Roche is betting more on artificial intelligence, unveiling Monday a collaboration that leans on a startup’s technology to find new ways to transport medicines into the brain.

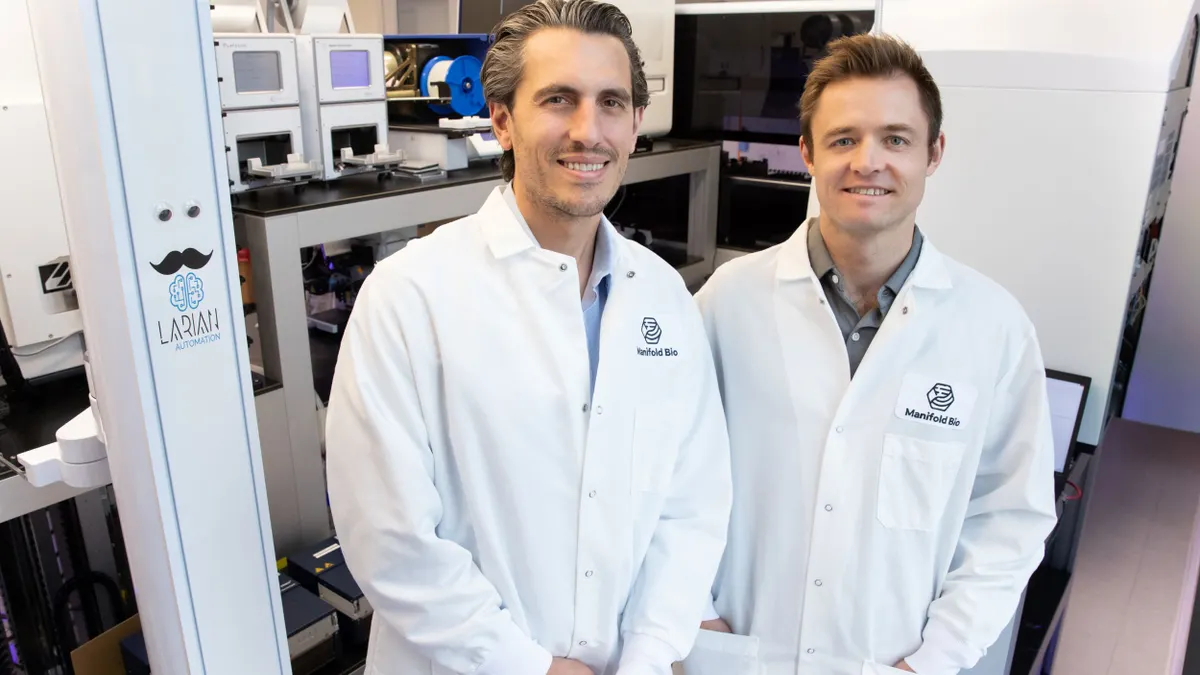

For $55 million, Roche has gained access to the drug discovery tools at Manifold Bio, a Boston-based company using AI to identify biological pathways that can direct therapies to specific tissues. Manifold says its platform can measure thousands upon thousands of “shuttles” that may be able to cross the blood-brain barrier — a casing that shields the organ from not only harmful substances, but also beneficial therapies.

This barrier, known as the “BBB” for short, has thwarted so many attempts at treating neurological diseases that a new class of companies has emerged with technologies designed specifically to overcome it. Just last month, Dublin-based Aerska, which is hoping to get RNA-interfering drugs into the brain, launched with $21 million supplied by more than half a dozen investment firms.

“It's always felt like going into clinical trials with your hands tied behind your back, because you never could really engineer a molecule that could successfully, fully get into the brain,” Gleb Kuznetsov, Manifold’s CEO and co-founder, said in an interview. “That's why there's been such a strong push into these brain-shuttling technologies.”

Manifold touts how its approach, unlike older ones, evaluates shuttles in a living organism, or “in vivo,” rather than in a petri dish or test tube. This, the company argues, should significantly speed up the process of translating basic research into actual drugs.

