Deals: Page 2

-

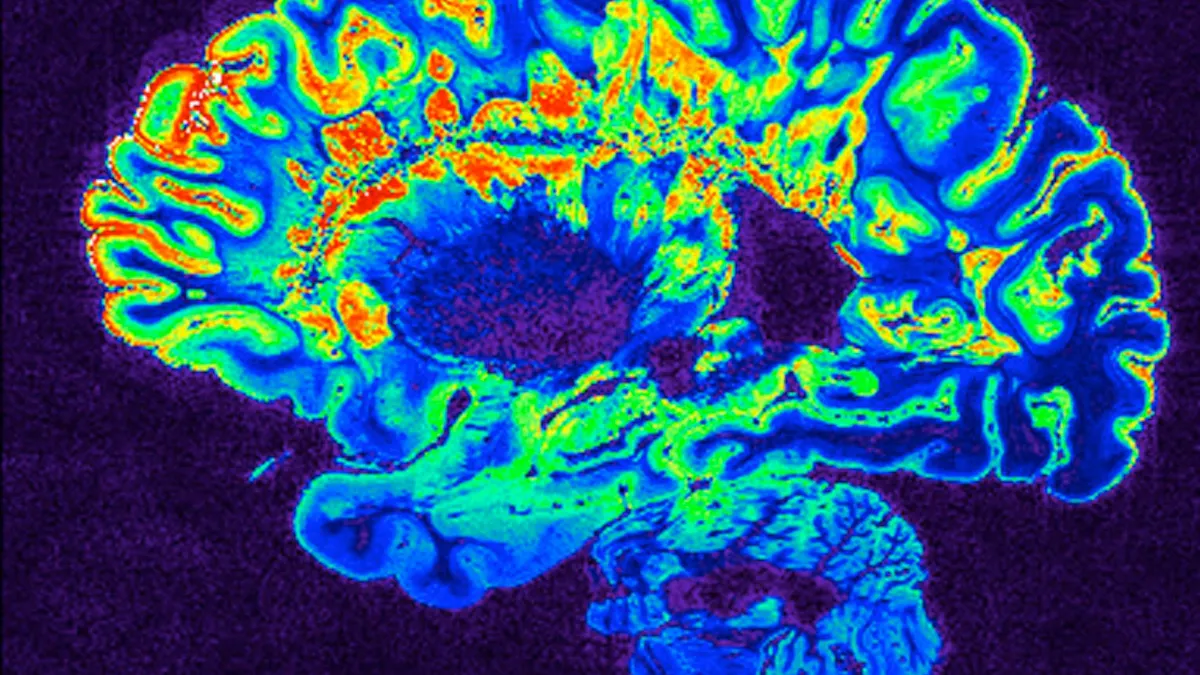

Brain drug revival

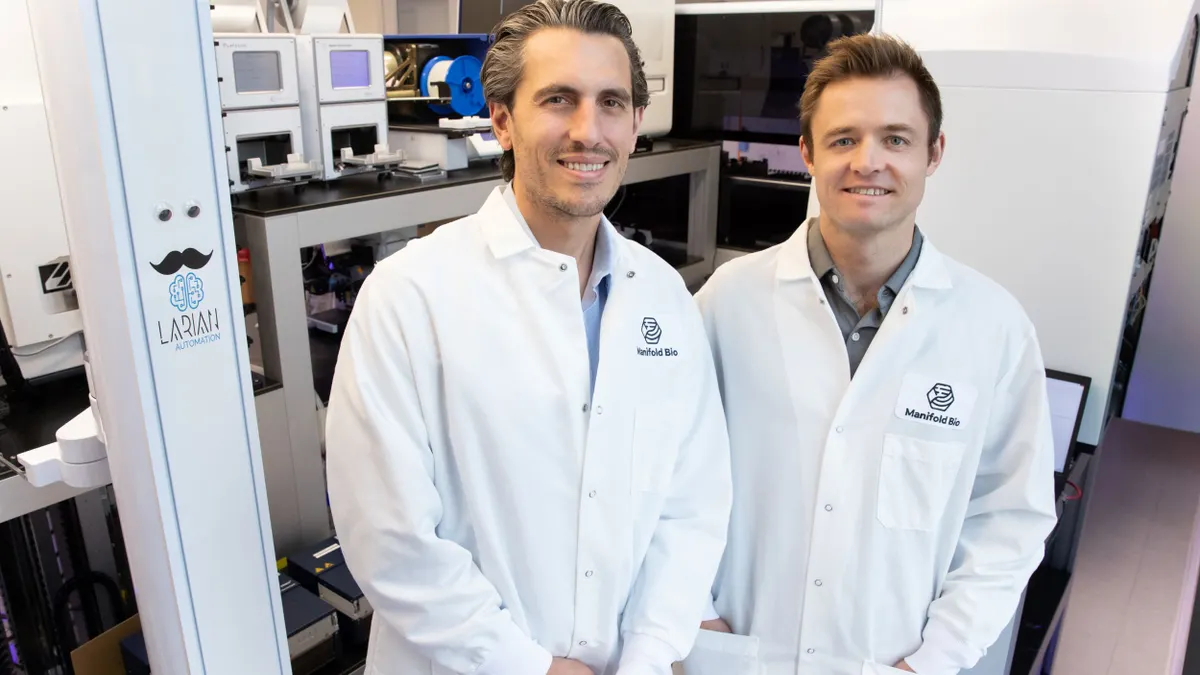

Roche taps an AI specialist to craft new brain drugs

For $55 million, Roche gains access to Manifold Bio’s drug discovery technology, which will be used to develop new “shuttles” that can get medicines across the blood-brain barrier.

By Jacob Bell • Nov. 3, 2025 -

Obesity drugs

Pfizer sues Metsera, Novo in effort to enforce buyout deal

The lawsuit escalates an unusual, high-profile battle between two large pharmaceutical companies over ownership of a coveted developer of obesity drugs.

By Ben Fidler • Updated Nov. 3, 2025 -

Obesity drugs

Novo tops Pfizer with $6.5B bid for Metsera

The offer sparked a bidding war between the two large pharmas over the obesity drug specialist, with Pfizer alleging Novo’s offer is “illusory” and “structured in a way to circumvent antitrust laws.”

By Jonathan Gardner • Updated Oct. 30, 2025 -

Novartis’ $12B Avidity deal shows a willingness to take big swings in neuroscience

A 46% premium paid for RNA candidates reflects what the pharma giant has sought to do for the last few years: aim at technology that fits into its own expertise.

By Michael Gibney • Oct. 28, 2025 -

Novartis to acquire Avidity in $12B bet on RNA drugs for neuromuscular disease

The deal, which Novartis expects can “unlock multibillion-dollar opportunities” in the years ahead, hands the company a group of medicines for multiple forms of muscular dystrophy.

By Ben Fidler • Oct. 26, 2025 -

Biogen licenses a possible immune drug from OrbiMed-backed biotech

The preclinical drug from Vanqua Bio is designed to inhibit “C5aR1,” a part of the immune system that regulates inflammation.

By Jacob Bell • Oct. 24, 2025 -

Adverum, hammered by gene therapy downturn, sells to Lilly in unusual deal

Lilly’s upfront offer for Adverum, the developer of a gene therapy for age-related macular degeneration, is less than the company’s previous closing share price.

By Jacob Bell • Oct. 24, 2025 -

Alkermes expands sleep portfolio with acquisition worth up to $2.1B

Analysts called the proposed purchase of Avadel Pharmaceuticals a “clear” strategic fit for Alkermes, handing it an already marketed product for excessive daytime sleepiness.

