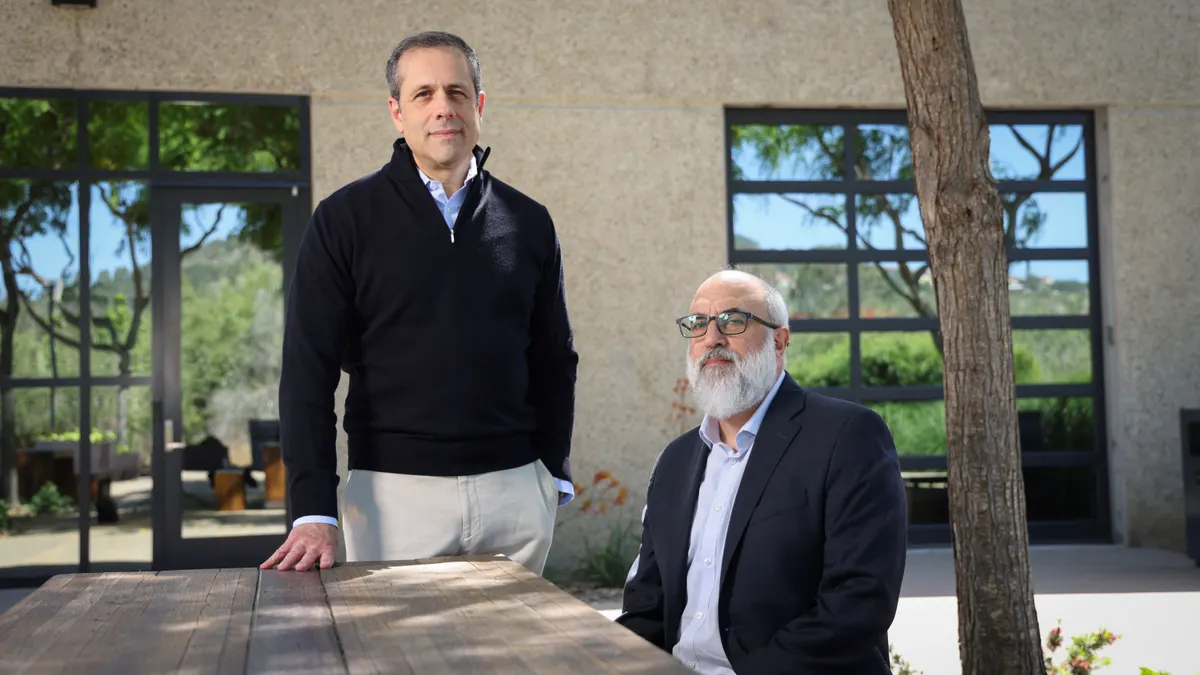

Medicxi, a European life sciences venture capital firm, said Friday it raised 500 million euros, or about $579 million, for its sixth investment fund.

The firm will use the new bankroll to continue “asset-centric” investing, or building new companies around one or a few experimental “products” rather than broad drugmaking “platforms.” It’ll also support other, existing biotechs that align with its focus, regardless of their stage of development.

