Pfizer is wagering billions of dollars on a new kind of cancer immunotherapy, agreeing Monday to license a type of dual-targeting medicine that’s emerged as a must-have for drugmakers in oncology.

The pharmaceutical giant will pay biotechnology company 3SBio $1.25 billion upfront for rights outside of China to a therapy dubbed SSGJ-707. 3SBio, which is based in Shenyang, China, could receive up to $4.8 billion more in additional payouts if the drug hits certain goals and sales royalties should it eventually reach market. Pfizer will make a $100 million equity investment in 3SBio upon the deal’s closing as well.

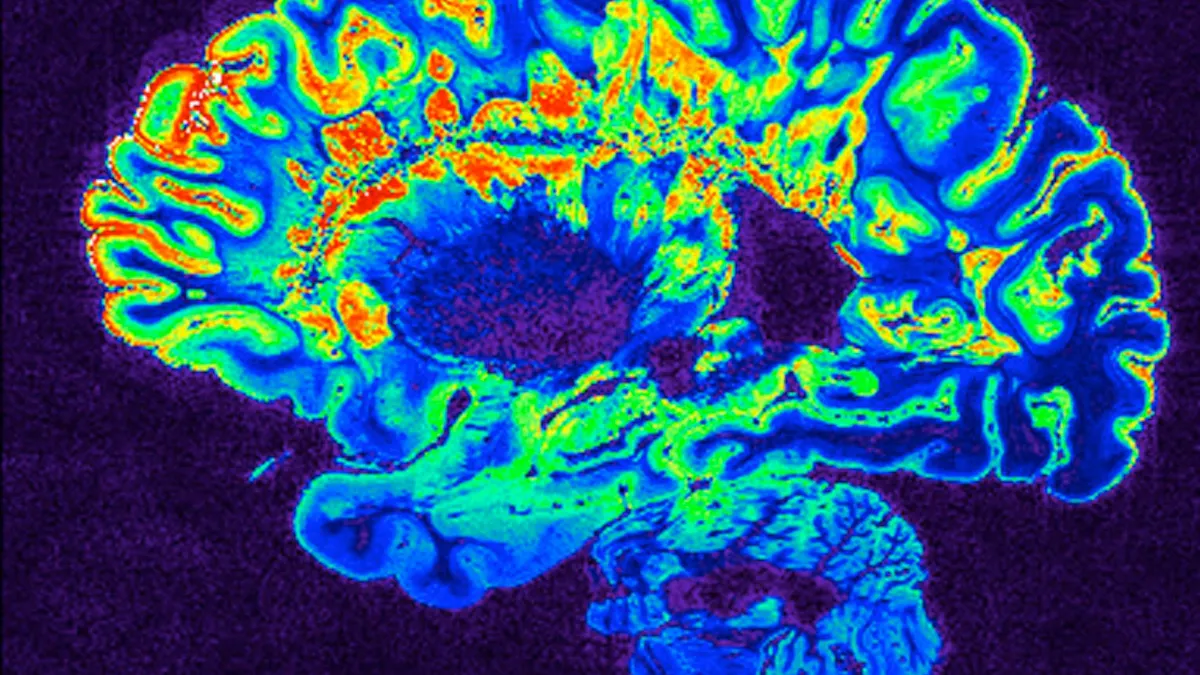

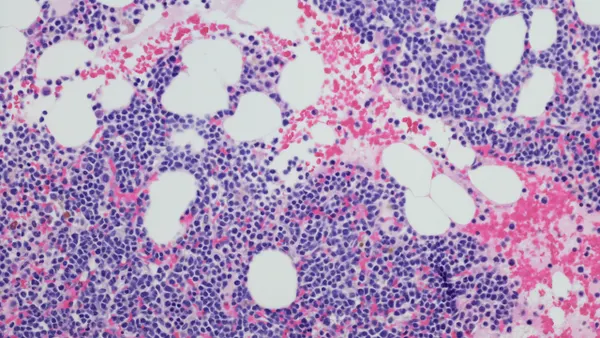

The deal makes Pfizer the latest large drugmaker to bet on drugs that simultaneously block the proteins PD-1 and VEGF, signaling through which helps tumors slip past the immune system and grow. The wave of investment comes after one such drug, ivonescimab, bested Merck & Co’s dominant immunotherapy Keytruda in a Phase 3 trial in lung cancer in China last year. More than a dozen companies are now developing them. Many are based in China or acquired their prospects from Chinese drugmakers, reflecting the biotech sector’s growth there.

“It’s become obvious that every [multinational corporation] wants a PD-1/VEGF on hand,” wrote Jefferies analyst Cui Cui in a Tuesday note to clients.

These PD-1/VEGF inhibitors are drawing interest because they might build upon Keytruda and other drugs like it, which can treat an array of cancers and earn billions of dollars in annual sales.

Questions remain, however. Study results from ivonescimab’s main trial in China suggested a modest survival benefit compared to Keytruda, but the difference wasn’t substantive enough to prove ivonescimab is better. It’s unclear whether PD-1/VEGF inhibitors will improve on standard therapies in other tumor types, or in international trials with more diverse pools of participants.

Pfizer is looking to oncology to help turn around a prolonged stock slide and sinking COVID vaccine revenue, and PD-1/VEGF drugs have become part of that effort. In February, it partnered with ivonescimab developers Akeso and Summit Therapeutics to study their drug alongside cancer medicines in Pfizer’s pipeline. Now Pfizer’s grabbed rights to an ivonescimab competitor that is currently undergoing clinical trials in China in lung cancer, metastatic colorectal cancer and certain gynecological tumors.

Pfizer will have to prove 3SBio’s drug can stand out. Ivonescimab was cleared in China last month and is in several other late-stage studies. BioNTech has a PD-1/VEGF prospect also acquired from China that’s currently in Phase 3 testing.

By comparison, 3SBio’s drug should start its first Phase 3 trial in China later this year. Earlier study data were “similar” to what was observed in testing of PD-1/VEGF drugs Merck & Co. and BioNTech acquired, wrote Jefferies analyst Cui. Phase 2 results will be presented at the American Society of Clinical Oncology meeting at the end of the month.

The drug “dovetails well” with Pfizer’s stockpile of antibody-drug conjugates “and adds another important pipeline candidate to [its] oncology portfolio,” wrote Leerink Partners analyst David Risinger, in a separate note. “However, we will need to assess its competitive differentiation given crowding in the category.”

Pfizer said it will manufacture the drug substance for SSGJ-707 in Sanford, North Carolina, and the drug product in McPherson, Kansas. The company and its peers have been pledging more investment in U.S. drug production as the Trump administration weighs levying tariffs on pharmaceuticals imported from abroad.