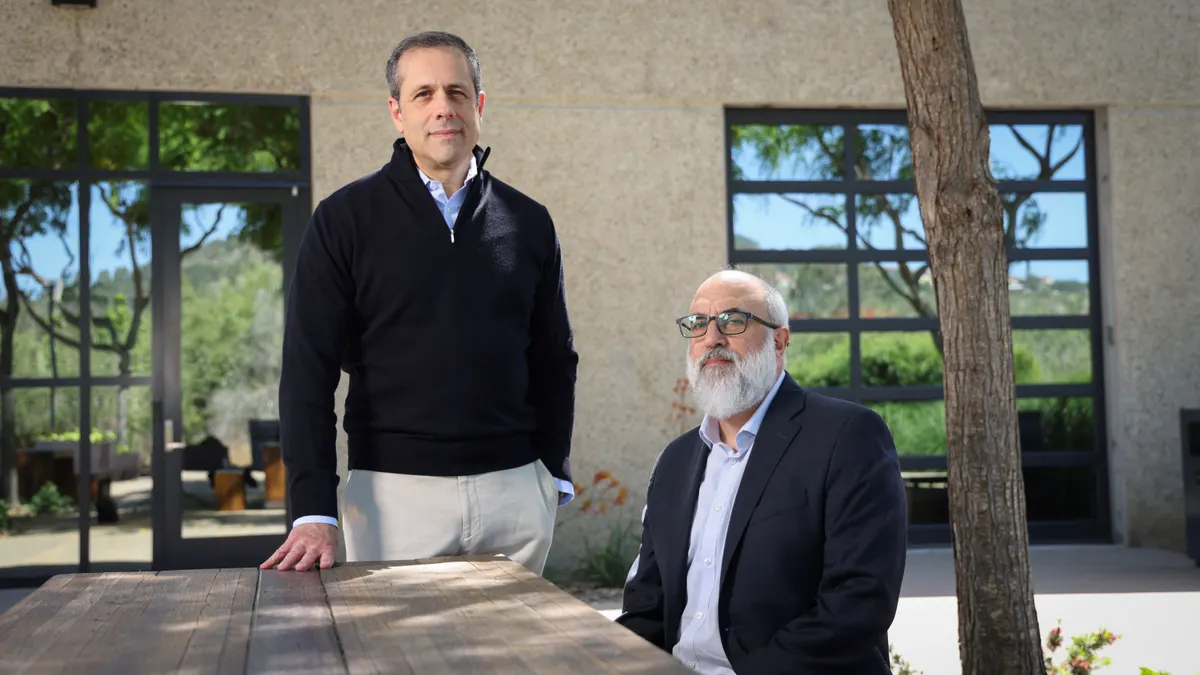

A new venture fund co-founded by the son of serial biotechnology entrepreneur Bob Langer announced the close of its first fund on Thursday, banking $77.5 million.

Called T.Rx Capital, the firm aims to invest in ten to 15 companies working at the “intersection of technology and biology,” which it described in a statement as including biotechs, “techbio” startups and those specializing in “tech-enabled services.”

In an email to BioPharma Dive, Michael Langer, the son of Bob Langer and one of the firm’s three founders, wrote that, within drug development, the company will consider investments in “next-generation modalities” like cell and gene therapies, radiopharmaceuticals and novel biologics. Outside of that scope, the firm is interested in AI-driven drug discovery, as well as digital tools that might speed development.

