Japan’s largest drug company is teaming up with an artificial intelligence specialist to find new medicines for cancer and other diseases, through a deal that could be worth more than $1.7 billion.

Announced Monday, the multiyear collaboration grants Takeda Pharmaceutical access to two technologies at Iambic Therapeutics. The first is an AI-driven platform used to discover and develop new drugs. The second is a model meant to predict how proteins will interact with certain receptors.

The companies haven’t disclosed the deal’s upfront cost, nor any specific disease targets. The focus, though, will be on small molecule drugs for cancers and conditions rooted in the digestive or immune systems. Iambic will get milestone payments based on the partnership’s level of success, and is also eligible to receive royalties on net sales of any products it generates.

The deal makes Takeda the latest large pharmaceutical firm to bet that AI can supercharge the discovery of new medicines. Many of these big drugmakers will soon lose patent protection on top-selling products, and have increasingly looked to AI tools for help quickly and efficiently identifying possible replacements.

AstraZeneca, for instance, handed over $110 million initially — and put another $5.2 billion on the table — to use AI technology from China-based CSPC Pharmaceutical Group to discover oral drugs for immunological diseases and other chronic conditions. Eli Lilly, Sanofi, Novo Nordisk and Bayer have inked their own billion-dollar-plus deals with biotechnology companies sporting AI solutions.

“The winners over the next five years — we're not talking decades, we're talking years coming — will be the ones who understand how to fully integrate artificial intelligence and automation into their processes, and how we rebuild our laboratories to enable that,” said Andy Plump, Takeda’s head of research and development, in an interview last month at the J.P. Morgan Healthcare Conference.

Investors of all stripes, from early-stage venture capitalists to the public markets, have also shown growing interest in this space. Last spring, Isomorphic Labs, a leading AI drug discovery firm founded by Google DeepMind CEO Demis Hassabis, raised $600 million from a backer pool that included Thrive Capital as well as Google’s parent company, Alphabet, and venture arm.

And just last week, Generate Biomedicines, an AI-driven startup created by biotech incubator Flagship Pioneering, filed papers to go public.

So far, AI’s potential has been tempered by the persistent difficulty of crafting medicines. One major player in the space, Recursion Pharmaceuticals, has lost most of its value since going public amid multiple research setbacks. Another, Exscientia, merged with Recursion after struggling with a depressed stock price. A third, BenevolentAI, was delisted following a difficult run on the public markets.

The hype surrounding AI has also raised concerns that biotechs built around it may be prone to exaggerating how revolutionary this technology can be, at least in the near-term.

