Dive Brief:

- Tubulis, an antibody-drug conjugate developer based in Germany, said Wednesday it raised a €308 million, or $361 million, Series C round to advance its lead program deeper into human studies.

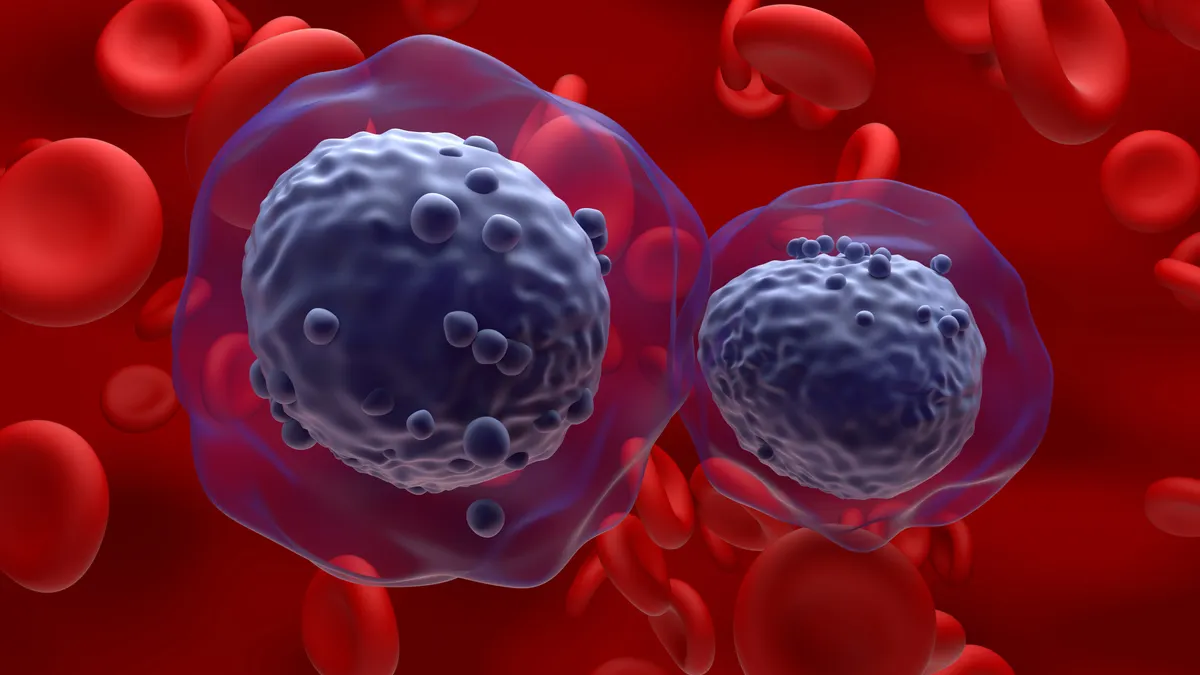

- Its top drug candidate, TUB-040, is in a Phase 1/2 trial for platinum-resistant ovarian cancer as well as relapsed or refractory non-small cell lung tumors. Interim data will be presented at the annual European Society for Medical Oncology meeting next Sunday.

- Tubulis’ financing round — one of the largest this year for a biotech startup — comes as investment in privately held cancer drugmakers has been in steep decline. Oncology investment in 2025 is down significantly, with companies raising just over $810 million so far this year compared to nearly $5 billion in 2024, according to BioPharma Dive data tracking a group of highly active venture capital firms.

