Deals: Page 18

-

Resilience, a well-funded manufacturing startup, joins with the Parker Institute to make cancer drugs

The unusual biotech, which just raised $625 million earlier this week, will work with the immunotherapy center under a five-year agreement to create and spin off new companies.

By Kristin Jensen • June 9, 2022 -

Yumanity's days as an independent biotech come to a close

After recently announcing plans to eliminate more than half its staff, the biotech now intends to sell its research programs to Janssen and enter a reverse merger with the private company Kineta.

By Jacob Bell • June 6, 2022 -

Bristol Myers bets $4B on Turning Point and its targeted cancer drugs

While priced at a significant premium, the deal values Turning Point well below its peak valuation last year, a potential sign biotechs might be adjusting their expectations amid the sector's downturn.

By Jonathan Gardner • Updated June 3, 2022 -

GSK wagers $2.1B on Affinivax and its next-generation pneumonia vaccine

The deal is the second acquisition for GSK since April and gives the company access to an experimental shot that’s meant to surpass new products from Pfizer and Merck & Co.

By Ben Fidler • May 31, 2022 -

National Institute of Allergy and Infectious Diseases. (2020). "Novel Coronavirus SARS-CoV-2" [Micrograph]. Retrieved from Flickr.

National Institute of Allergy and Infectious Diseases. (2020). "Novel Coronavirus SARS-CoV-2" [Micrograph]. Retrieved from Flickr.

NIH licenses COVID-19 technologies to WHO-backed program

The agreement, which covers three experimental vaccines as well as several key patents, will be royalty free for products sold in 49 low-income countries.

By Jonathan Gardner • May 13, 2022 -

Taiho, chasing larger rivals, buys back rights to Cullinan cancer drug

The deal hands $275 million upfront to Cullinan, whose medicine is being developed for a genetic driver of lung tumors that's become a top target for drugmakers.

By Kristin Jensen • May 12, 2022 -

Pfizer to acquire Biohaven in $11.6B bet on biotech's migraine drugs

The deal, which hands Pfizer full rights to the biotech's fast-selling Nurtec ODT, could provide a much needed spark for the sector after months of stock market declines.

By Ben Fidler , Jacob Bell • Updated May 10, 2022 -

Biogen, having scrapped Aduhelm, tries to convince investors of turnaround plan

Though executives claimed that inking deals and derisking research programs are priorities, analysts questioned whether any meaningful strategic changes will occur in the near term.

By Jacob Bell • May 4, 2022 -

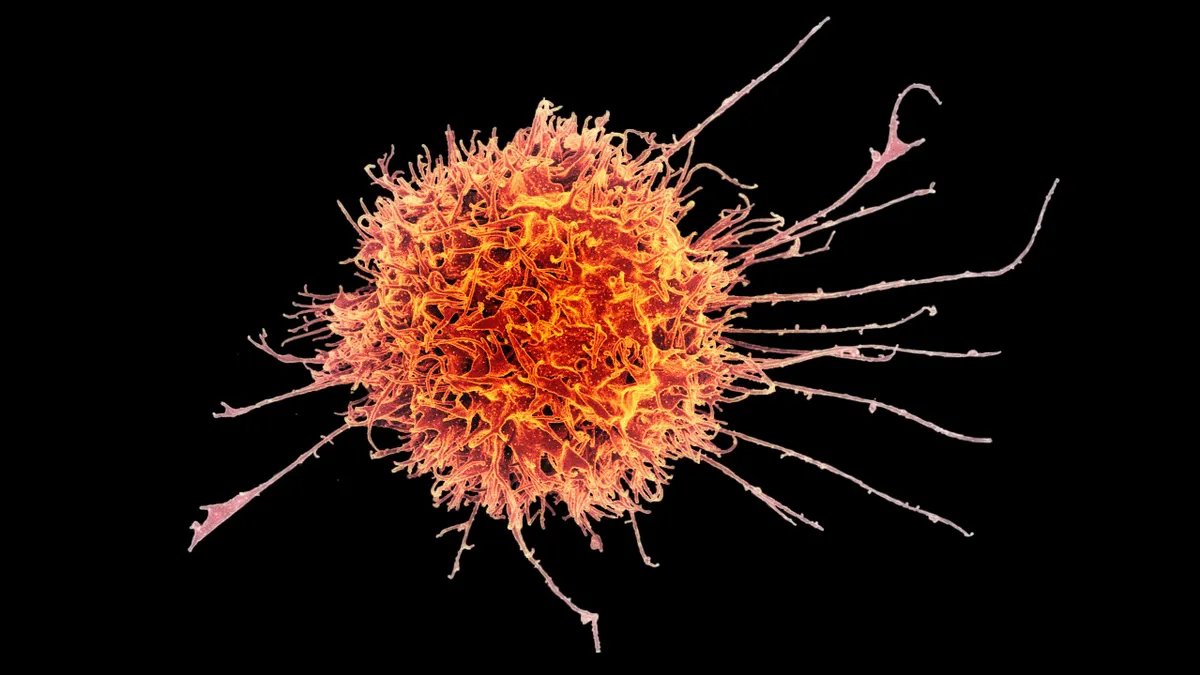

National Institutes of Allergy and Infectious Diseases. (2016). "Human natural killer cell" [Micrograph]. Retrieved from Flickr.