By Jacob Bell • Oct. 22, 2025 -

China competition

Takeda stakes more than $11B on cancer drugs from China

The Japanese pharma is licensing up to three next-generation cancer drugs from Innovent Biologics in a deal it believes to be “transformative” for its oncology portfolio.

By Ben Fidler • Oct. 22, 2025 -

News roundup

Iambic partners with Jazz; Merck breaks ground on $3B plant

The biotechs will assess a combination of two drugs against HER2-positive breast cancer. Elsewhere, Merck unveiled the latest piece of its more than $70 billion domestic manufacturing investment.

By BioPharma Dive staff • Oct. 21, 2025 -

Novo wagers up to $2.1B on Omeros’ rare disease drug

The deal gives Novo rights to a drug it sees as having "multiple advantages" over other treatments for so-called complement-mediated diseases.

By Delilah Alvarado • Oct. 15, 2025 -

Obesity drugs

Kailera nets $600M more to advance Zepbound-like obesity drug

Among the largest private biotech funding rounds this year, the financing will support global trials of an obesity shot that just succeeded in late-stage testing in China.

By Jonathan Gardner • Oct. 14, 2025 -

BioCryst goes ‘all in’ on rare swelling disease with Astria deal

A deal valuing the Boston biotech’s stock at $700 million hands BioCryst a long-acting injectable for hereditary angioedema that complements its daily pill.

By Delilah Alvarado • Oct. 14, 2025 -

Immune reset

Bristol’s $1.5B Orbital buyout extends ‘in vivo’ cell therapy deal streak

The acquisition of the well-funded startup is the fourth this year involving companies with technologies that can genetically modify immune cells inside the body.

