Deals: Page 19

-

Biohaven stocks up on experimental drugs with new acquisition, licensing deal

Separate agreements with Channel Biosciences and Bristol Myers Squibb give Biohaven access to experimental treatments for spinal muscular atrophy and for epilepsy.

By Jacob Bell • Feb. 25, 2022 -

Sponsored by TrialCard

Copay accumulators, maximizers and the CMS best price rule: What you need to know now

Copay accumulators, maximizers and best price concerns dominated the copay assistance landscape in 2021. Here is an update on the most prominent developments in this area over the last six months.

By Jason Zemcik, Vice President, Patient Affordability, TrialCard • Feb. 22, 2022 -

Pressed by Wall Street, pharma executives signal openness to M&A

Despite tumbling biotech valuations, however, several said they still prefer smaller-sized "bolt-on" deals to larger, potentially more disruptive, transactions.

By Ned Pagliarulo • Feb. 7, 2022 -

Intellia, expanding in gene editing, buys startup Rewrite for $45M

Founded by University of California, Berkeley scientists, Rewrite is studying ways to expand the reach of gene editing beyond limitations of current technologies, including Intellia's.

By Ned Pagliarulo • Feb. 3, 2022 -

Biogen, facing pressure on all sides, sells stake in biosimilars business

The biotech will sell the roughly 50% stake it holds in a biosimilars joint venture to Samsung Biologics for as much as $2.3 billion — cash that analysts expect the drugmaker to invest in M&A.

By Ned Pagliarulo , Jacob Bell • Jan. 28, 2022 -

J&J 'constantly looking' at biotech M&A, but focused on small, mid-sized deals

Despite sliding stock prices, biotechs aren't "on sale," J&J CFO Joe Wolk said Tuesday. "It's really hard to say whether there's been a capitulation, or a recognition, that values have come down."

By Ned Pagliarulo • Jan. 25, 2022 -

Carol Highsmith. (2005). "Apex Bldg." [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "Apex Bldg." [Photo]. Retrieved from Wikimedia Commons.

Antitrust regulators aim to revamp merger guidelines, signaling threat to health sector deals

The news sparked headlines about an attempt by regulators to target big tech, but it could have serious implications for healthcare, too.

By Samantha Liss • Jan. 19, 2022 -

UCB to buy Zogenix for nearly $2B in 'first step' for M&A in 2022

The acquisition will give the Belgian pharma access to an epilepsy drug that won U.S. approval in June 2020 but that Zogenix has struggled to sell.

By Ben Fidler • Jan. 19, 2022 -

5 questions facing biotech M&A in 2022

Analysts expect that deal engines are ready to start firing again following the recent quiet period. Still, uncertainty remains about how biopharma acquisitions could play out in the coming months.

By Jacob Bell • Jan. 12, 2022 -

JPM22: M&A anxiety, Roche's comeback plan and Vir's omicron moment

Pharma executives fielded many questions about their dealmaking intentions on the conference's second day, while Roche outlined its plan to compete against Merck and Bristol Myers in cancer immunotherapy.

By Ben Fidler , Ned Pagliarulo • Jan. 11, 2022 -

Pfizer expands into gene editing with Beam research deal

Pfizer's work with mRNA vaccines led it to explore other applications of the technology, resulting in a multiyear partnership with the high-profile biotech Beam Therapeutics on gene editing treatments for rare diseases.

By Ned Pagliarulo • Jan. 10, 2022 -

Lilly pours more money into genetic treatments for neurological diseases

For $50 million, Lilly has secured rights to a technology that's meant to transport nucleic acid therapies in a way that's more targeted and better tolerated than other methods.

By Jacob Bell • Jan. 6, 2022 -

Biogen brings in a successor to Spinraza

The company spent $60 million to secure global rights to an experimental drug developed by Ionis Pharmaceuticals to treat spinal muscular atrophy.

By Jacob Bell • Jan. 4, 2022 -

Novartis ups investment in gene therapy for the eye with $800M buyout

The deal for Gyroscope Therapeutics, worth up to $1.5 billion, gives the Swiss pharma access to a treatment for a type of age-related blindness as well as new means of delivering drugs into the eye.

By Jonathan Gardner • Dec. 22, 2021 -

Sanofi to buy cancer immunotherapy biotech for $1B

The French drugmaker is interested in Amunix Pharmaceuticals' technology, which could allow for more precise delivery of biologic drugs into cancerous tissue.

By Ned Pagliarulo • Dec. 21, 2021 -

Bristol Myers returns to Immatics for a dual-targeting cancer drug

The pharma has expanded an alliance with a German biotech by paying $150 million for a drug candidate that executives hope can have "cell therapy-like efficacy" for solid tumors.

By Ben Fidler • Dec. 14, 2021 -

Arena, completing its turnaround, sells to Pfizer for nearly $7 billion

Pfizer will pay $100 per share to acquire Arena and the portfolio of inflammatory disease medicines it developed in the wake of a disappointing drug launch.

