Latigo Biotherapeutics, a private drug company developing experimental pain medicines, has closed another nine-figure fundraising round.

Asset manager Blue Owl Capital led the $150 million Series B round. As part of the raise, Kevin Raidy, a senior managing director at Blue Owl, has joined Latigo’s board of directors. More than half a dozen other new backers participated in the financing, as did existing investors 5AM Ventures, Foresite Capital, Alexandria Venture Investments and the firm that created Latigo, Westlake Village BioPartners.

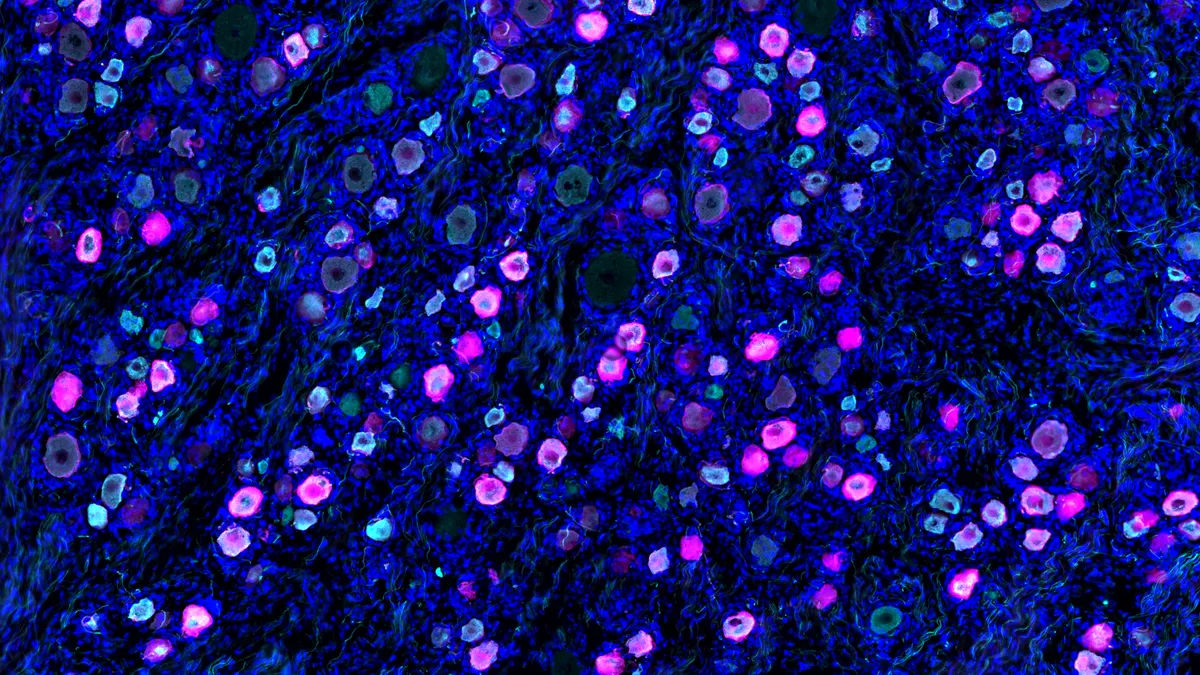

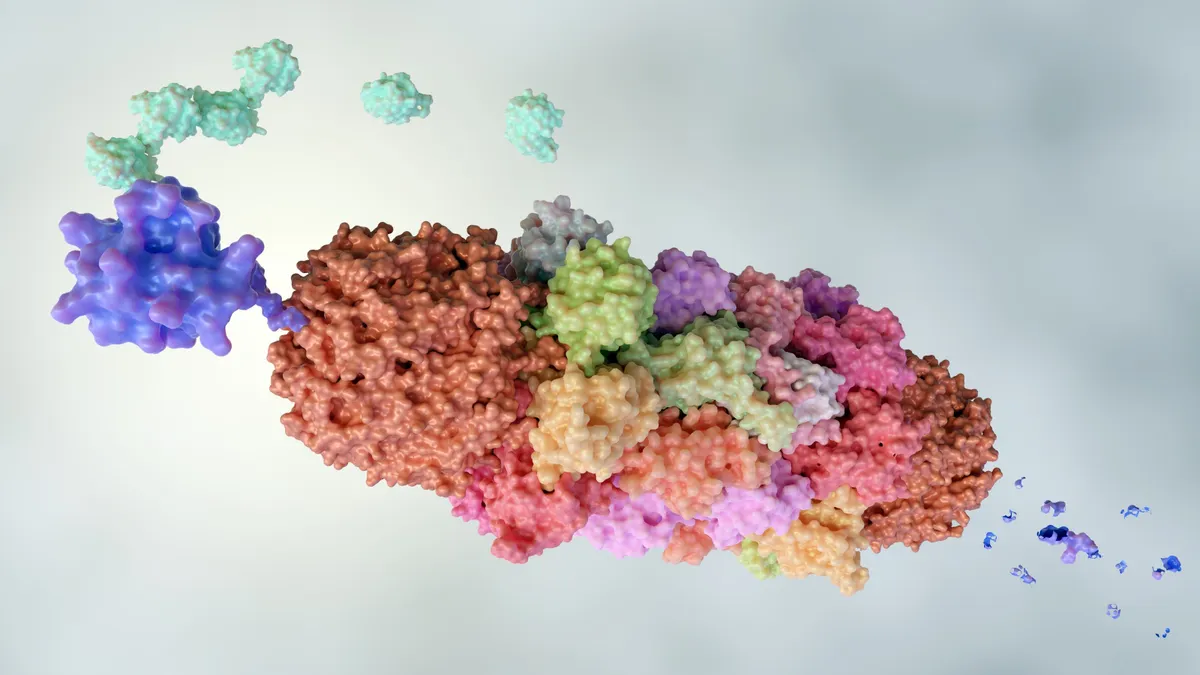

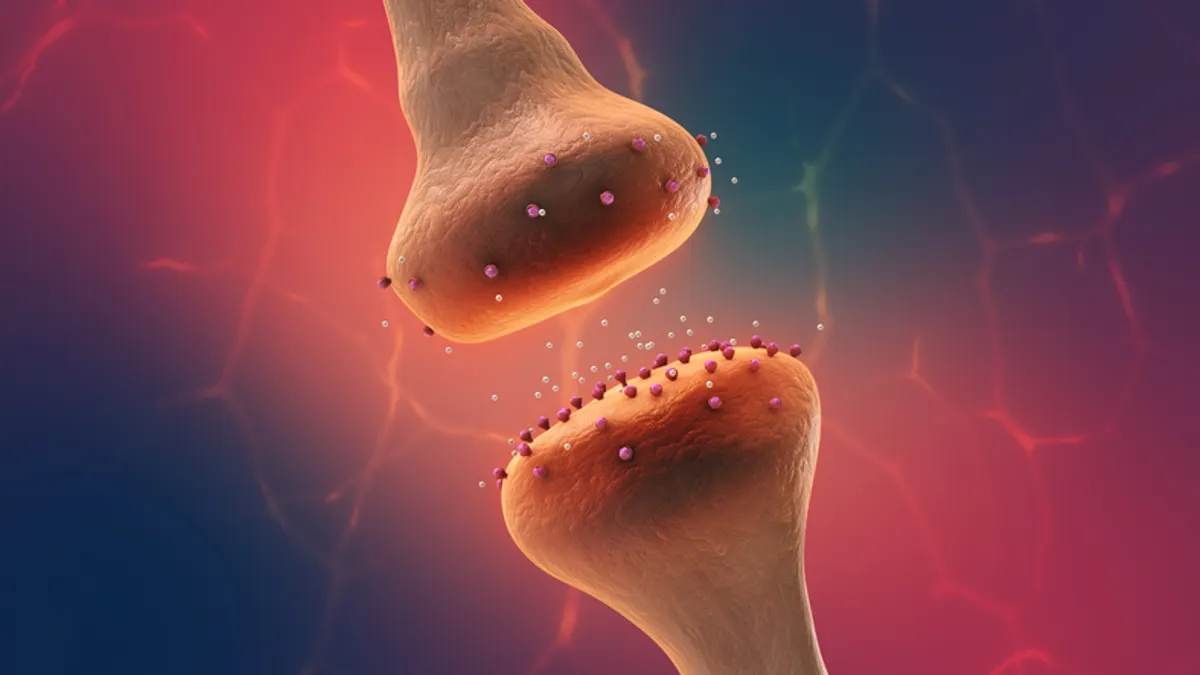

Latigo’s research mostly focuses on NaV1.8, a tube-shaped protein embedded in the outer casings of cells. When the body gets injured, these proteins act like alarm bells that blare pain signals to the brain. Silencing them can provide pain relief.

