Biotech: Page 34

-

Sands Capital raises $555M fund amid upturn in biotech ‘crossover’ investing

The firm, one of the sector’s more active crossover investors, closed the fund during a surge in the financings that bridge biotechs to the public markets.

By Ben Fidler • May 14, 2024 -

Sanofi gambles $80M on Fulcrum’s muscular dystrophy drug

The deal gives the pharma partial rights to a medicine GSK once developed for heart disease but could soon become the first therapy for facioscapulohumeral muscular dystrophy.

By Jonathan Gardner • May 13, 2024 -

Explore the Trendline➔

Explore the Trendline➔

National Institutes of Allergy and Infectious Diseases. (2016). "Human natural killer cell" [Micrograph]. Retrieved from Flickr.

National Institutes of Allergy and Infectious Diseases. (2016). "Human natural killer cell" [Micrograph]. Retrieved from Flickr. Trendline

TrendlineCell therapy

The continued emergence of CAR-T therapy has fueled research into next-generation approaches and new applications, such as its use in autoimmune diseases.

By BioPharma Dive staff -

Ajax, aiming for a better JAK drug, raises $95M to begin first tests

Goldman Sachs and Eli Lilly are among those backing the startup, which claims its prospect could be more potent than the myelofibrosis therapies that have come to market in recent years.

By Gwendolyn Wu • May 13, 2024 -

NewVale, an unorthodox investment firm, sets out to support biotech’s ‘infrastructure’

The firm, which closed a $167 million fund, aims to fill a “crucial gap” by growing the companies startups turn to for outsourced services, founder Todd Holmes told BioPharma Dive.

By Ben Fidler • May 13, 2024 -

iTeos shares jump on TIGIT update; Acelyrin swaps CEOs

Interim data surpassed expectations, iTeos said. Bluebird bio, meanwhile, gave a fuller accounting of launch progress for its gene therapies Lygenia, Zynteglo and Skysona.

By BioPharma Dive staff • May 10, 2024 -

Maze lands new partner for Pompe drug, after Sanofi pact came apart

An alliance with Shionogi involves similar terms as a deal Sanofi canceled in response to an unusual challenge from the Federal Trade Commission.

By Ben Fidler • May 10, 2024 -

Novo taps another Flagship startup in search for next obesity drugs

The deal with Metaphore Biotechnologies is the third from a Flagship alliance meant to boost the Danish drugmaker’s pipeline of weight loss medicines.

By Gwendolyn Wu • May 9, 2024 -

Verve moves forward with backup base editing therapy

Weeks after a safety setback derailed its lead candidate, the company has treated the first participant in a trial of its heart disease treatment Verve-102.

By Ned Pagliarulo • May 7, 2024 -

Zenas, with new funding, aims dual-targeting antibody at lupus and MS

The $200 million round is the latest evidence that surging interest in autoimmune disease cell therapies could expand to include developers of bispecific antibodies.

By Ben Fidler • May 7, 2024 -

Prologue, Flagship’s newest startup, looks to mine viruses for new drugs

The company is using what it claims is the largest database of viral protein structures to unearth medicines for a range of diseases, said CEO and Flagship origination partner Lovisa Afzelius.

By Gwendolyn Wu • May 7, 2024 -

Bluebird, Vertex prep for first commercial use of sickle cell gene therapies

One patient has started the treatment process for Bluebird's Lyfgenia, while five others have done the same for Vertex's Casgevy.

By Ned Pagliarulo • Updated May 7, 2024 -

Sponsored by Qiagen

Free pathway analysis: How much do you really save?

Can free bioinformatics tools get the job done?

May 6, 2024 -

CG follows big IPO with new results for bladder cancer drug

Newly disclosed Phase 3 results presented Friday match findings the biotech disclosed last year, while offering a more comprehensive look at how its drug stacks up to rival therapies.

