Prolific biotechnology investment firm Atlas Venture said Thursday it raised $400 million to pump into its existing portfolio of drug startups, a move meant to support the companies that might struggle to secure further funding in the current climate.

The new fund is Atlas’ third “Opportunity Fund,” an investment vehicle that provides cash to the growing startups Atlas has previously backed through its complementary early-stage fund. Atlas’ Opportunity Fund is designed to help those companies find the kind of follow-up investment rounds that can help them advance their drug prospects — and that have been tougher to come by of late.

"We’ve been encouraged by the incredible progress made across our portfolio, despite the array of challenges faced by biotechs in the current environment,” Atlas’ partners said in a joint statement. The new fund, which is smaller than some of its peers’ recent raises, also reinforces Atlas’ strategy of “raising funds tailored in size and strategy to our bespoke investment approach,” they added.

Atlas’ last raise came in December, when it banked $450 million for the 14th iteration of its early-stage fund. At the time, partner Bruce Booth wrote in a blog post that the “modest” haul reflected lessons learned after Atlas grew too quickly. Atlas, as a result, now wants to “stay disciplined and focused on the model that we continue to try to perfect: seed-led venture creation,” he wrote.

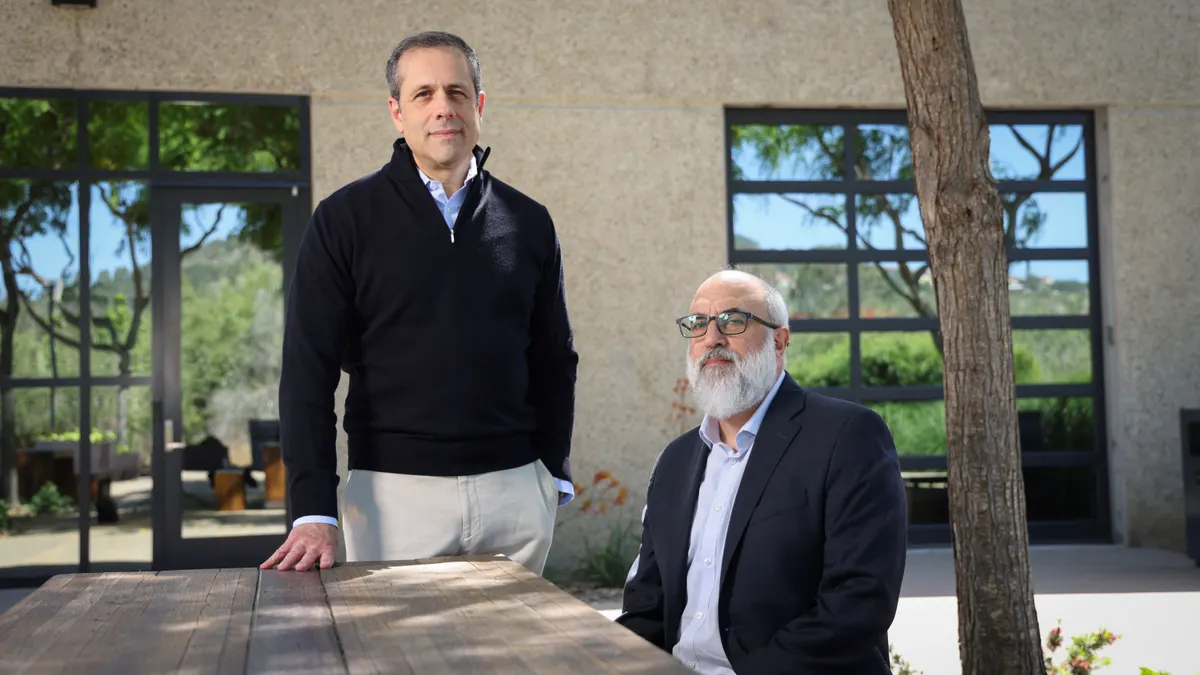

Four of Atlas’ partners — Booth, Kevin Bitterman, Michael Gladstone and Jason Rhodes — are the general partners of the most recent fund.

Atlas joins several other life sciences investors in closing a new fund this year, among them Omega Funds, Frazier Life Sciences and Deerfield Management. The firm is known for supporting a number of successful biotech companies, including Alnylam Pharmaceuticals and startups like Mariana Oncology and Aiolos Bio that were sold to larger drugmakers. Though it’s on pace to make fewer investments in 2025 than last year, according to BioPharma Dive data, the firm has still launched young companies such as Antares Therapeutics and Renasant Bio.