By Ben Fidler • Updated Dec. 13, 2021 -

Sobi buyout breaks down

Three months after proposing a roughly $8 billion acquisition of Sobi, the investment firms Advent International and GIC have withdrawn their offer.

By Jacob Bell • Dec. 3, 2021 -

Novartis pays $150M for access to UCB's Parkinson's drug

UCB's experimental pill is one of the most advanced projects that's aimed at blocking accumulation of an abnormal protein in patients' brains.

By Jonathan Gardner • Dec. 2, 2021 -

GSK sets sights on brain diseases through Oxford partnership

Equipped with $40 million in funding, a new institute from GSK and Oxford will initially focus on developing treatments for Alzheimer's, Parkinson's, ALS and other neurological conditions.

By Jacob Bell • Dec. 2, 2021 -

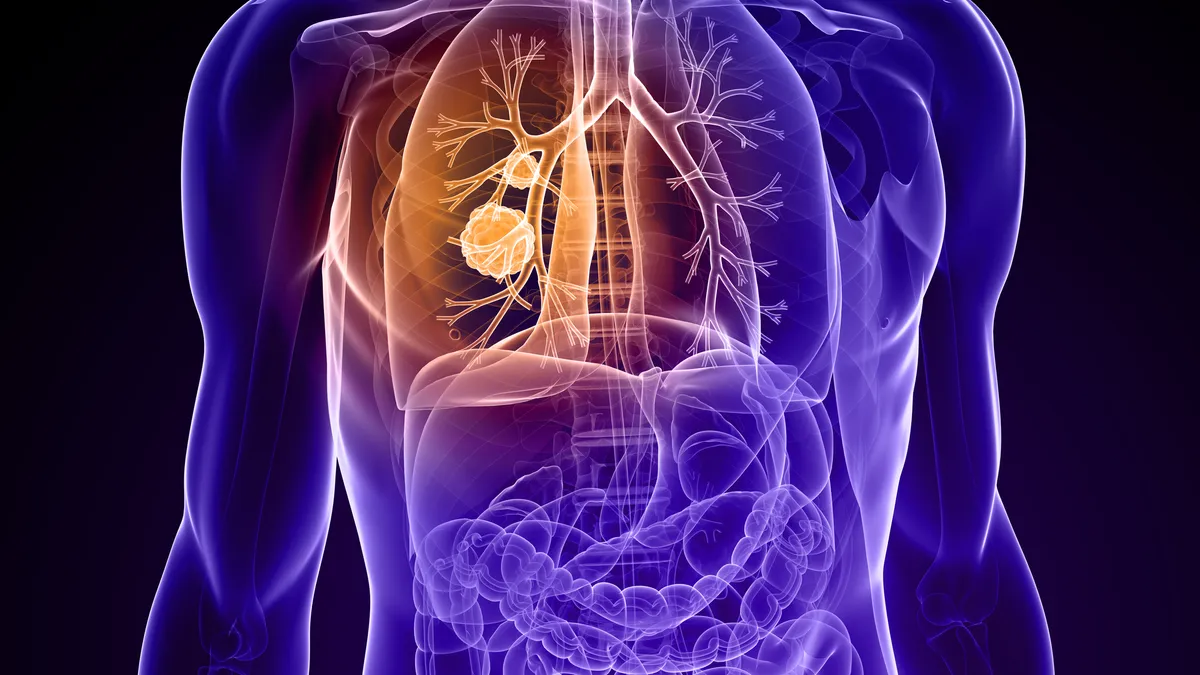

Blueprint, taking aim at larger drugmakers, becomes a biotech buyer

A $250 million acquisition of startup Lengo Therapeutics has given Blueprint a lung cancer drug that could compete with medicines from Takeda and J&J.

By Jonathan Gardner • Nov. 29, 2021 -

GSK dives into NASH, RNA interference with Arrowhead deal

GSK has secured rights to a genetic medicine in early-stage human testing for NASH, a disease thought to affect millions of people that has proven to be a tough target for drugmakers.

By Jacob Bell , Ned Pagliarulo • Nov. 23, 2021 -

Neurocrine stocks up on a biotech's psychiatric drugs

A new deal with Sosei Heptares hands Neurocrine a "broad portfolio" of drugs for schizophrenia, dementia and other neuropsychiatric disorders.

By Jacob Bell • Nov. 22, 2021 -

Gilead pays up to retain rights to Arcus cancer drugs

The biotech will pay $725 million to opt into rights on four experimental medicines developed by Arcus, including ones that could challenge Merck's Keytruda in lung cancer.

By Jonathan Gardner • Nov. 18, 2021 -

Novo to acquire Dicerna for more than $3B amid RNA drug resurgence

The acquisition would give Novo Nordisk ownership of one of the oldest and largest developers of RNA interference drugs, along with a web of potential royalty streams.

By Ben Fidler • Updated Nov. 18, 2021