By Gwendolyn Wu • May 3, 2024 -

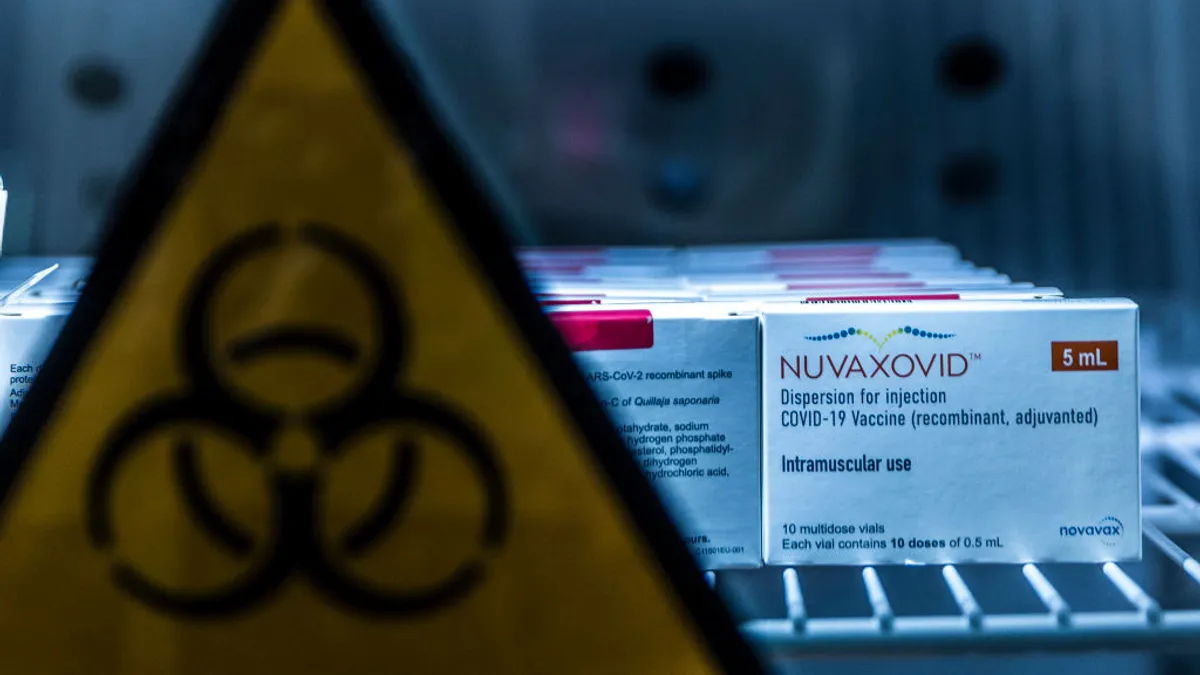

Activist investor pushes case against Novavax leadership

Shah Capital, which owns a 7.5% stake in Novavax, called for shareholders to vote against re-electing three of the vaccine maker’s director nominees.

By Meagan Parrish • May 3, 2024 -

Moderna ends gene editing alliance with Metagenomi

Metagenomi said the companies’ decision to part ways followed a “strategic prioritization” undertaken by Moderna, which has made several investments in gene editing research in recent years.