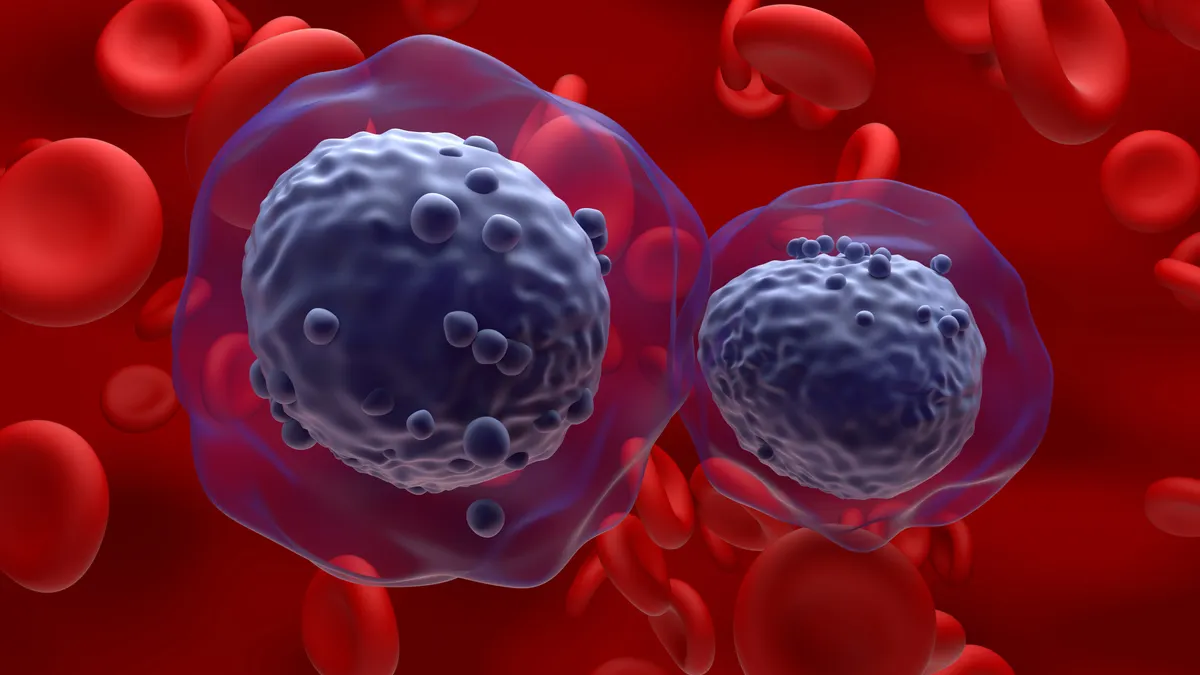

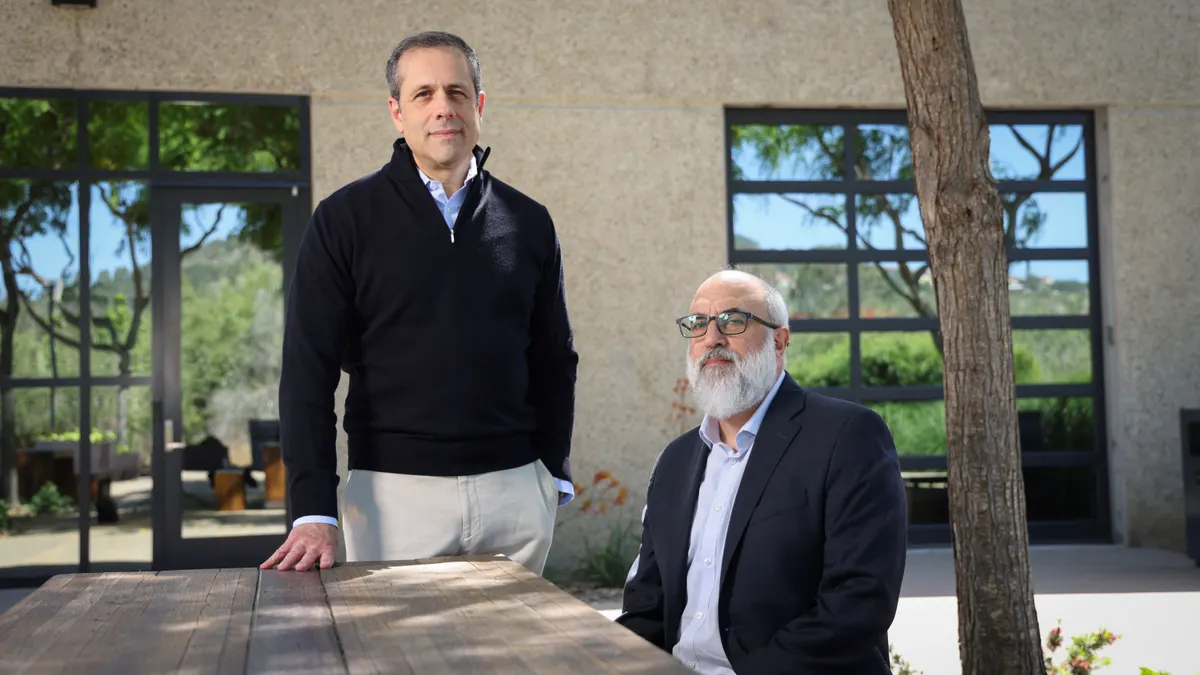

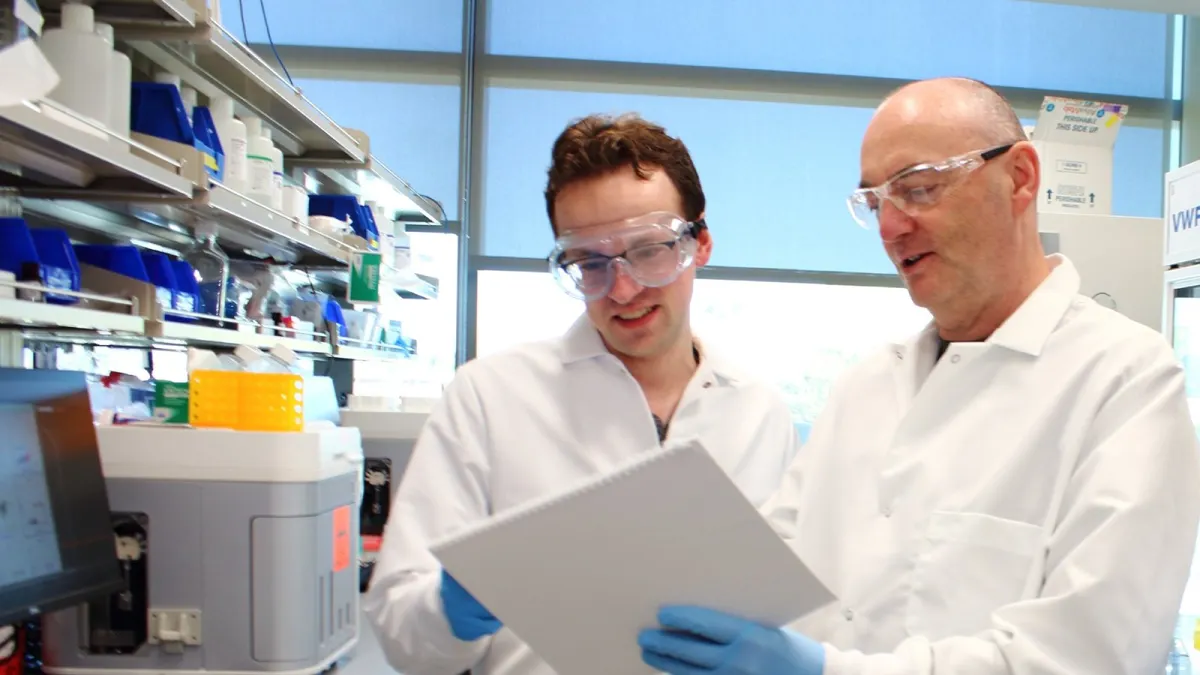

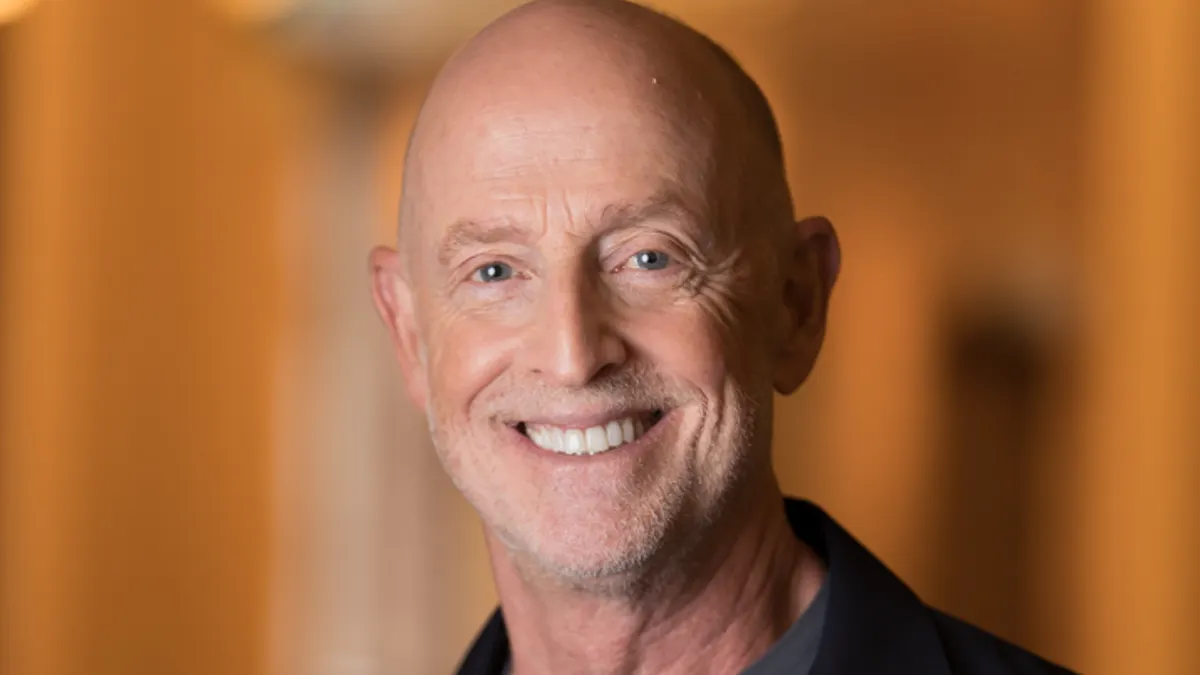

Thomas Miller, CEO of Iambic, argues that the clinical data his company has generated help separate it from what’s become a crowded, vociferous market. In October, Iambic shared data from an early-stage study of its most advanced program — which takes aim at mutated forms of a receptor protein, “HER2,” tied to breast, stomach, ovarian and other cancers — at a major medical meeting in Europe. The results suggested the drug, which Iambic brought to testing in less than two years, was safe and active against its intended target.

“If your intention is to make medicines, you might ask yourself, which of these AI drug discovery companies have actually put a molecule into the clinic? That narrows it down to maybe a handful,” Miller said in an interview. “Then you ask, have any of those done that in less than two years? Now you're on Iambic.”

Iambic has, for the past year and a half, been working with Denmark-based Lundbeck to develop therapies for neurological disorders, including migraine. More recently, it entered a research collaboration and drug supply agreement with Jazz Pharmaceuticals.

Takeda now extends that deal streak while providing a vote of confidence from a big pharma player. The associated upfront payments also add to Iambic’s mounting cash reserves. The company closed a $100 million financing round in November, then last week secured $20 million from the Ireland Strategic Investment Fund.

The funding, according to Miller, should allow Iambic to progress its three leading drugs into or through human testing, get new programs off the ground, and keep the company well-capitalized into 2028.

The executive noted, too, that as Iambic has matured, it’s become quite selective about collaborations. “We've turned away more partners than we work with, to be sure.”

The deals that have materialized, Miller explained, were in large part because of shared views on how to approach making drugs. That was the case with Takeda, which had been in conversation with Iambic “for a good length of time” leading up to their partnership.

Miller stresses, however, that the “end game is not to do a bunch of partnerships.”

“That's not the business model,” he said. “The business model is to advance a wholly-owned pipeline of really outstanding, best-in-class and first-in-class drugs.”

“Working with partners furthers that goal. That's kind of the rubric we hold them up to.”