Dive Insight:

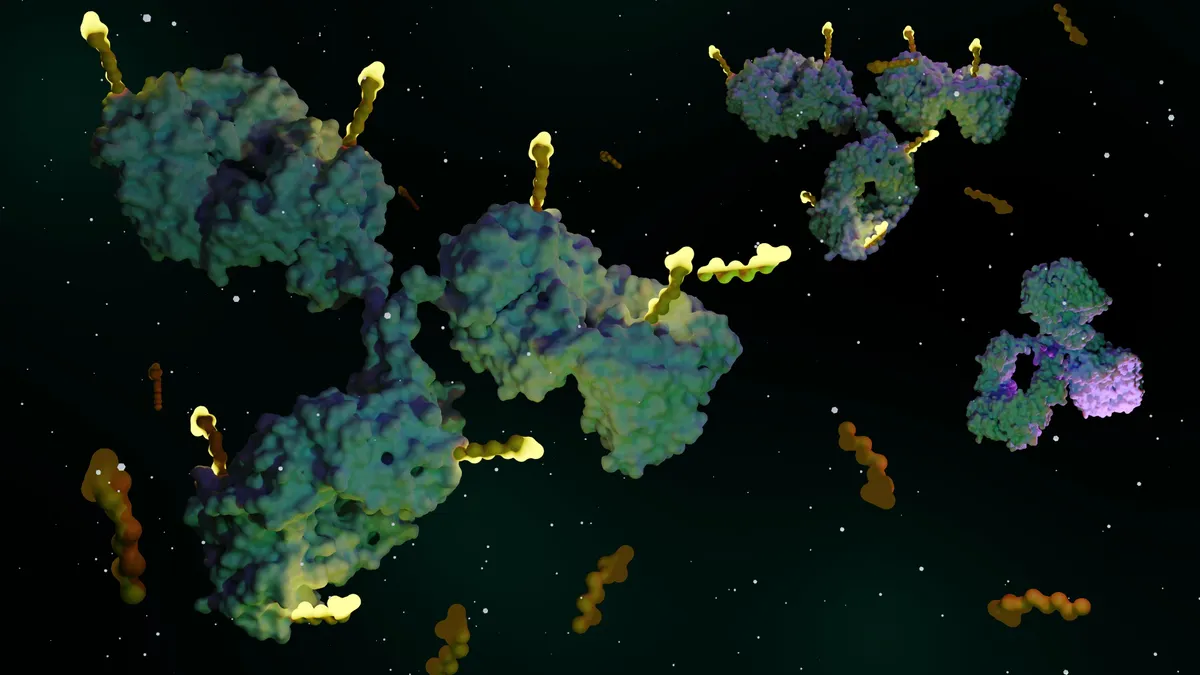

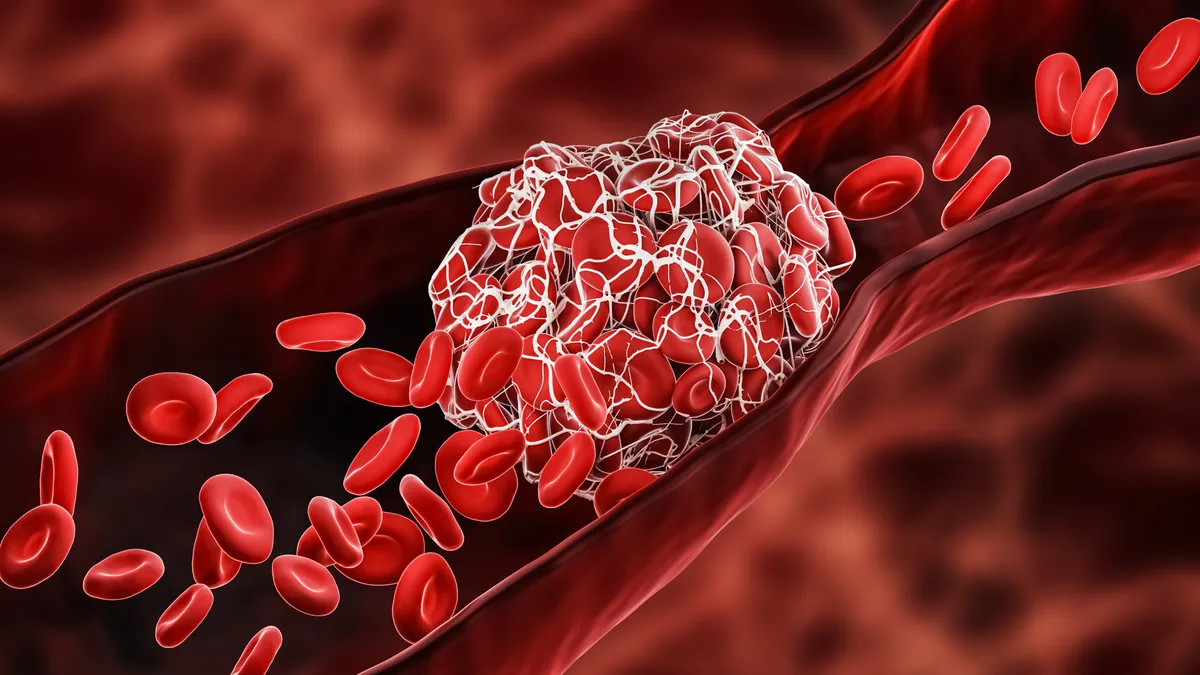

Antibody-drug conjugates, or ADCs, became one of the most popular areas of cancer research over the last decade, spurred on by scientific progress and the clinical success of AstraZeneca and Daiichi Sankyo’s Enhertu. The drug has been approved for a variety of tumor types and already changed the way certain breast cancers are treated. It generated nearly $3.8 billion in sales last year, a 50% jump from 2023.

