Johnson & Johnson is confident it can manage the impact of tariffs on its pharmaceuticals and medical device businesses this year, announcing Tuesday that it will maintain its financial forecast for the year while raising its sales guidance.

J&J, which is the first large drugmaker to report results for the first quarter, expects adjusted earnings per share of $10.60 for 2025. That number is the same as the company estimated in January, before President Donald Trump announced sweeping new tariff policies that will tax imports of medical devices along with most other goods.

Duties on drugs are likely coming soon, too. The Trump administration disclosed Monday an investigation into the national security effects of pharmaceutical imports in a move that analysts anticipate will result in new levies in the near future.

“We built into our guidance about $400 million in tariff costs based on what we know today,” said J&J CFO Joe Wolk in a CNBC interview Tuesday morning. “It was really a pretty healthy beat considering we didn’t have those things in January that we’re now absorbing.”

Much of that $400 million impact involves J&J’s medical device business, Wolk clarified on a company conference call held later on Tuesday morning, and also reflects retaliatory tariffs China has imposed on U.S. goods.

Wolk declined to share an annualized estimate for the impact of tariffs, citing the fast-changing nature of the Trump administration’s policies.

Yet, for an industry shaken by both Trump’s tariff threat and a chaotic regulatory restructuring, J&J’s stability may be welcome news.

“[J&J management] downplayed tariff risks this morning, which we view as an important positive development for perception about the threat to [J&J] and the branded biopharma industry at large,” wrote Leerink Partners analyst David Risinger in a client note.

Recently, J&J said it will spend $55 billion over the next four years on building new drug factories in the U.S., one of several drugmaker announcements of plans to reshore manufacturing to the U.S. — something Trump has leaned specifically on the industry to do. After those plants are complete, J&J expects that “essentially all” of its advanced medicines will be made in the U.S.

Speaking on the company’s conference call, J&J CEO Joaquin Duato made the case that tax policy, not tariffs, is more effective at spurring capital investment.

“Tariffs can create disruptions in the supply chain, leading to shortages,” Duato said. “If what you want is to build manufacturing capacity in the U.S. ... the most effective answer is not tariffs, but tax policy.”

The pharmaceutical industry benefited mightily from the tax law passed in 2017 during Trump’s first administration, and is arguing for its renewal.

It’s unclear what kind of pharma tariffs might emerge from the newly begun probe by the Department of Commerce. According to a regulatory notice posted Monday, Commerce will look at both branded and generic medicines, as well as the active drug ingredients they contain and the starting materials from which they’re derived.

Trump has threatened duties between 50% and 200%, which, if imposed, would dramatically increase costs for an industry that has supply chains spread throughout Europe and Asia. Most precursor chemicals and active ingredients are sourced from China and India, while many branded manufacturers have production facilities in countries like Ireland, Switzerland, the Netherlands and Singapore.

Wolk, in his CNBC interview, speculated that the administration might focus on generic medicines and precursor chemicals, but stressed that was only J&J’s view of where national security concerns might be most acute.

“I think it’s also important that companies in healthcare partner with the administration to look to mitigate some of the vulnerabilities that exist today in other healthcare supply chains,” said Duato, on the conference call. “It is important for us to partner with the administration ... and we plan to do it.”

Overall, J&J reported sales of about $21.9 billion during the first three months of the year, an increase of 2.4% from the same period the year prior and higher than consensus Wall Street estimates. Revenue from the company’s pharma business also beat expectations, totaling roughly $13.9 billion in the quarter.

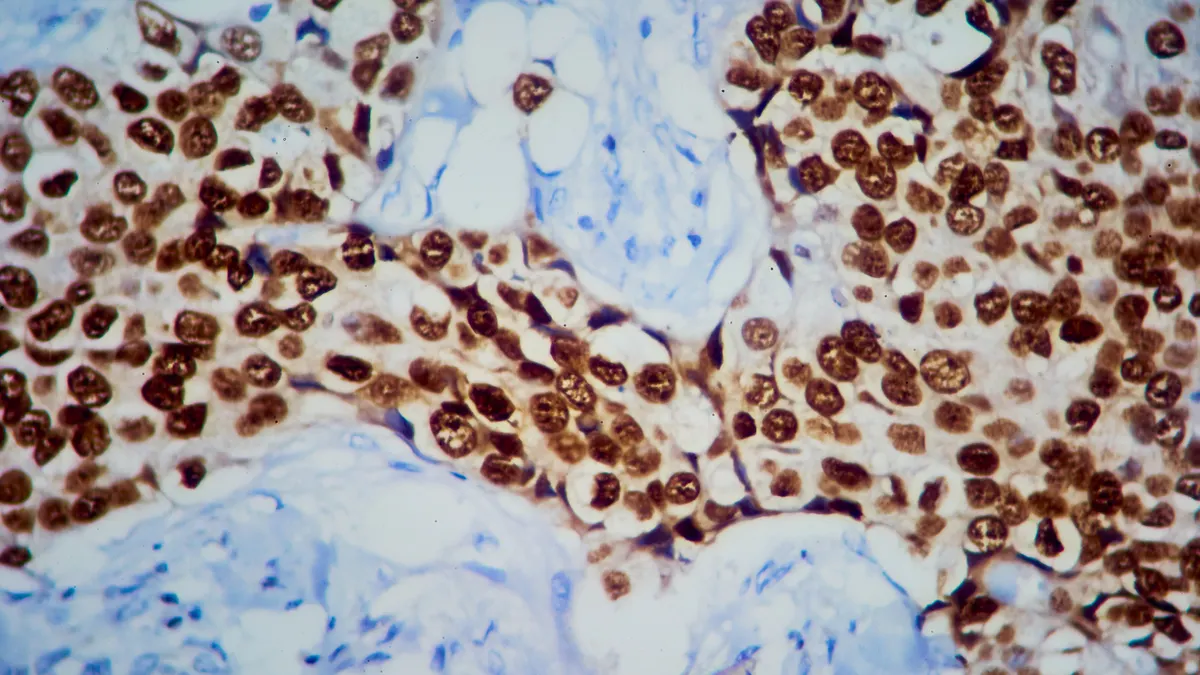

J&J executives highlighted on the call several of the company’s approved medicines and two experimental therapies for which it thinks analysts forecasts are too low. Notably, the company expects sales of its cancer drug combination Rybrevant and Lazcluze to reach about twice as high in 2027 as Wall Street’s current estimate of $1.8 billion.

Shares were trading down about 0.5% by mid-morning Tuesday.