Dive Brief:

- Hemab Therapeutics raised a $157 million Series C round to advance a pipeline of drugs aimed at what it describes as “underserved” blood disorders.

- The startup has two prospects in clinical testing for a pair of conditions that hinder the body’s ability to properly clot blood. One, sutacimig, will begin a pivotal trial in Glanzmann thrombasthenia next year. The other, HMB-002, is currently in an early-stage study that’s shown “proof of mechanism,” CEO Benny Sorensen told BioPharma Dive.

- Hemab’s funding was led by Sofinnova Partners and involved a dozen other firms, including Novo Holdings and multiple “crossover” investors that back private and publicly traded companies. The cash will support testing of its top two medicines and other to-be-announced drug programs. “All of this is in the spirit of building the ultimate coagulation disorders company,” Sorensen said.

Dive Insight:

Innovation in hemophilia has taken off over the last decade or so. Longer-lasting “replacement” therapies, antibody drugs and gene therapies have all given patients a better ability to control the spontaneous bleeds that characterize their condition.

But progress in multiple other bleeding diseases has been slower going. In the three Hemab is focusing on — Glanzmann thrombasthenia, Von Willebrand and Factor VII deficiency — questions about market size have left drugmakers with “less commercial incentive” to develop treatments, Sorensen said. These disorders also require more “complex innovations and bioengineering” to unearth better options, he added.

That might be changing, however. In Von Willebrand, a group of drugmakers including Hemab, Star Therapeutics and larger pharmaceutical companies like Roche have been working on newer approaches. As with hemophilia, they’re aiming for better alternatives to the clotting factor-replacement therapies that require frequent infusions or injections.

Roche, for instance, is evaluating its antibody drug Hemlibra in certain Von Willebrand patients. Star also has what it hopes will prove a longer-lasting, subcutaneously injected antibody.

Hemab’s drug is also an antibody, but works differently, binding to a key area of the clotting protein that’s lacking in Von Willebrand. That interaction is supposed to boost circulating levels of that “Von Willebrand” factor as well as another clotting protein, Factor VIII, in turn providing a more durable and convenient treatment, Sorensen said.

Hemab is aiming for once-monthly dosing, and Sorensen claimed HMB-002 is the only molecule that “directly targets the underlying pathophysiology” of the disease.

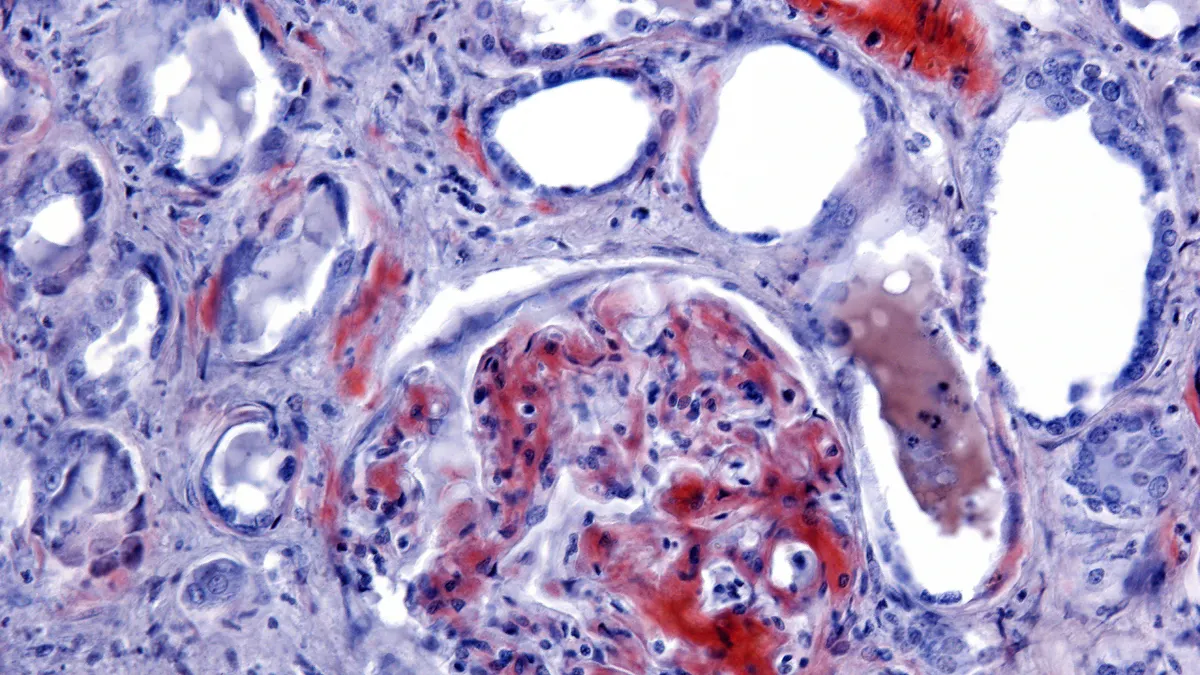

In Glanzmann thrombasthenia and Factor VII deficiency — two rarer disorders — Hemab is working on a dual-targeting antibody that effectively drags a clotting protein to activated platelets. The goal is to precisely “plug” a bleed, which Hemab believes could offer advantages over other therapies. Phase 2 testing in the former condition showed a greater than 50% reduction in yearly bleeds. A Phase 2 study in the latter disease will read out results next year, according to Sorensen.

Hemab’s fundraise comes amid a recent upswing in venture funding after a slow start to 2025. October has been the most active month since January among the roughly two dozen firms tracked by BioPharma Dive, with 17 financings announced so far, 10 of which have been worth $100 million or more.

“I can only speak for our own experience,” Sorensen said, but Hemab “experienced lots of interest” and its funding was “significantly oversubscribed.”