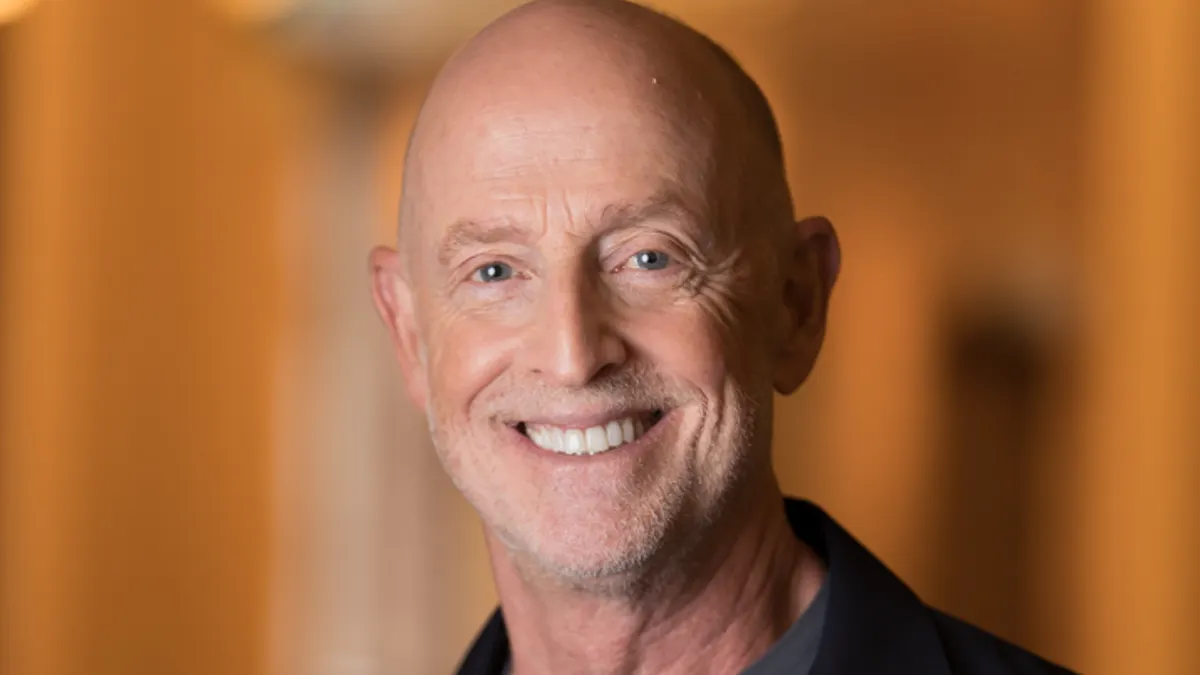

“Especially in times where generally in the market, capital is constrained, it helps us really focus on the stories that we believe have a higher chance of success of delivering products to patients,” said Medicxi partner and co-founder Giovanni Mariggi.

The fundraise comes during a recent upswing in biotech venture funding. According to BioPharma Dive data, at least a dozen young biotechnology companies have raised more than $100 million in private funding since the beginning of October, part of a broader rally Mariggi attributes to lower interest rates and an influx of cash from investors that have recently scored some investment returns.

Medicxi is one of those firms. In a statement, the firm noted that it’s realized more than $1 billion in returns across its portfolio since its previous fundraise, with companies like Merus, ProfoundBio and ViceBio acquired in large deals and investments in AbiVax and Vaxcyte, among others, appreciating in value following positive readouts.

Medicxi last raised $400 million two years ago, following the acquisitions of three of its portfolio companies by Gilead Sciences, Incyte and Eli Lilly, respectively. The firm is hoping for more of the same in the years to come, Mariggi said, due to pharmaceutical companies’ “continued need to renew pipelines.”

“As capital allocators, there always has to be a divorce from our companies,” he said. “The fact that you're seeing continuous M&A in our portfolio must mean that we are developing assets that are of interest to acquirers.”

Medicxi was previously known as Medicxi Ventures and launched out of Index Ventures in 2016 with the backing of GSK and Johnson & Johnson. Since closing its last fund, the firm has created 16 new companies, among them Ottimo Pharma, a biotech making dual-pronged cancer immunotherapies, and Curevo, a shingles vaccine developer. Medicxi has also built several of its biotechs by merging multiple startups together, as it’s done with Centessa Pharmaceuticals and Alys Pharmaceuticals.

Medicxi is one of many firms to close new funds this year, among them Frazier Life Sciences, Atlas Venture and Omega Funds. “There’s not been a lack of private capital,” Mariggi said.

Still, at least until recently, investors have been reticent to deploy that cash amid economic turmoil and regulatory uncertainty, he said. In October, Pitchbook and the National Venture Capital Association projected a dip in total life sciences venture deals in 2025 compared to last year.

Corrected: A previous version of this story referred to Medicxi’s latest fund as its fifth.