By Jonathan Gardner • Oct. 10, 2025 -

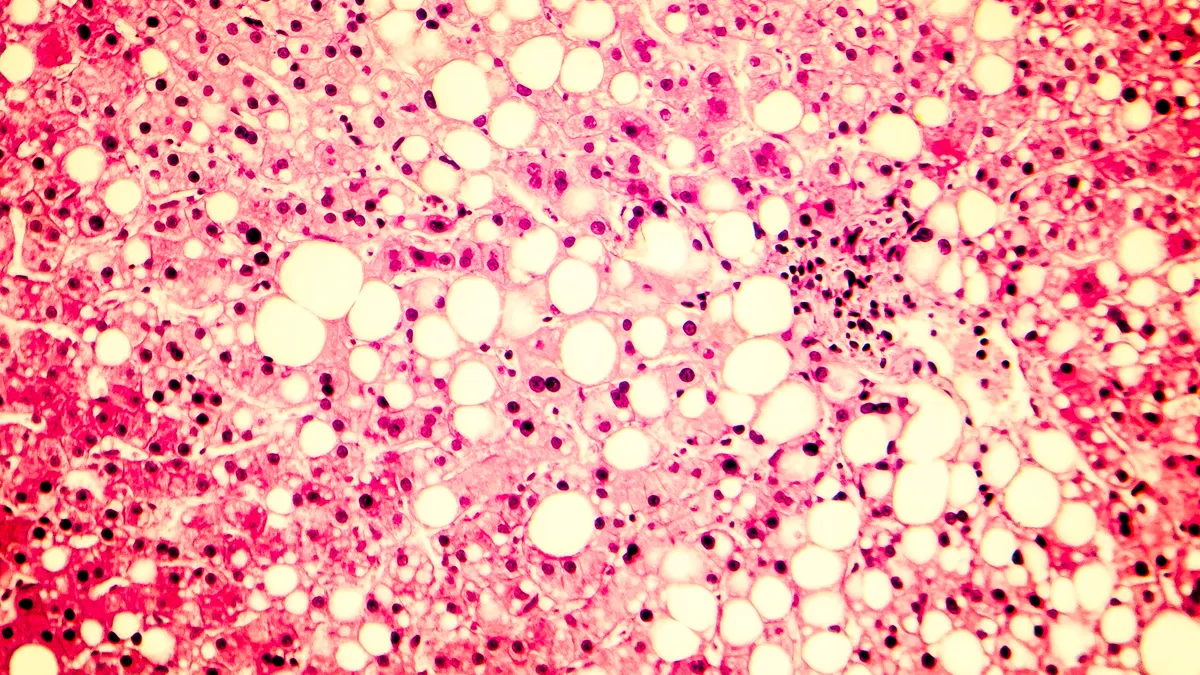

Novo joins MASH dealmaking surge with $4.7B Akero buyout

The deal is the third acquisition since May involving a drug that could reverse liver scarring in people with metabolic dysfunction-associated steatohepatitis.

By Jonathan Gardner • Oct. 9, 2025 -

Bhagavatheeshwaran, Govind. (2016). "MRI Scan" [Image]. Retrieved from Flickr.

Bhagavatheeshwaran, Govind. (2016). "MRI Scan" [Image]. Retrieved from Flickr. China competition

China competitionZenas looks to China to stock pipeline with 3 more immune drugs

A potentially $2 billion deal with InnoCare Pharma hands Zenas rights to a BTK inhibitor in late-stage testing for multiple sclerosis and two other immune medicines in earlier development.

By Kristin Jensen • Oct. 8, 2025 -

Obesity drugs

Metsera strengthens case for Pfizer buyout with latest study data

In a Phase 2 trial, a drug at the center of the $4.9 billion deal matched the type of weight loss trajectory seen in testing of Eli Lilly’s Zepbound.

By Jonathan Gardner • Sept. 30, 2025 -

Genmab to acquire closely watched cancer drug in $8B Merus buyout

The deal hands Genmab a drug that showed the potential in earlier testing to extend survival in head and neck cancer when added to Merck’s widely used immunotherapy Keytruda.

By Delilah Alvarado • Sept. 29, 2025 -

Obesity drugs

Pfizer buys back into obesity drug chase with $4.9B Metsera deal

The deal ends a short run as a publicly traded company for Metsera, which is being sold for more than double its IPO price amid enthusiasm for its weight loss medicines.

By Jonathan Gardner • Sept. 22, 2025 -

Biogen to buy startup Alcyone, eyeing easier delivery of RNA drugs

The purchase gives Biogen full access to an implantable device that could help patients avoid the repeat lumbar punctures required for drugs like Spinraza.

By Kristin Jensen • Sept. 18, 2025 -

Roche dives into MASH with $2.4B deal for 89bio

Roche’s CEO claimed 89bio’s drug, which is in late-stage testing, has the potential to show “best-in-disease efficacy” for many people with the condition.

By Ben Fidler • Sept. 18, 2025 -

CSL nabs option to acquire a startup and its blood-clotting drug

A deal with Dutch startup VarmX gives CSL an option to buy a Phase 3-ready drug that could reverse the effects of popular anticoagulants like Eliquis, which carry the risk of internal bleeding.

By Kristin Jensen • Sept. 16, 2025 -

Novartis to gain heart drug in $1.4B deal for Tourmaline Bio

Tourmaline recently unveiled mid-stage trial data for its anti-inflammatory drug, which is ready for Novartis to advance into Phase 3 testing for heart disease.

By Delilah Alvarado • Sept. 9, 2025 -

China competition

Bravehart, a stealthy startup, looks to China to challenge Bristol Myers heart drug

Led by the former CEO of Hi-Bio and backed by notable investors, the startup licensed from Hengrui a drug it claims is superior to Bristol Myers' Camzyos as well as other, similar medicines.

By Ben Fidler • Sept. 5, 2025 -

Brain drug revival

Novartis thinks Arrowhead brain drug can succeed where others couldn’t

A licensing deal worth at least $200 million will give Novartis access to a preclinical RNA medicine designed to combat diseases like Parkinson’s.

By Jacob Bell • Sept. 2, 2025