Novartis is exploring options to meet the Trump administration’s goal of bringing U.S. drug prices down to match what European and other high-income countries pay, but doesn’t expect any policy resolution soon, CEO Vas Narasimhan said on an earnings call Thursday.

“Conversations with the administration, from the Novartis standpoint, have been productive, very open dialogue to find solutions,” Narasimhan told analysts.

Yet, “in terms of resolution, it’s very difficult to say,” the executive added later. “There are different approaches that HHS is thinking through,” he said, referring to the Department of Health and Human Services.

HHS is leading the U.S. government’s efforts to carry out an executive order President Donald Trump issued in May that seeks to link domestic pharmaceutical costs to foreign prices, which often appear substantially lower. Pharma companies argue that such sticker price comparisons are misleading, as rebates and discounts paid to insurer middlemen lower U.S. net costs by at times large margins.

The drug industry opposes this policy, known in shorthand as a “most favored nation” arrangement, but has been considering how it could work with the White House, which has vaguely threatened consequences for companies that don’t. The administration is also weighing drug import tariffs that Trump has said could be as high as 200%.

While the pricing and trade policies are separate, Novartis and some of its industry peers appear to be making a case to the Trump administration for how they could intersect.

“The goal is very much to see how we can have markets outside of the U.S., in the OECD, pay more for innovative medicines,” Narasimhan said Thursday, referring to the Organization for Economic Cooperation and Development. “I’d say there is strong desire within the administration to maintain U.S. leadership in biopharmaceutical innovation and not cede that leadership to China or any other market.”

“I think that’s very high on their mind to ensure they get the balance right,” he added.

The Trump administration’s menu of options for enforcing the “most favored nation” policy are limited. In a statement that followed the president’s order later in May, HHS said it “expects” companies will voluntarily work to align U.S. prices of certain branded medicines to the lowest price among a group of OECD countries.

