Dive Brief:

- Abbvie has agreed to acquire cell therapy developer Capstan Therapeutics in a deal worth up to $2.1 billion, the companies announced Monday.

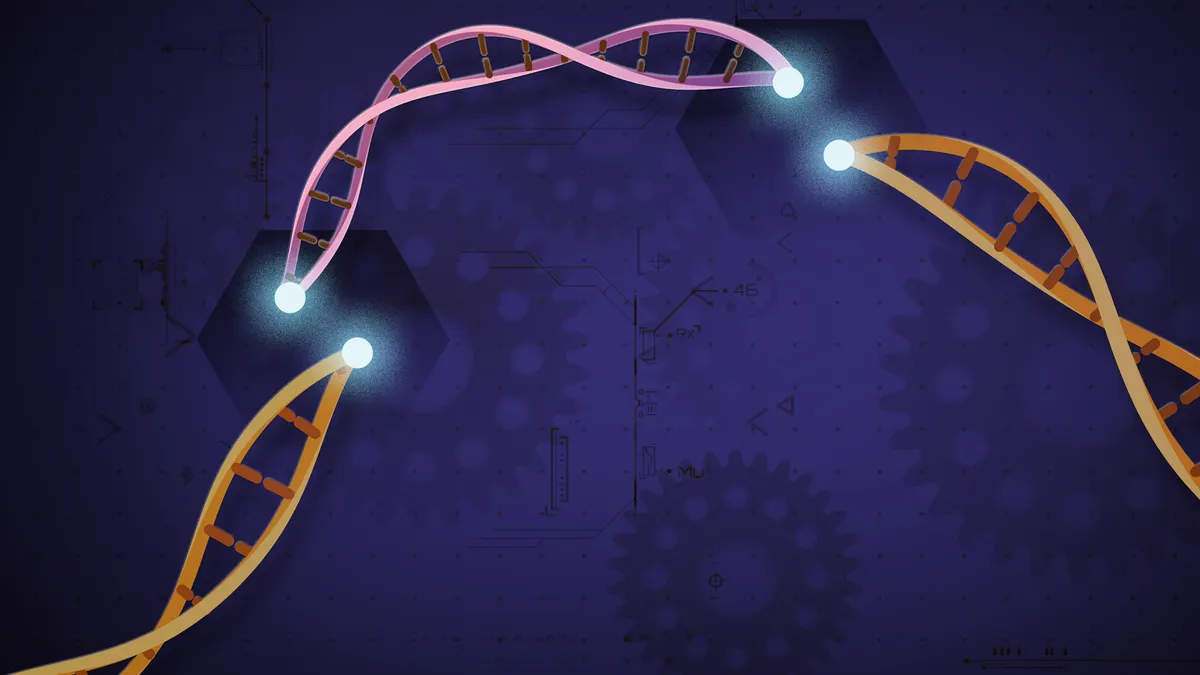

- The acquisition will hand AbbVie access to technology developed by Capstan that uses small fatty spheres known as lipid nanoparticles to deliver into the body genetic instructions able to engineer specific cells. It’s an ambitious scientific approach that blends the science behind CAR-T cell therapy with that of messenger RNA vaccines.

- Capstan is a few weeks removed from dosing the first patient in a Phase 1 trial of its lead drug candidate, which it’s testing as treatment for B cell-mediated autoimmune diseases. Dubbed CPTX2309, the therapy is designed to reprogram immune T cells to target a protein called CD19 that’s commonly found on B cells.

Dive Insight:

AbbVie’s deal to buy Capstan takes the pharmaceutical company to the frontiers of cell therapy research.

While CAR-T therapies are now well established in cancer medicine, all existing treatments are constructed by removing a patient’s own cells and reengineering them in a laboratory. The complexity, expense and time involved in this process has, for the most part, kept adoption of CAR-T to just a few treatment niches within oncology broadly.

Researchers have imagined broader usage could come if production of CAR-T was done by the body, rather than by technicians in a lab. This “in vivo” approach requires delivery of genetic instructions to the target cells.

Capstan accomplishes this by using modified lipid nanoparticles and messenger RNA, building blocks similar to the technology that enables mRNA vaccines to train the body to recognize viral proteins. Capstan engineers its lipid nanoparticles to especially seek a certain type of T cell.

In vivo CAR-T could offer a more convenient alternative in oncology, where AbbVie is already working with partner Umoja Biopharma.

But it also could be well suited for applying CAR-T to immune disease. Academic research from several years ago showed CAR-T’s potential treating diseases like lupus and kindled a frenzy of investment from small and large drugmakers alike. Capstan is one of many companies now exploring whether cell therapy might help “reset” the immune system in diseases where the body’s self regulation has come unglued.

With its drug CPTX2309, Capstan aims to redirect T cells to hunt down B cells that express the CD19 protein. By clearing both pathogenic and normal B cells, the reprogrammed T cells will prompt this immune reset and hopefully prevent disease progression.

And because T cell reprogramming is accomplished by mRNA instructions, Capstan believes the engineered T cells its treatment creates will be transient and clear out after accomplishing their job.

Prior to Monday’s deal, the biotech had convinced a good number of investors in its approach. Pfizer, Bayer, Eli Lilly, Bristol Myers Squibb, Novartis and Johnson & Johnson all invested in Capstan in at least one of its private funding rounds, through which the startup has raised $340 million.

The acquisition could pay Capstan’s investors up to $2.1 billion at closing. A spokesperson for AbbVie, reached via email, declined to break down the deal’s terms further.

Earlier this year, AstraZeneca paid $425 million upfront to acquire EsoBiotech, which is also working on in vivo cell therapy.