By Kristin Jensen • May 2, 2024 -

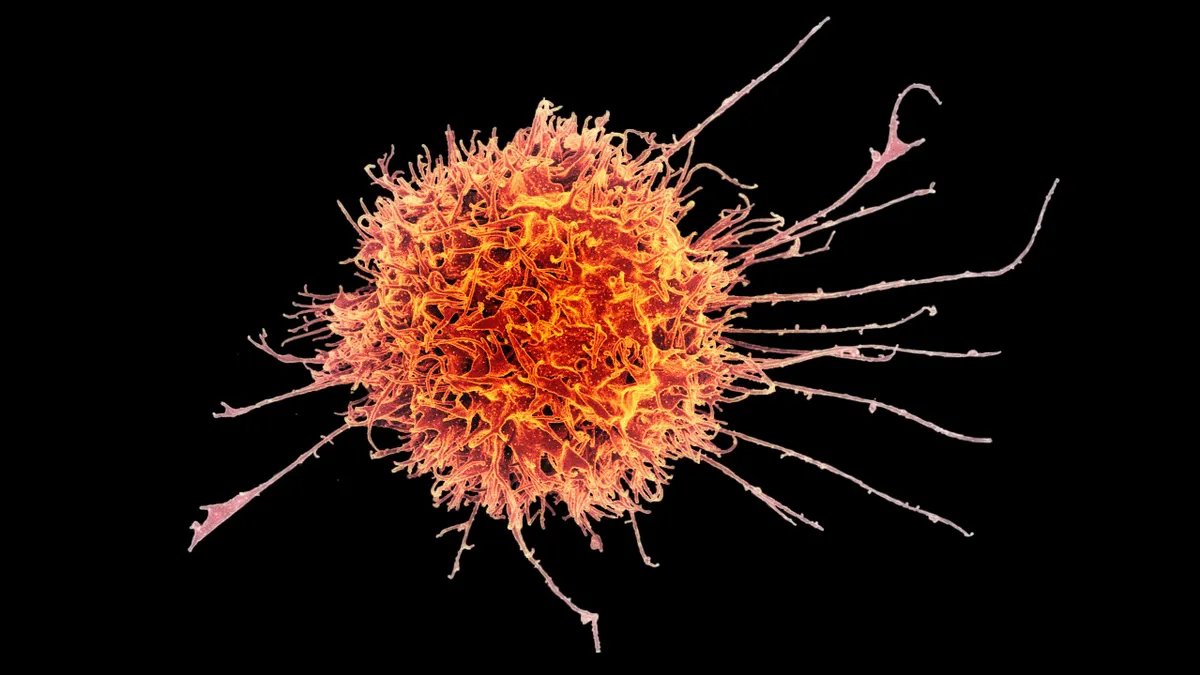

Retrieved from National Cancer Institute on September 27, 2019

Retrieved from National Cancer Institute on September 27, 2019

BridgeBio spinout launches with $200M for KRAS cancer drugs

The company, BridgeBio Oncology Therapeutics, has one drug in the clinic and hopes to soon advance two other candidates.

By Ned Pagliarulo • Updated May 2, 2024 -

Delphia starts up with $67M to make a new type of cancer drug

The startup is developing medicines designed to overstress cellular pathways to the point tumor cells die, an approach the biotech calls “activation lethality.”

By Gwendolyn Wu • May 2, 2024 -

Reunion raises over $100M to build a better psychedelic drug

The funding will help Reunion pay for a mid-stage study testing its most advanced medicine — essentially a synthetic version of the hallucinogenic psilocin — in women with postpartum depression.

By Jacob Bell • May 2, 2024 -

Enlaza gets JP Morgan, Regeneron backing for covalent biologics

The funds will help the cancer-focused startup Enlaza bring several candidates toward human testing in the next few years, its CEO said.

By Gwendolyn Wu • April 30, 2024 -

Repertoire pivot pays dividends with Bristol Myers deal

The alliance validates the new direction pursued by Repertoire, a startup that cut staff and switched CEOs in 2022 after research on personalized cell therapies disappointed.

By Gwendolyn Wu • April 29, 2024 -

BioMarin drops drug programs in pipeline cull

The cuts of four pipeline prospects come as BioMarin resets its priorities following the slow launch of its hemophilia gene therapy Roctavian.

By Kristin Jensen • April 25, 2024 -

Regeneron expands in gene editing with Mammoth deal

“With each passing year, we're more committed to becoming a serious player in the genetic medicine space,” a Regeneron executive said.

By Gwendolyn Wu • April 25, 2024 -

Biogen: Don’t expect any big acquisitions this year

While the company is eager to diversify, CEO Chris Viehbacher said any near-term dealmaking would likely focus on collaborations and early-stage assets.

By Jacob Bell • April 24, 2024 -

Moderna turns to AI to change how its employees work

An expanded partnership with OpenAI is helping Moderna embed custom-built AI chatbots in a wide range of research and business processes.

By Ned Pagliarulo • April 24, 2024 -

Biogen to invest more in launch of Alzheimer’s drug Leqembi

Growing demand has convinced Biogen that it's worth expanding the sales force around Leqembi by 30%.

By Jacob Bell • April 24, 2024