In explaining his company’s aim, Kuznetsov finds it helpful to picture an autobody shop.

“If we could just take diseased cells out of a human body — like we could take an engine out of car — repair them and put them back in, we will have cured many diseases. Of course, it is very hard to do that,” Kuznetsov said.

“And so a big part of drug design and drug engineering is effectively bringing the mechanic to the broken cells in the body,” he added. Getting potential medicines to the right tissues, and understanding how they’ll interact with the body, “that is why in vivo measurement is very, very important.”

The shuttles Manifold ultimately finds the most suitable are then fused to engineered antibodies or genetic medicines: the types of therapies the BBB is particularly adept at keeping out.

Steve Holtzman, Manifold’s executive chairman, believes the company’s work will lead to medicines that can be effective at lower, safer doses and given in more convenient, comfortable ways.

Roche and Manifold aren’t yet revealing exactly what diseases they’re targeting, but, according to Kuznetsov, some are “massive” in scope and “in many ways, diseases of aging.”

In addition to the upfront payment, Manifold could take home north of $2 billion more if it hits certain research, development and sales milestones. The company will lead activities related to discovering and advancing novel shuttles that are tailored to Roche-selected therapeutic payloads. Roche will then take the reins for preclinical and human testing, along with commercialization.

Per deal terms, Manifold may receive tiered royalties on resulting products. It also maintains the right to opt-in and co-fund development of one product candidate.

For Roche, technologies like Manifold’s could be especially valuable, given the Swiss pharmaceutical giant stands as one of the more prolific brain drug researchers. It currently lists 21 neuroscience programs in human trials, including more than a dozen for not-yet-approved drugs. The programs mostly target rare illnesses, multiple sclerosis, and neurodegenerative diseases like Alzheimer’s, Parkinson’s and Huntington’s.

Last year, sales from Roche’s neuroscience products increased 13% — to 9.3 billion Swiss francs, or roughly $10.6 billion — and accounted for 20% of overall pharmaceutical sales.

In neuroscience, which investors often describe as a high-risk, high-reward area, Roche has veered toward collaborations and licensing agreements rather than all-out acquisitions. In 2023, it paid Ionis Pharmaceuticals $60 million for rights to two RNA medicines meant to combat Alzheimer’s and Huntington’s. The following year, it licensed some technology from Sangamo Therapeutics for another shot at an Alzheimer’s treatment, and partnered with an RNA editing specialist in a deal structured similarly to the Manifold pact.

Roche became a leader in the field of BBB shuttles over the past 15 years, and so is well-versed in the persistent obstacles. One of the company’s most closely watched candidates, the Alzheimer’s drug trontinemab, was built using shuttle technology.

The Manifold deal is therefore exciting, Boris Zaïtra, Roche’s head of corporate business development, said in a statement, as it holds the potential to “tackle some of the most important neurological and neurodegenerative diseases.”

Yet, it also carries risk. While AI promises to drastically speed up the discovery and development of new drugs, its impact on the sector so far has been modest. Some of the premier companies built around AI drug discovery, among them Recursion Pharmaceuticals, have struggled to prove themselves.

Roche may understand these risks better than its peers, having inked several AI-focused deals over the past several years. It’s been working with Dyno Therapeutics to craft gene therapies for neurological diseases, as well as the world’s most valuable company, chipmaker Nvidia. Roche’s Genentech division also agreed in late 2021 to partner with Recursion to speed up the process of identifying new targets for cancer or nervous system medicines.

As for Manifold, executives claim the new alliance provides not only validation that the company has a valuable technology, but also a “foundational partnership” that allows it to keep growing independently. Holtzman noted how terms of the deal give Roche rights to specific product candidates, but Manifold retains ownership of the shuttles and can use them create other drugs for the same or different diseases.

“AI, in and of itself, is really no longer an edge,” said Pierce Ogden, the company’s chief technology officer and fellow co-founder. “It has to be paired with quality and relevant data. And that's really what makes Manifold unique.”