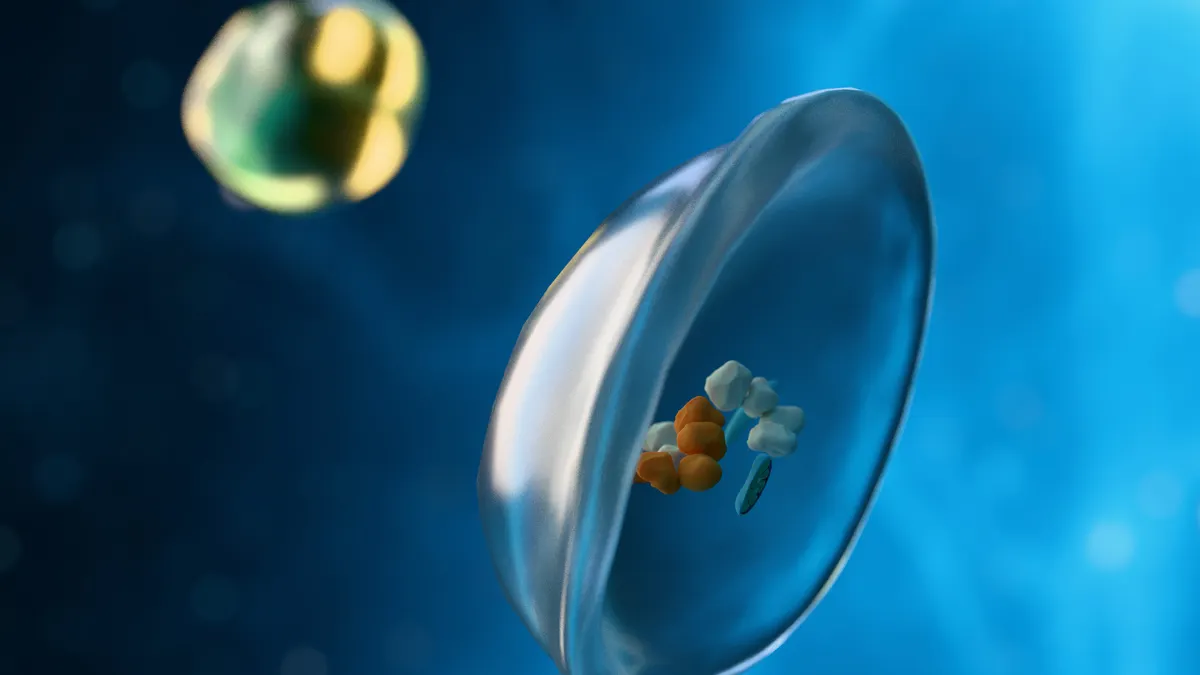

ADCs are essentially targeted chemotherapy. They work by pairing a work by pairing a toxin with an antibody, leading to a more precise, tumor-killing punch. Many major pharmaceutical companies have at least one in development, while legions of startups have emerged in the hopes of improving on the concept.

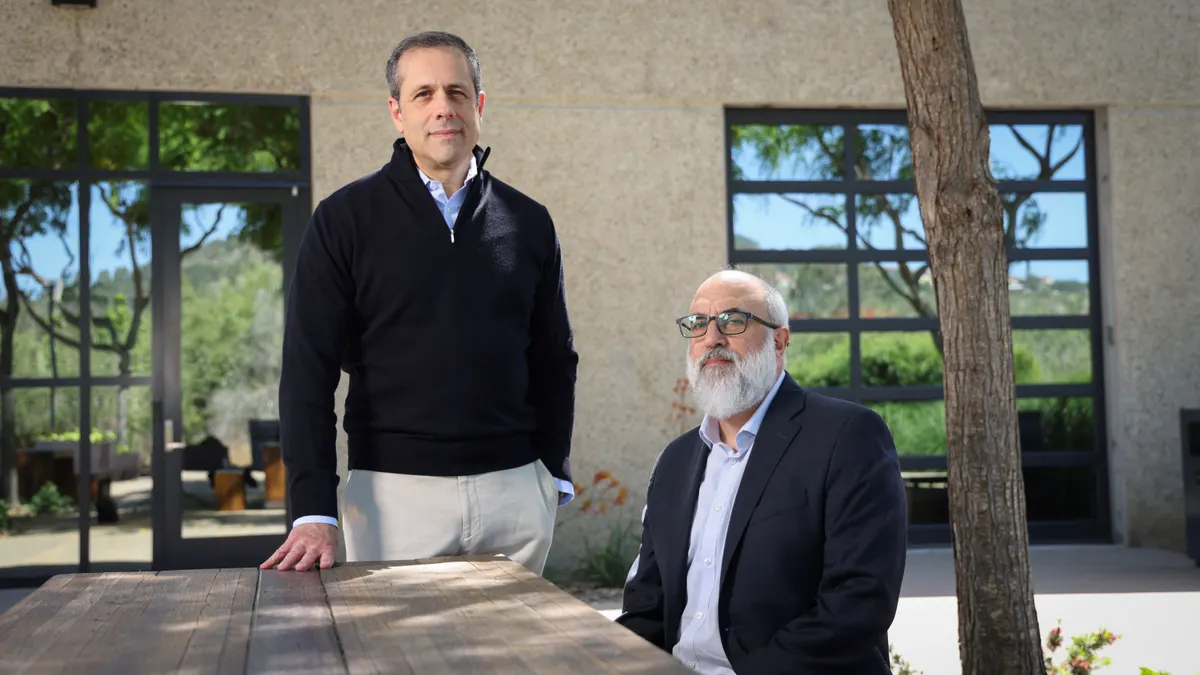

Tubulis is one of those startups. The company spun out of two research institutes in Germany six years ago and, since then, has advanced a technology it’s using to tailor each component of an ADC to the cancer the drug’s targeting. TUB-040 takes aim at NaPi2b, a protein target some other ADCs have struggled with. According to Dominik Schumacher, Tubulis’ CEO, the biotech has developed a type of chemical linker that could help it sidestep some of the toxicity issues other ADCs have run into.

“All the preclinical data gave us this confidence that we want to move these molecules forward and that [they’re] very, very different compared to other ADCs,” Schumacher said.