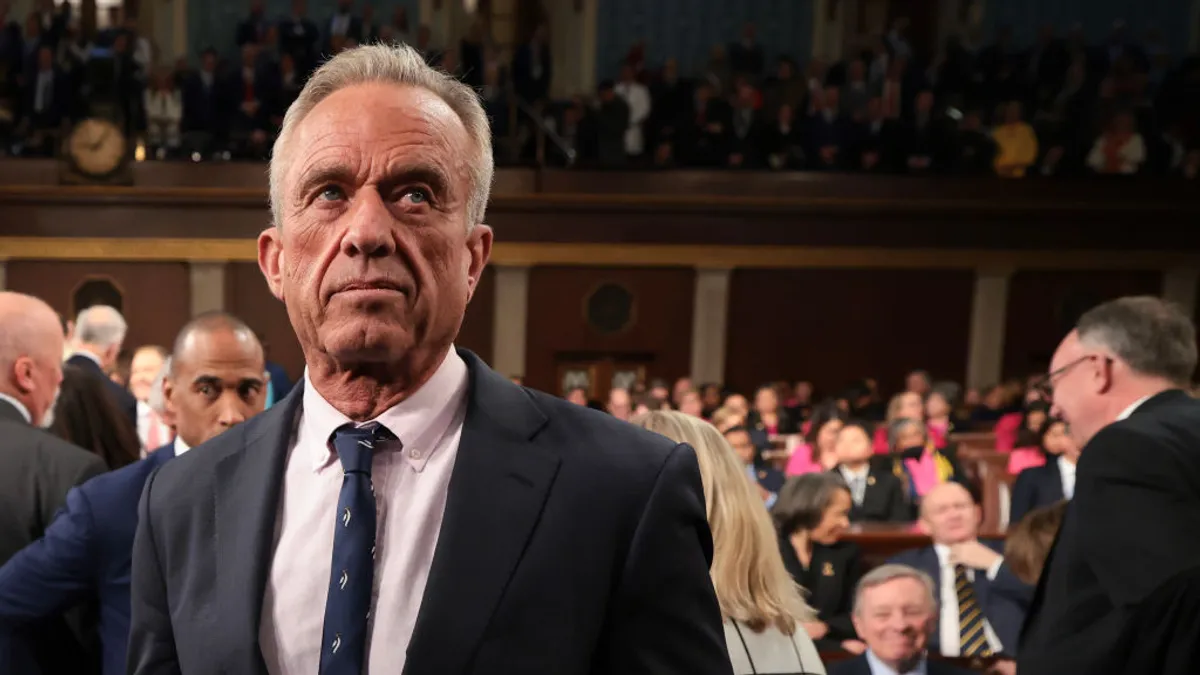

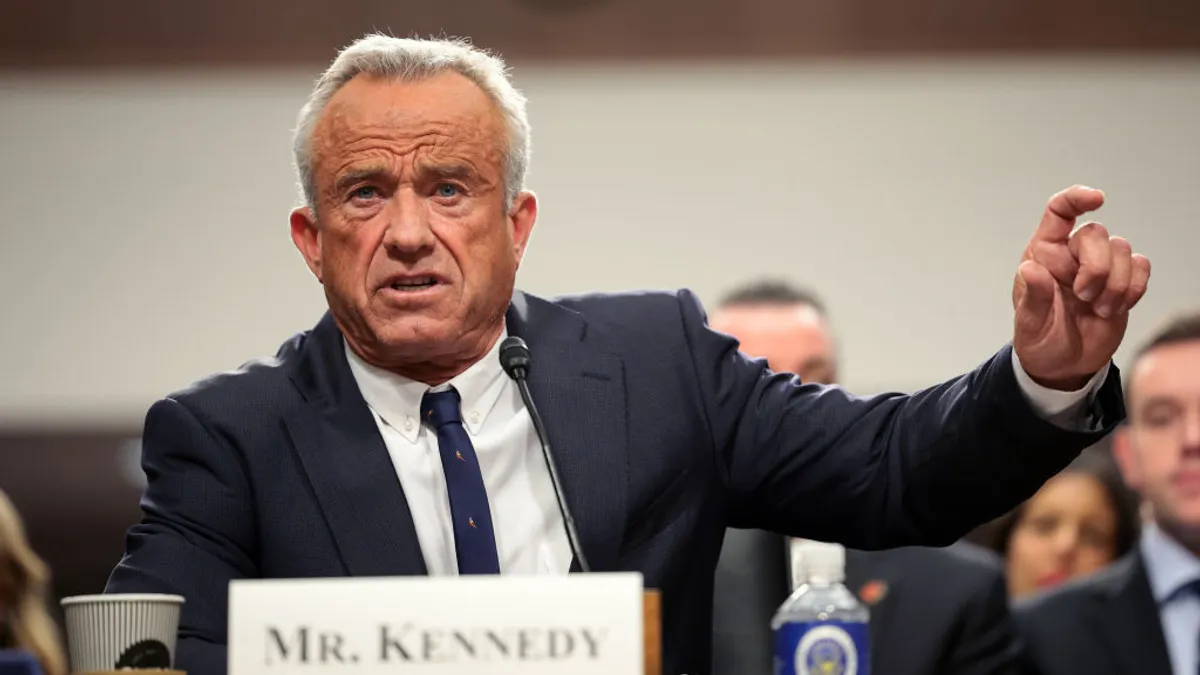

Should drugmakers not comply, the president’s executive order has directed HHS Secretary Robert F. Kennedy Jr. to pursue a “rulemaking plan.” It’s not clear what form that could take, though.

Drugmakers could also challenge the order in court and argue Congressional action is needed for Medicare and Medicaid to set “most favored nation” prices. The president has little authority to dictate payment rates in commercial markets, meanwhile.

“Doing any of these things requires significant shifts in rulemaking,” Narasimhan said Thursday. “Some of the knock-on effects across the system are not at trivial to do overnight.”

“We might have the beginning of what we want to do in the coming quarters,” he continued. “But then actually implementing it and then rolling it out will certainly take time.”

One option drugmakers could pursue is establishing new ways for patients to access drugs at lower cash prices, outside of insurance. Eli Lilly and Novo Nordisk have experimented with doing this for their in-demand obesity medicines and, on Thursday, Pfizer and Bristol Myers Squibb announced a new program for patients to get the blood thinner Eliquis at a reduced cash price.

Asked by an analyst on Wednesday’s call about Lilly’s and Novo’s efforts, Narasimhan indicated Novartis is evaluating these channels, too.

“Depending on the product, you have gross-to-net [reductions] anywhere from 50% to 70%,” he said. “Giving those discounts direct to patients as opposed to the various intermediaries would be a very attractive option.”

“We’re in the very early days of evaluating,” Narasimhan added. “Overall in the sector there’s certainly an evaluation as well to see if there are any approaches we could work with HHS to come up with.”

Narasimhan delivered his comments as Novartis reported second quarter sales that fell just shy of Wall Street expectations, but profits that beat consensus forecasts. The Swiss drugmaker raised its guidance for core operating income this year, predicting a low teens increase from its previous benchmark of low double digits.

Novartis’ cancer medicines Pluvicto and Kisqali outperformed analyst expectations, while the immune drug Cosentyx faced headwinds in the second quarter that brought sales lower than estimated.

Editor’s note: This story was updated with additional details.