Over the next five years, several blockbuster oncology drugs from leading pharmaceutical companies will lose patent protection, ushering in a wave of “patent cliffs” that pose significant revenue and strategic risks. This concentrated wave of oncology losses of exclusivity (LOEs) stems from a historic surge in immuno-oncology approvals during the mid-2010s, particularly in checkpoint inhibitors and targeted therapies. Many of these blockbuster assets—launched between 2014 and 2017—were granted expedited pathways, bringing them to market faster but also aligning their exclusivity periods. These cliffs, historically associated with revenue drops that can exceed 50% within two years of LOE, present a critical inflection point, especially for sponsors heavily reliant on a few oncology assets [1].

What happens when the cliff hits? The historical signals

Historical signals from Avastin, Gleevec and Revlimid, illustrate the disruptive nature of such events. Each saw rapid revenue declines—Avastin dropped over 40% post biosimilar entry, Gleevec lost more than 50% of U.S. sales within a year of generic launch, and Revlimid faced a projected 50% erosion despite staggered generic entry—underscoring the urgent need for proactive lifecycle and pipeline strategies [1,2]. Sponsors unprepared for the transition faced valuation declines, market share loss and delayed R&D pivots, either in the reprioritization of promising clinical assets or in investing in registrational-stage ones.

Conversely, sponsors with diversified pipelines or aggressive acquisition strategies managed to absorb the impact and maintain momentum. Oncology, due to its high-value therapies and pricing premiums, is particularly vulnerable to erosion once biosimilar and generic competition enters the scene.

We took a closer look at the waters ahead to understand how well-positioned companies are to navigate the looming patent cliffs. Drugs like Keytruda, Opdivo and Darzalex approaching LOE represent tens of billions in annual revenue at risk. While some companies have fortified pipelines or pursued lifecycle management strategies, others remain overexposed or delayed in their planning. This snapshot aims to highlight strategic posture as of today, while recognizing that these positions are dynamic—and that sponsors still have time to improve their trajectories.

Oncology LOE risk and readiness lens

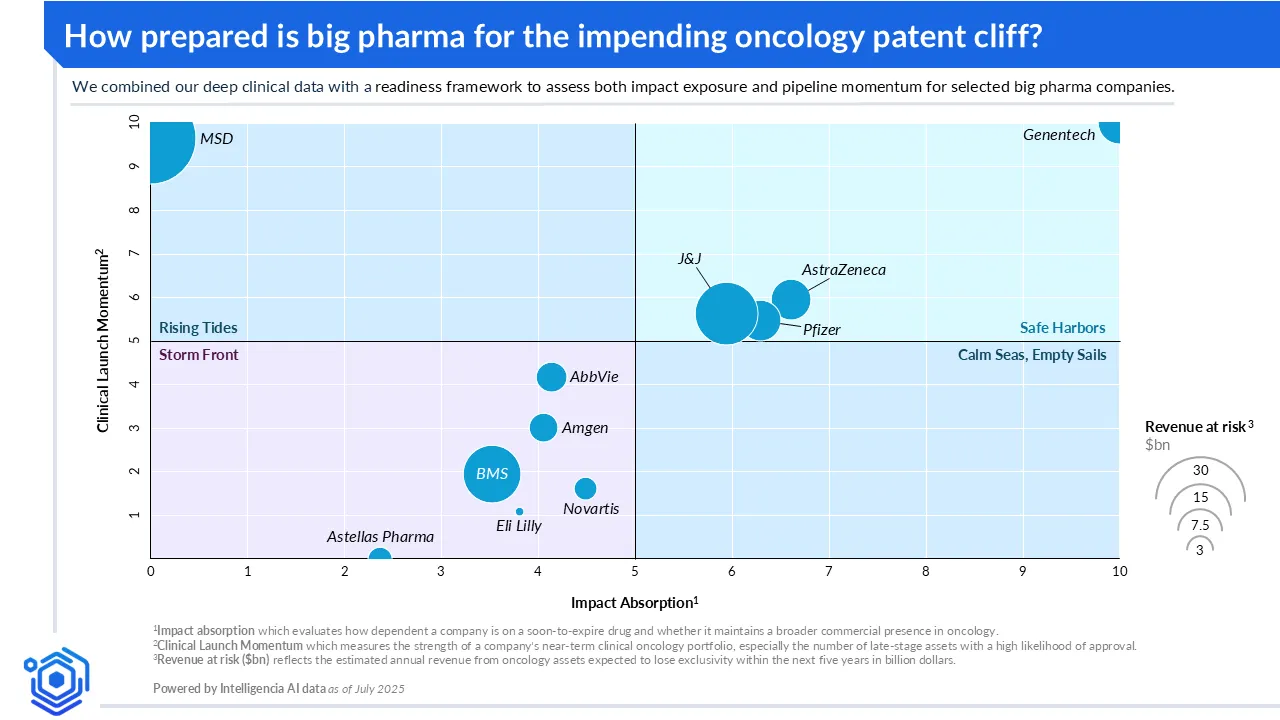

To better understand which companies are strategically positioned to weather the impact of oncology patent cliffs, we developed a readiness framework that assesses both impact exposure and pipeline momentum. The framework incorporates two metrics:

- An Impact Absorption Score, which evaluates how dependent a company is on a soon-to-expire drug and whether it maintains a broader commercial presence in oncology; and

- A Clinical Launch Momentum Score, which measures the strength of a company's near-term clinical oncology portfolio, especially the number of late-stage assets with a high likelihood of approval.

