Korsana Biosciences, a biotechnology company making a treatment for Alzheimer’s disease, officially emerged from stealth Wednesday with $175 million to round out its portfolio of drugs for neurodegenerative conditions.

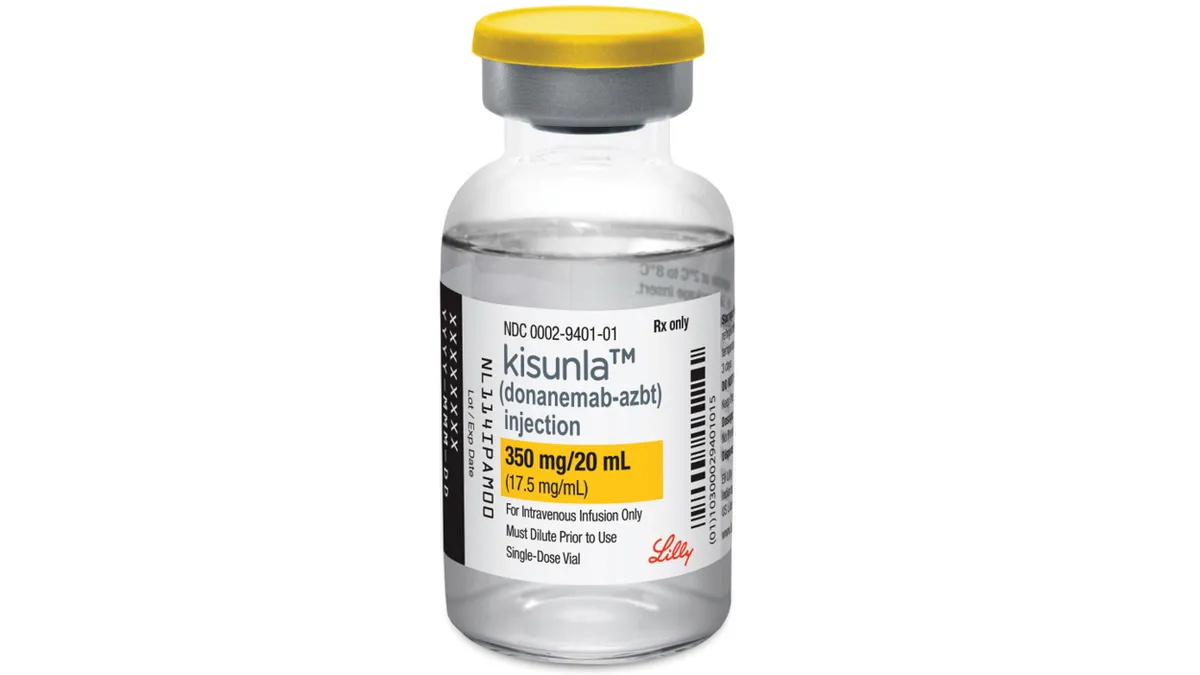

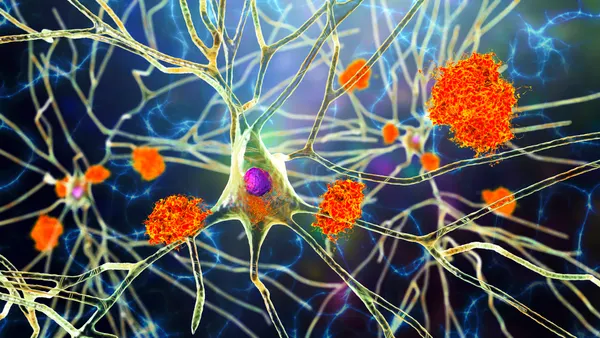

The startup is built around a program called KRSA-028, an antibody that targets the buildup of a sticky protein called amyloid beta in the brain. Korsana is betting its drug can help clear amyloid plaque, like already approved treatments for Alzheimer’s such as Eli Lilly’s Kisunla and Eisai and Biogen’s Leqembi, while sidestepping adverse side effects such as brain swelling and micro-bleeds.

With KRSA-028, Korsana is aiming to deliver more of the drug past the blood-brain barrier, a historically difficult obstacle for developers using monoclonal antibodies to treat neurodegenerative conditions. Very little of a drug makes it past that barrier, reducing efficacy, and increasing dosage to overcome that can cause safety issues.

Korsana is relying on technology to help shuttle its drug through using less frequent subcutaneous administration, which Wall Street analysts have previously said could drive uptake for Leqembi. (Kisunla is only available as an intravenous infusion, while patients on Leqembi can progress to weekly subcutaneous administration, approved last year by U.S. regulators, after 18 months of intravenous infusions.)

“Only two disease-modifying therapies have been approved to treat Alzheimer’s, and both carry safety warnings, offer only modest efficacy, and impose a high burden of care,” said Korsana president and CEO, Jonathan Violin, in a statement. “Patients deserve better options than what is currently available.”

Korsana plans to have proof of concept data for its drug by the end of 2027.

KRSA-028 was developed by Paragon Therapeutics, a so-called hub-and-spoke biotech that launches spinouts focused on a single asset. Its roster of previous “spoke” companies include Apogee Therapeutics and Crescent Biopharma.

Korsana has two other unnamed programs in development for neurodegenerative conditions.

Korsana was first established with a $25 million seed round in 2024, backed by Fairmount and Venrock Healthcare Capital Partners. Its Series A round, co-led last September by Wellington Management and TCGX, brought in another $150 million from the J.P. Morgan Life Sciences Private Capital, Janus Henderson, Sanofi Ventures, Foresite Capital and more.

The biotech is led by Jonathan Violin, a partner at Fairmount and the former CEO of Viridian Therapeutics.