National Institutes of Allergy and Infectious Diseases. (2016). "Human natural killer cell" [Micrograph]. Retrieved from Flickr.

A cancer biotech attracts another deep-pocketed partner in Gilead

Following rivals like Bristol Myers Squibb and Merck, Gilead has linked up with Dragonfly Therapeutics to develop new immunotherapies based on "natural killer cell engagers."

By Jacob Bell • May 2, 2022 -

A promising cancer drug leads Regeneron to reconsider its aversion to M&A

Regeneron has agreed to purchase Checkmate Pharmaceuticals for $250 million, the first acquisition of a publicly traded company in the biotech's nearly 35-year history.

By Jacob Bell • April 19, 2022 -

Halozyme, doubling down on a licensing strategy, buys a drug delivery biotech for nearly $1B

Antares Pharma's auto-injector technology is of particular interest to Halozyme, which believes that the various markets to which it could be applied represent billions of dollars in potential sales.

By Jacob Bell • April 13, 2022 -

GSK acquires Sierra Oncology, betting $2B on a bone cancer drug with a long history

The British pharma is buying into the potential of a medicine meant to treat the anemia often associated with myelofibrosis, a complication that isn't adequately addressed by current therapies.

By Ben Fidler , Ned Pagliarulo • April 13, 2022 -

Pfizer, Moderna name new finance chiefs amid surging revenue

Pfizer is bringing in former Lowe's and CVS Health executive David Denton, while Moderna hired Jorge Gomez, previously CFO at Cardinal Health. Both take the reins as their new companies face strategic questions.

By Jonathan Gardner • April 11, 2022 -

Pfizer buys a private biotech and its RSV drug research

The pharma company will add experimental RSV treatments to its pipeline through the deal, which is worth up to $525 million.

By Kristin Jensen • April 7, 2022 -

Regeneron, in search of an eye gene therapy, turns to a young biotech

Facing mounting competition to its top-selling drug Eylea, Regeneron is teaming up with ViGeneron to develop a genetic medicine for an inherited retinal disease.

By Jacob Bell • April 6, 2022 -

Sanofi pays IGM $150M, continuing search for better antibody drugs

The French pharmaceutical giant has inked its third antibody-focused deal since December, this time betting on a Californian biotech trying to pioneer a new class of medicines.

By Ben Fidler • March 29, 2022 -

Pfizer claims study success for drug key to Arena buyout

Etrasimod, the basis of the $7 billion acquisition and a potential rival to Bristol Myers Squibb's Zeposia, has cleared the first of two trials in ulcerative colitis.

By Kristin Jensen • March 23, 2022 -

GSK partners with LifeMine as startups advance plans to make drugs from fungi

The deal, announced alongside a $175 million round, makes biotech entrepreneur Greg Verdine's startup the most well-funded among an emerging group of companies searching for drugs in fungal DNA.

By Ben Fidler • March 23, 2022 -

Biogen and its partner rework terms of Aduhelm deal amid slow sales

Instead of sharing global profits and losses, Eisai will receive royalties tied to net sales of the Alzheimer's drug. Biogen, meanwhile, said the amended deal should make it easier to "address market developments."

By Jacob Bell • March 15, 2022 -

Sanofi lures Blackstone backing in unusual deal for multiple myeloma drug

Rather than fund development of a more convenient version of its blood cancer drug Sarclisa on its own, Sanofi has instead turned to Blackstone, which has fast become one of the sector's more active investors.

By Kristin Jensen • March 15, 2022 -

AbbVie keeps up dealmaking pace in neuroscience

On the heels of its Syndesi acquisition, the company has announced an agreement with Gedeon Richter focused on researching and developing new dopamine-regulating drugs for neuropsychiatric diseases.

By Jacob Bell • March 11, 2022 -

Carol Highsmith. (2005). "Apex Bldg." [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "Apex Bldg." [Photo]. Retrieved from Wikimedia Commons.

After slower-than-expected review, Pfizer and Arena close buyout deal

Pfizer officially closed its $7 billion acquisition of Arena Pharmaceuticals on Friday without needing to divest any assets.

By Jacob Bell • Updated March 11, 2022 -

Novartis turns to Voyager for nervous system gene therapies

The deal, which carries a $54 million upfront payment, could give Novartis access to as many as five of Voyager's capsids, which would be used to develop gene therapies for the central nervous system.

By Jacob Bell • March 8, 2022 -

Bluebird's CFO resigns as cash woes raise doubts about its future

The gene therapy developer's top financial executive, Gina Consylman, is stepping down amid concerns the company needs to raise additional cash to survive for more than a year.

By Jonathan Gardner • March 7, 2022 -

Viatris sells off biosimilars business in $3.3B deal

The sale to Biocon represents the first major step Viatris has taken to reshape itself, following a strategic review that took place throughout 2021.

By Jacob Bell • Feb. 28, 2022