To complement these, we included a Revenue at Risk metric—reflected in the bubble size on the accompanying chart—capturing the absolute dollar value of oncology revenue exposed to LOE. This provides an at-a-glance sense of the potential financial magnitude each company must contend with as they approach key cliff events.

From our perspective at Intelligencia AI—through access to a comprehensive clinical trial database and regular analysis of the competitive positioning of pharma pipelines—the current snapshot of patent cliff–exposed companies comes as little surprise.

We've seen early signals across trial activity, pipeline robustness, and business development behavior. For instance, we’ve observed that sponsors with consistently high trial initiation rates in post-LOE indications, coupled with targeted in-licensing of late-stage assets, tend to rank higher in readiness—patterns we've seen reflected in companies like Merck Sharp & Dohme (MSD).

At the same time, companies with fewer late-stage trials and limited BD&L activity in oncology subtypes where exclusivity is expiring may face a more challenging transition unless strategic adjustments are made. By continuously integrating clinical data in real time with deal flow analytics, sponsors can improve situational awareness and act well before cliff-side impacts become visible in earnings.

Our analysis, represented in the graph above, highlights both existing strengths and areas where renewed focus may be required. Some companies already show strong signs of preparation, while others have the opportunity to enhance their resilience through targeted action.

Facing the cliff: Who’s ready to leap, and who’s looking down?

To bring this framework to life, we highlight three illustrative sponsors—each occupying a distinct quadrant:

Genentech (Roche): Safe harbors

Positioned in the upper right quadrant, Genentech combines strong momentum with the ability to absorb impact—making it a clear example of a Safe Harbor. Despite facing near-term LOEs for Kadcyla and Perjeta, Genentech retains exclusivity for more than fifteen oncology therapies. Notably, almost half of its pipeline has progressed to late-stage development, supporting future revenue continuity. Its relatively balanced revenue distribution across assets limits vulnerability, reducing the size of its Revenue at Risk bubble despite upcoming expiries.

Astellas: Storm front

In the lower left quadrant, Astellas exemplifies the Storm Front—low absorption capacity paired with limited momentum. With Xtandi approaching LOE and few other oncology products or late-stage candidates to offset the loss, Astellas faces concentrated risk with little in the near-term pipeline to relieve pressure. Its Revenue at Risk is moderate in absolute terms but highly concentrated, amplifying its strategic vulnerability. The window for action remains open, but it’s narrowing.

MSD: Rising tides

MSD is a classic example of a Rising Tide—a company with strong clinical momentum but high exposure to a single anchor product. With Keytruda accounting for nearly half of its oncology revenue, MSD carries one of the largest Revenue at Risk profiles in the landscape. However, the company has taken deliberate steps to accelerate its pipeline, with multiple late-stage assets progressing toward approval. This momentum signals a clear effort to offset future erosion and positions MSD to ride the tide of clinical progress, even as it faces a sharp LOE drop from a heavily concentrated revenue base.

From Analysis to actionable strategy: Staying ahead of the oncology patent cliff

The oncology patent cliff presents a complex and urgent challenge. As blockbuster therapies approach loss of exclusivity, the consequences for unprepared sponsors can be steep—ranging from sharp revenue erosion to delayed R&D pivots and weakened market positions. But while the risks are significant, the window for action remains open.

Companies best positioned to weather the cliff are those that actively invest in late-stage pipelines, accelerate clinical execution, and pursue external innovation with a sense of urgency. This challenge touches all parts of the organization.

Portfolio strategy leaders must reassess timelines and resource allocations with LOE pressure in mind. Search & evaluation teams are racing to identify high-fit external assets amid fierce competition. And BD&L professionals must act decisively to close value-driving deals before the window narrows.

This current snapshot reflects where companies stand today, not where they ultimately need to be. Strategic posture in this environment is inherently dynamic. Companies can still shift course by reprioritizing clinical assets, tightening portfolio governance, identifying whitespace for in-licensing, and building partnerships that close therapeutic or modality gaps. Success will hinge on the ability to translate pipeline and market foresight into coordinated, data-driven action.

At Intelligencia AI, we equip sponsors to do exactly that — drive smarter decisions with the right data, insights and AI. Our solution brings together predictive analytics, clinical data in real-time, and business development intelligence to help teams evaluate risk precisely, monitor competitive activity continuously, and uncover strategic opportunities early—before cliff-side impacts appear in earnings.

The patent cliff is real and fast approaching—but its outcome is not yet written. For those willing to act decisively, there is still time not only to mitigate the fallout but to emerge stronger, more focused, and better positioned for the next era of oncology innovation.

References

-

Kim, M. S., Haslam, A., & Prasad, V. (2025). Trend of sales revenue by year for top-selling cancer drugs in the US and the effect of loss of market exclusivity. Journal of Cancer Policy, 43, 100533. https://doi.org/10.1016/j.jcpo.2024.100533

-

FirstWord Pharma. (2021, April 21). Roche confirms outlook despite drug sales falling 14% in Q1. Retrieved from https://firstwordpharma.com/story/5279321