An experimental medicine from BridgeBio Pharma, the San Francisco-area biotechnology company, has succeeded in a late-stage clinical trial as a treatment for the most common type of dwarfism, results which could tee up an approval and greater competition for two other closely watched therapies.

The trial enrolled around 110 children with achondroplasia, who, over a main treatment period of a year, were given either a placebo or BridgeBio’s drug, called infigratinib. On Thursday, BridgeBio announced that those in the drug arm were growing taller faster. Depending on the measure, this “annualized height velocity” was, on average, between 1.74 and 2.1 centimeters greater per year than what researchers observed in the control group.

Not only did infigratinib meet the trial’s central goal, it also scored so well on a couple other height and growth tests that BridgeBio said it set records for a randomized study of achondroplasia patients. The drug was well tolerated, too, as no serious adverse events were tied to it. No one dropped out of the trial because of side effects either. BridgeBio did disclose three cases of patients having abnormally high levels of phosphate in their blood, but all were mild, transient, asymptomatic, and didn’t require the dose given to be changed or stopped.

Based on the results, the company plans to meet with regulators to discuss submitting marketing applications for infigratinib in the back half of this year. BridgeBio also intends to accelerate the drug’s development in another type of dwarfism, hypochondroplasia, where it’s currently in mid-stage testing.

Should infigratinib secure approval, it would offer a new treatment choice for achondroplasia — a condition that, according to some estimates, affects one in every 15,000 to 40,000 newborns. So far, the Food and Drug Administration has approved just one medicine: BioMarin Pharmaceutical’s Voxzogo, a daily shot designed to overcome genetic mutations and spur bone growth. Voxzogo generated $654 million for BioMarin from January through September last year, accounting for more than a quarter of the company’s revenue.

A similar, but once-weekly injection from Ascendis Pharma is under FDA review, and could be cleared for market by the end of the month.

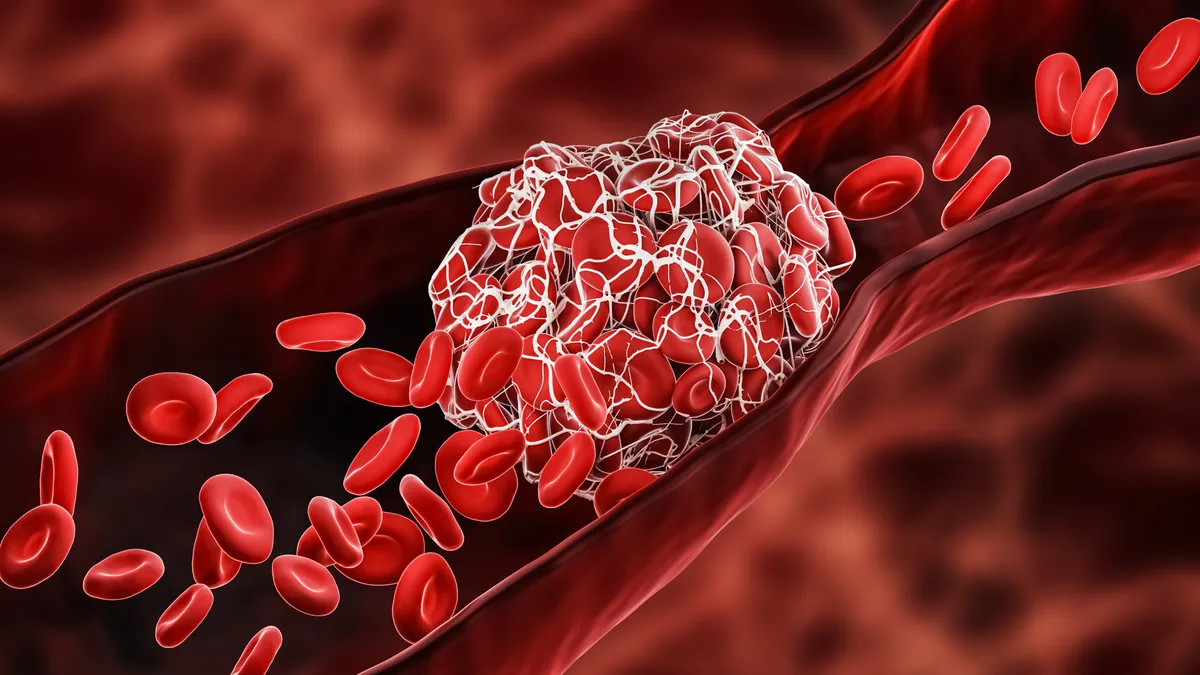

BridgeBio’s drug, meanwhile, is taken orally, and works by directly latching onto and blocking a protein that’s overactive in multiple kinds of dwarfism. The protein — known, in short, as FGFR3 — stalls bone growth by keeping cartilage cells from multiplying, maturing and turning into bone.

Daniela Rogoff, chief medical officer of BridgeBio’s skeletal dysplasia unit, said in a statement there’s “significant” demand among achondroplasia patients for therapeutic options that are effective, practical, and less invasive than what’s now available. “These results represent meaningful progress for those who have been waiting for a better approach, and we look forward to advancing this program towards global submissions.”

“Today’s announcement represents another milestone in achondroplasia research,” added Michael Hughes, chair of the biotech industry liaison committee at patient advocacy organization Little People of America, in BridgeBio’s statement.

In the key experiment that led to Voxzogo’s approval, BioMarin reported an “AVG” or annualized growth velocity of 1.57 cm per year compared to a placebo. Pivotal testing of Ascendis’ “TransCon CNP” therapy showed a treatment difference of 1.49 cm per year, though the rate rose higher, to 1.78 cm per year, when looking at children aged 5 to 11.

Ascendis further built its case last month, by unveiling data from a different trial that evaluated its drug in combination with TransCon hGH, the company’s already approved treatment for growth hormone deficiency. Ascendis said that, among patients who hadn’t previously tried TransCon CNP, the average AVG was 8.80 cm at the one-year mark, indicating “a tripling of efficacy” compared to TransCon CNP used by itself.

“The data undoubtedly raises the stakes,” Mani Foroohar, a Leerink Partners analyst who covers BridgeBio, wrote in a note to clients, referring to the Ascendis results.

The analyst further explained that infigratinib is “the most closely followed and hotly debated” of BridgeBio’s three candidates in late-stage testing. That’s because, while the drug is directed at a “large” and “de-risked” market, those advantages are partially offset by “high expectations and safety debates.”

Yet positive clinical results, like the ones released Thursday, should open up the addressable market “as infigratinib becomes treatment of choice, driven by best-in-class efficacy and convenience,” Foroohar wrote in his Jan. 9 note. He estimated that, if the drug demonstrated above a 2 cm per year improvement on height growth rate, plus a “clean” safety profile, the company’s value could rise another roughly $2 billion.

BridgeBio’s market capitalization was just over $14 billion Wednesday afternoon. The biotech, buoyed by a series of other clinical wins and the recent launch of its cardiovascular medication Attruby, has seen its share price increase 140% over the past year.