In late January, Vertex Pharmaceuticals’ Journavx became the first pain medication targeting NaV1.8 to gain approval from the Food and Drug Administration. While Journavx faces substantial commercial challenges — namely a pain relief market that’s been skewed toward the use of cheap opioids — analysts still expect it to eventually reach billions of dollars in sales.

Smaller biotechnology companies like Latigo and SiteOne Therapeutics bet there’s room on the market for their drugs, too. Tens of millions of people in the U.S. alone suffer from chronic pain. Millions more each year experience the short-lived “acute” pain typically felt after an operation or accident.

NaV1.8 drugs work differently than opioids and, so far, don’t appear to carry the addictive risks. Healthcare experts say such options could be extremely valuable given the U.S. remains mired in an opioid overdose crisis. And at least some politicians agree. A new federal law that went into effect this year aims to amend Medicare so patients can more easily access and afford certain non-opioid pain drugs.

Latigo hopes to be on that list one day. The company’s most advanced candidate, code-named LTG-001, is in a Phase 2 clinical trial, where researchers are evaluating its use alleviating the acute pain from wisdom teeth removals.

CEO Nima Farzan expects results from that study to come in the back half of this year. Data from late-stage experiments that will test the drug in patients who just underwent either a “tummy tuck” or a bunion removal should be available early next year, he said.

Latigo is working on at least two other NaV1.8 drugs geared towards chronic pain. The first, LTG-305, is in an early-stage study of healthy volunteers. The second, LTG-321, is a “follow-on” compound that, according to Farzan, has “unique scaffolding” which may make it more potent than its predecessor.

Farzan said the new funding gives Latigo a substantial cash runway that should keep it operational into next year, at least until the company has Phase 3 data for LTG-001 and what’s known as “proof-of-concept” data for LTG-305. Latigo closed a Series A round totaling $135 million last year.

Not long ago, a startup that raised hundreds of millions of dollars and ushered drugs to mid-stage testing had a relatively easy path to an initial public offering. But a dramatic downturn in the biotech stock market over the last few years has made this journey far more fraught. Twenty four biotechs went public last year, a steep drop off from the more than 100 that did in 2021.

Those that were able to pull off an IPO generally haven’t fared well either. Of last year’s class of 24, all but two are trading below their offering price.

Often, public markets are the only fundraising source substantive enough to get young drugmakers through the larger, pricier studies needed to secure approval. But the size of Latigo’s latest fundraising round means the company doesn’t have to race to an IPO, Farzan said.

“We can take our time. It's not right now. The markets are a little choppy,” he added. “We'll be responsible. We'll take a look. And when we think the backdrop’s relevant and interesting, it's something we would consider. But there are no immediate plans, given the current backdrop.”

If Latigo’s lead candidate ultimately gains approval, it would likely compete against Vertex’s in the acute pain setting. There, Vertex already looks to be making some commercial inroads. Journavx got its first nod from a major health insurer this month, with UnitedHealth Group’s pharmacy benefit manager placing the drug on some of its commercial formularies in an interim decision while a formal review continues.

Jefferies analyst Michael Yee also highlighted in a note to clients Friday that Journavx prescriptions grew from 44 to 606 — a 14-times increase — between the first and second weeks of the drug’s launch.

Going against a deep-pocketed rival can be daunting. Farzan acknowledges Latigo’s investors are “looking at the success of Vertex and using that as a reference for us.”

Still, he sees two areas where Journavx has left room for Latigo to compete. One is in how fast it’s able to reduce pain. The other is in the breadth of patients who might benefit. The hope, according to Farzan, is Latigo’s therapies will have fewer drug-drug interactions, or maybe help certain harder-to-treat populations, like those with impaired livers.

Looking ahead, Latigo's leaders will be closely watching how Journavx performs.

“The good news is that one quarter or two quarters of sales at launch is probably not the biggest thing … especially for a hospital product, especially for a company like Vertex, which is not a Pfizer or Merck when it comes to commercializing. They've historically been in much more niche markets,” Farzan said.

“Now, over a couple years, if you're not seeing the uptake, or you're seeing really great uptake, that will make, certainly, some impact.”