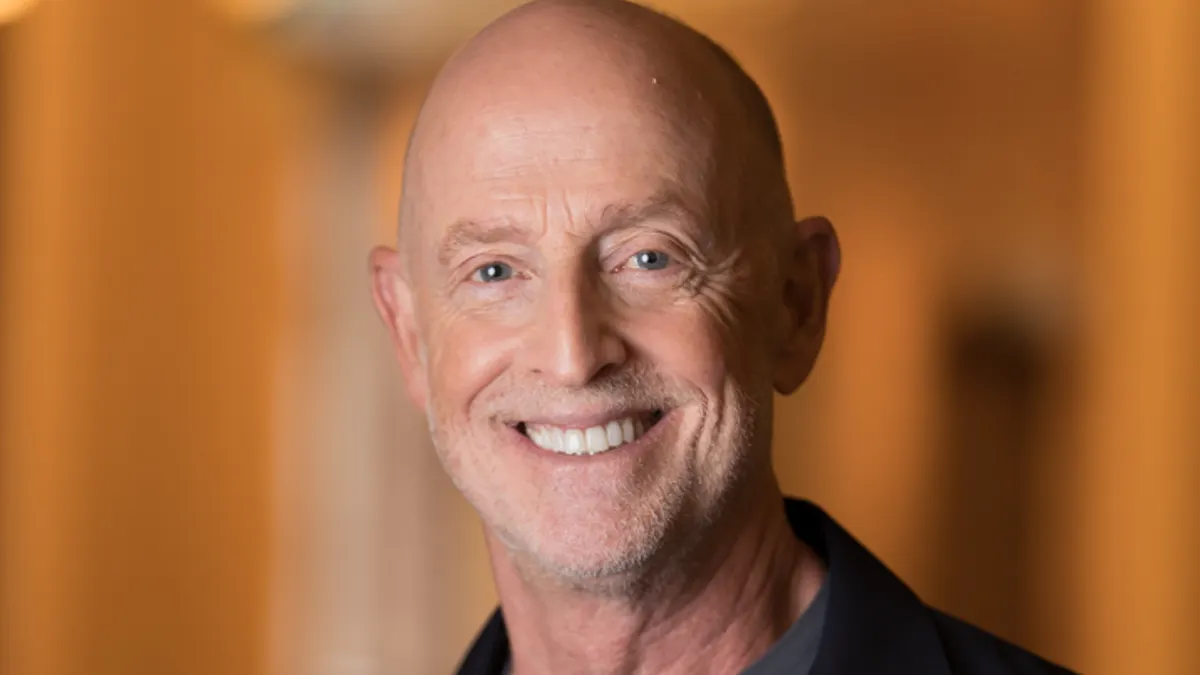

The team sees a “unique deal flow to early stage companies,” he said, from its ability to draw ideas from a network of more than 1,000 alumni who have worked in Bob Langer’s lab at the Massachusetts Institute of Technology and are now “active across academia and industry.” In addition to his prolific work as a scientist at MIT, Bob Langer has helped form dozens of biotech companies, among them Moderna in 2010. He’s also the firm’s executive chairman.

“We wanted to create a new venture platform built from the ground up to combine deep operator experience with access to one of the most robust innovation ecosystems in the world,” Michael Langer wrote.

T.Rx will target early-stage investments, focusing on company formation through Series B investments. It plans to invest between $5 million to $10 million in each startup and have “active roles” in “creation, scale and governance,” it said in its statement.

The fundraise was supported by a variety of family offices and limited partners, including individual founders of prominent biotech investment firms like Polaris Partners, Third Rock Ventures and Arch Venture Partners.

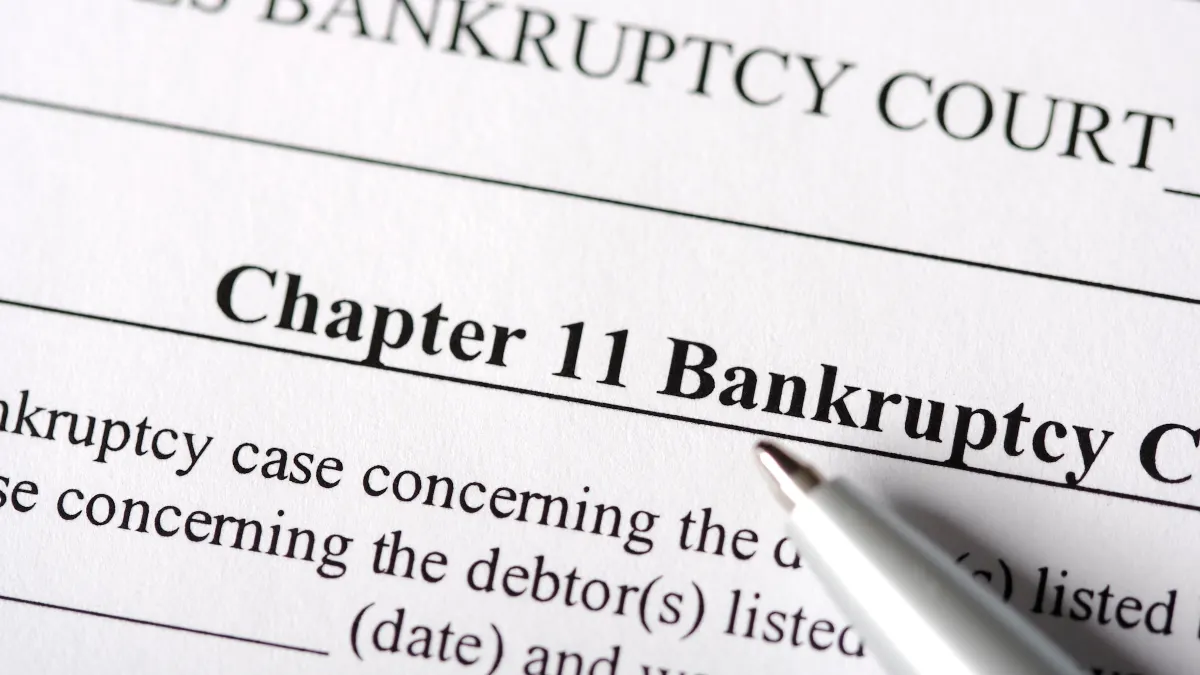

T.Rx is run by Corey McCann, the former CEO of digital therapeutics developer Pear Therapeutics; Kwesi Frimpong-Boateng, a former business development director at Eli Lilly; and Michael Langer, who formerly oversaw licensing at Pear.

Michael Langer previously founded Old Silver VC, a family investment vehicle, and spent time at investment firms like Polaris and Boston Seed Capital.

The firm’s scientific advisory board includes Bob Langer, Third Rock founder Mark Levin, former Pfizer Chief Medical Officer Freda Lewis-Hall and current Voyager Therapeutics CEO and longtime Biogen executive Al Sandrock. Its name is a fusion of the well-known symbol “Rx,” for medicine, and “T” for technology, the company said.

“With exit markets recovering, this is an exceptional time for venture capital to support the next wave of transformative biotech companies,” Frimpong-Boateng said in the statement.