Will 2025 herald a sudden turnaround for biopharma? Unlikely, but continued recovery is likely with some strong growth in therapy areas including cancer, diabetes and – inevitably – obesity.

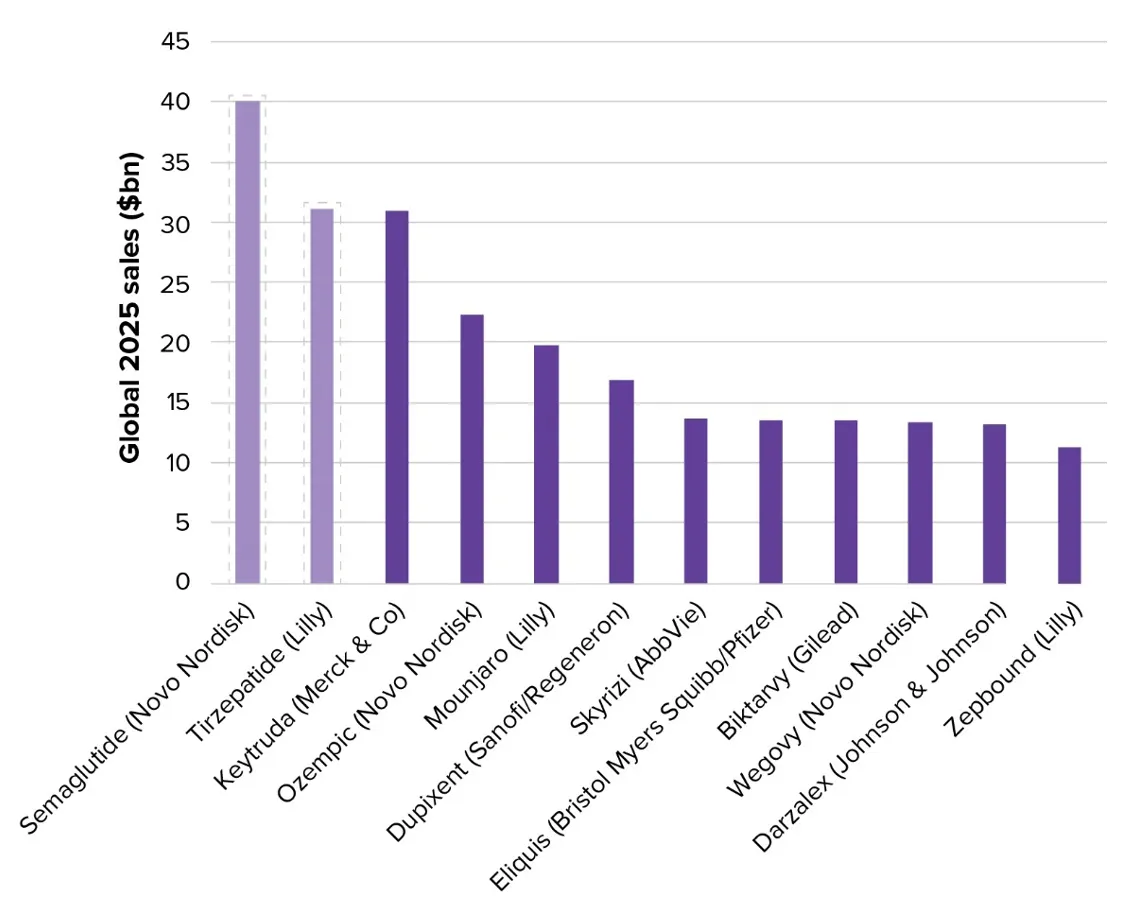

Four of the top 10 drugs by prescription sales in 2025 will be from the new incretin class, according to the latest analysis by Evaluate. Consensus forecasts for Ozempic, Wegovy, Mounjaro and Zepbound are on track to generate over $70bn in combined sales – and they top the charts of the fastest-growing drugs for the year.

The challenge for Novo Nordisk and Lilly, the drugs’ owners, will be staying ahead in a game that is going to become incredibly competitive in the coming years. In the short term, their focus will be on meeting demand for these drugs to the satisfaction of both patients and investors.

Top selling drugs in 2025

GLP-1s don’t quite take the top spot yet. That place, according to the analysis, is held for a further year by Merck & Co’s Keytruda. Its sales are projected to peak in 2025 as loss of exclusivity looms, however, and Merck is expected to file for approval of a subcutaneous version of the anti-PD-1 antibody this year.

Key Players

What of the companies behind these drugs? Novo and Lilly may dominate the drug sales charts for the year ahead, but they will not – yet - trouble the list of the top three manufacturers. Evaluate’s data forecasts Roche to be the largest drug maker by prescription sales, with Merck & Co. in second place and AbbVie in the bronze position. Notably, Roche has no drugs in the top 10 but its broad portfolio features a number of products just behind those biggest sellers. Merck of course is still well supported by Keytruda’s $30bn a year contribution.

It will surprise exactly no one that the fastest-growing company by sales is Lilly who are projected to increase their revenues by close to $14bn in 2025. This increase propels them into 4th place in the list of top drug makers – a significant leap given they weren’t in the top 10 at all last year.

It’s very tight at the top, however, with only $10bn in forecast annual sales between the companies in the number one and number 10 slots – and only $1bn between the top three.

Waiting in the Wings

The top-selling drugs in 2025 are already established (though in the case of Lilly’s Zepbound, still pretty new to market). What are the potential big launches to look out for this year? Vertex’s vanza triple for cystic fibrosis may be one of the first off the blocks and has projected sales of over $8bn in 2030. Vertex has another pending approval in the form of its novel pain medication suzetrigine which is also expected early in the year.

There is potentially more competition for the incretin giants in the shape of Innovent’s mazdutide (licensed to Lilly for co-development). It’s unlikely to make a dent in the sales figures for the existing therapies, but for a Chinese developer its $1.2bn 2030 forecast sales would be significant. We may also see a second ADC from the Daiichi Sankyo/AstraZeneca partnership which has huge expectation in a space that’s been red hot on the dealmaking front in the past year.

An Unpredictable Environment

While the pharma market is never predictable, 2025 starts with a lot of uncertainly that will continue to keep the markets skittish for the time being. Geo-politics remain a source of unease, and until the new Trump administration is settled and key roles filled, there will be many holding back on key investment decisions.

There’s promise, though. Evaluate’s analysis projects a strong year for FDA approvals – potentially on a par with 2023 which was a strong year for new drug approvals with 71 getting the nod. This, combined with a potentially less-hawkish FTC may help drive more dealmaking, ease access to capital and mean that 2025 is – finally – the year in which biopharma completes its recovery.

There is significantly more detailed analysis in the full 2025 Preview report by Evaluate which is available here.