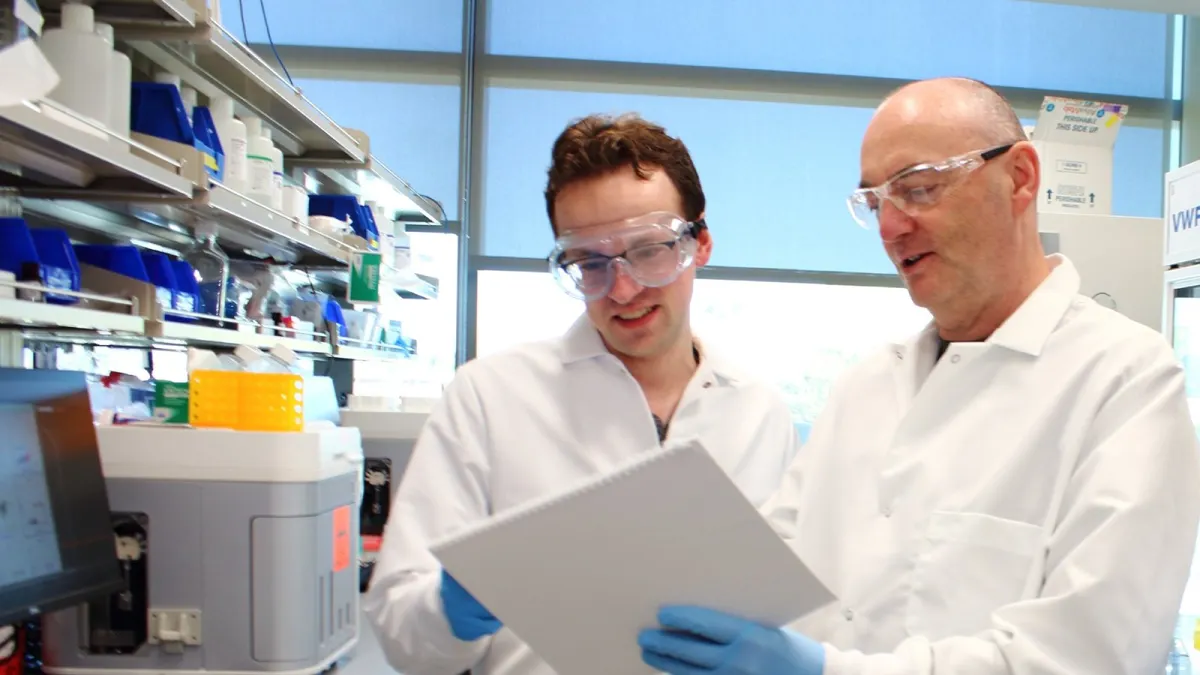

Behind Tubulis’ lead candidate is another ADC called TUB-030, which is aimed at another popular target called 5T4 that’s expressed in several different cancers. That drug is currently being studied in a Phase 1 trial for solid tumors. Tubulis also announced earlier this year that an ADC it’s developing with Bristol Myers Squibb advanced into human testing.

Tubulis has several other preclinical prospects, some of which are involved in partnerships with Gilead Sciences and Bristol Myers. Schumacher said the company is trying to anticipate what cancer patients will need in the future as ADCs become more widely used.

“At some point, there will also be a lot of patients that have built up resistances against this mode of action, and we need to have an answer for these patients as well,” Schumacher said.

Venrock Healthcare Capital Partners led the Series C round, which involved other well-known investors such as Wellington Management, Nextech Invest, EQT Life Sciences and Frazier Life Sciences. Ascenta Capital, a fund recently launched by Moderna veterans, also participated.

Prior to Wednesday’s announcement, the German company had banked nearly €200 million in private financing. It’s used that cash to establish a presence in Cambridge, Massachusetts, and plans to open another office in Lausanne, Switzerland.