Bristol Myers Squibb. Both are part of a broader initiative that, according to Prime, will help the company get the most out of its technology, a precision gene editing approach known as “prime editing.”

“We’re not going to push all of these programs into the clinic ourselves,” said Allan Reine, the company’s chief financial officer. “So it’s natural to say, what are the programs we want to focus on today? What are the programs we’d like to move forward with partners?”

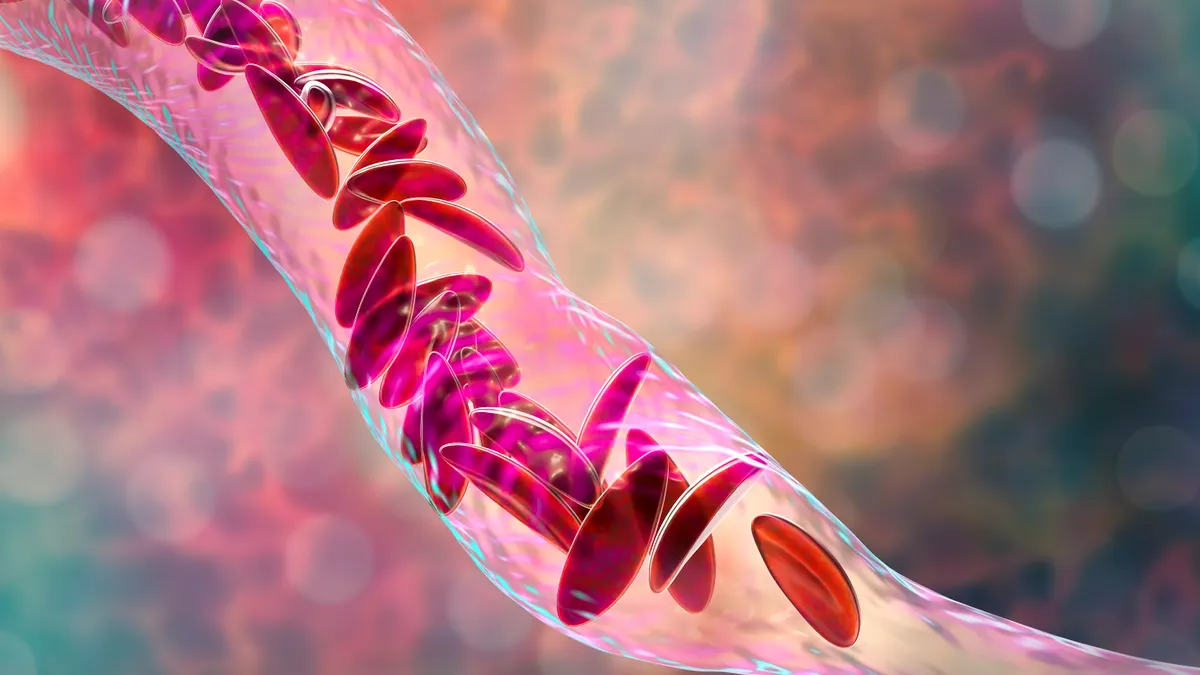

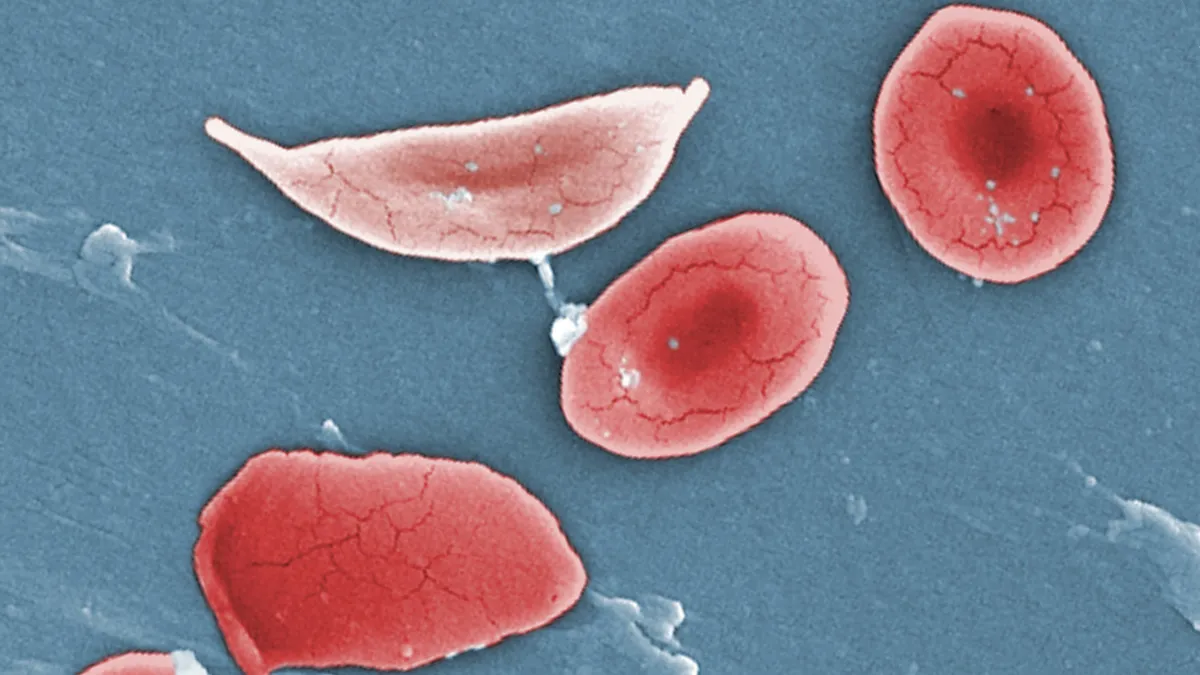

For now, Prime will primarily devote its resources to three genetic conditions. One program, PM359, is for certain people with an uncommon inherited disorder called chronic granulomatous disease and is currently in an early-stage trial. Prime is also investing in a second candidate that, combined with PM359, could enable the company to reach about 90% of people with the disease, according to Reine. It’s also working on experimental therapies for the rare condition Wilson’s disease and the lung disorder cystic fibrosis.

Prime views each of these programs as potential proof points for its technology. The Wilson treatment involves a type of delivery system Prime aims to use to treat liver diseases. The cystic fibrosis research consists of two different methods of targeting the disease.

The company will also work with Bristol Myers to develop cell therapies for immune diseases and cancer. The deal is centered on a Prime technology that’s intended to shuttle large amounts of genetic material into cells and boost the potency of cell therapies. The biotech is getting $55 million in cash upfront, as well as a $55 million equity investment from Bristol Myers. It is also eligible for up to $3.5 billion in future payments tied to developmental and commercial milestones.

Prime will seek out partnerships for its other programs, including cell therapies and prospects in development for diseases of the brain, eye and ear. The company is streamlining its spending in the meantime, and now expects to have enough cash to fund operations into the first half of 2026. The spending changes aren’t expected to include layoffs, according to Reine.

