Developing a new cancer treatment is a high-stakes endeavor where every decision can make or break success. Pharmaceutical companies must balance speed, risk and regulatory hurdles while ensuring patients have access to life-saving treatments as soon as possible. Based on Intelligencia AI’s comprehensive, proprietary database of over 20,000 industry-sponsored, interventional oncology clinical programs (around 12,400 clinical trials), recent insights highlight key strategies that can streamline the clinical development process and improve the chances of regulatory approval.

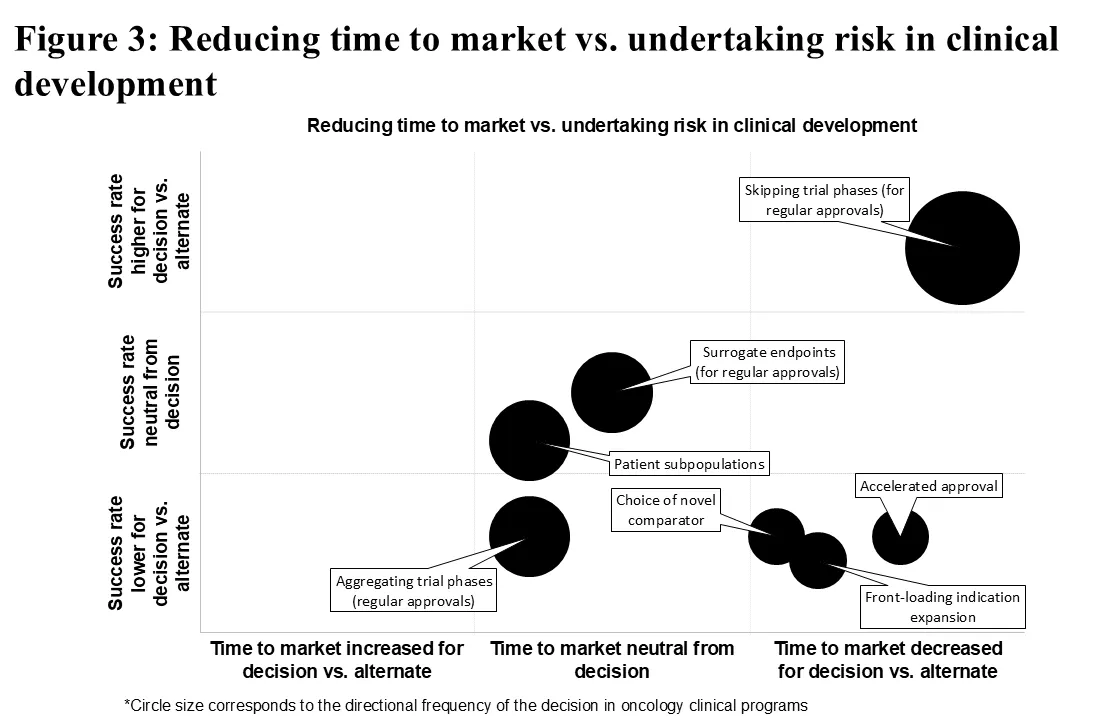

We analyzed each strategy based on its impact on time to market and historical success rates. The key findings are illustrated in the figure below, with a detailed breakdown of each strategy in the following sections, and you can read the complete analysis here.

Accelerated approvals: A shortcut with risks

One approach many companies take to reach the market more quickly is seeking accelerated approval. This pathway allows promising cancer treatments to reach patients faster by using early trial data instead of waiting for long-term results. On average, opting for an accelerated approval can reduce the time to market by nearly 30%. However, the tradeoff is clear: these drugs are less likely to get full approval, with a success rate of just 1.5% compared to the 4.4% seen in traditional approvals.

Additionally, regulatory agencies are tightening oversight, meaning companies must be prepared for increased scrutiny and be more proactive in initiating their confirmatory trial post-conditional approval.

Expanding drug indications: Thinking bigger from day one

Instead of focusing on just one type of cancer at a time, some pharmaceutical companies are “front-loading” indication expansion to start subsequent registrational trials before an initial registration trial is complete. This strategy speeds up the expansion process, potentially cutting a year off the timeline (15% benefit). However, it is exceedingly rare to find an asset that succeeds across multiple tumor types. Truly innovative companies carefully select which additional indications to pursue early, as well as which assets to attempt expanding across multiple indications, balancing the potential for broader market reach with the realities of clinical trial complexity.

Rethinking clinical trials: When skipping steps make sense

Traditional drug development moves through set phases, but innovative trial designs are shaking up this approach. For example, some companies bypass early-stage trials in certain cases, moving straight into mid-stage studies. When done strategically, this not only speeds up time to market (30% benefit) but also improves approval chances – a 4.5% success rate compared to 1.2% when not implemented. However, skipping phases isn’t a one-size-fits-all solution—it requires strong scientific backing and alignment with regulators to avoid setbacks.

Taking calculated risks

Some trial design choices come with mixed results. Using novel comparators—new treatments instead of standard ones—can shorten development time (12% benefit) but also decreases success rates. Similarly, combining trial phases, such as merging early and mid-stage studies, has been a popular strategy but hasn’t always delivered the expected benefits. The takeaway? While innovation is crucial, companies must assess when these tactics will truly add value rather than introduce unnecessary risk.

Decisions with neutral impact: When change doesn’t mean progress

Not all strategic shifts yield meaningful advantages. Some approaches, such as employing surrogate endpoints or focusing on patient sub-populations (usually genetically based), have shown little to no effect on time-to-market or approval rates.

While these decisions definitely have potential and have proven to be successful on occasion, they do not significantly influence success outcomes on aggregate. Pharmaceutical companies should ensure that resources are allocated toward high-impact changes and only employ such tactics when there is significant scientific or industry rationale to back them up.

The financial upside: Every month counts

Time isn’t just money—it’s millions of dollars. Every month shaved off the development timeline can add an estimated $5-6 million in value per billion dollars of peak sales. This makes the case for smarter clinical decisions even stronger. By adopting the right strategies, companies can gain a competitive edge, maximize return on investment, and, most importantly, bring life-changing treatments to patients faster.

The bottom line

While there is no single formula for success in oncology drug development, companies that embrace well-informed, strategic decision-making stand to gain the most. Whether it’s leveraging accelerated approvals, expanding indications early, or rethinking trial designs, the key is balancing speed with probability of success. Pharmaceutical companies can drive both financial performance and patient impact by making smarter clinical choices, ensuring a win-win for all stakeholders.

To read the complete analysis, visit intelligencia.ai.

Authors:

- Matthew Furlow, PhD, Associate Principal at ZS

- Andreas Dimakakos, PhD, MBA, PMP, Director of Scientific Insights, Intelligencia AI

- Evgenia Kyriakidou, Business Insights Associate, Intelligencia AI

- Elpiniki Georgiou, PhD, Senior Data Analyst, Intelligencia AI