For Prime, the initiatives follow a steady decline in its share price since the company raised $175 million in an initial public offering two years ago. At the time of its IPO, the company was working on 18 programs across a variety of disease areas. All were in preclinical testing at the time, and only five months ago did the company gain clearance to bring its first prospect, for CGD, into human trials.

Since the IPO, investors have become more critical of companies like Prime that burn through cash while still years away from hitting the type of clinical milestones that can dramatically boost their value. In a research note in August, Stifel analyst Dae Gon Ha noted how Prime’s challenge is advancing a “generally early-stage pipeline that’ll take time to mature” without diluting investors through equity raises.

Wall Street analysts have also been skeptical of whether its lead program is worth the investment. While positive clinical results could prove prime editing’s worth, the disease affects an estimated 700 people in the U.S., and only a fraction would be amenable to treatment with PM359, Ha wrote. Prime’s second program could enable it to reach considerably more.

Prior to Monday, Prime had only enough cash to get through the first half of 2025. The Bristol Myers deal extends that runway while offering what Ha referred to in a Monday note as validation for Prime’s technology. Nonetheless, it has more work to do, as investors currently place a premium on “capital allocation and [balance sheet] strength,” which “we see as lingering questions,” he added.

Reine noted how partnerships like the Bristol Myers deal will provide Prime with alternative — and non-dilutive — sources of funding. “We don’t expect this to be our last deal,” Reine said.

Prime shares climbed about 40% in early Monday morning trading. But at just under $5 apiece, they’re still worth far less than their $17 debut price in October 2022.

Ned Pagliarulo contributed reporting.