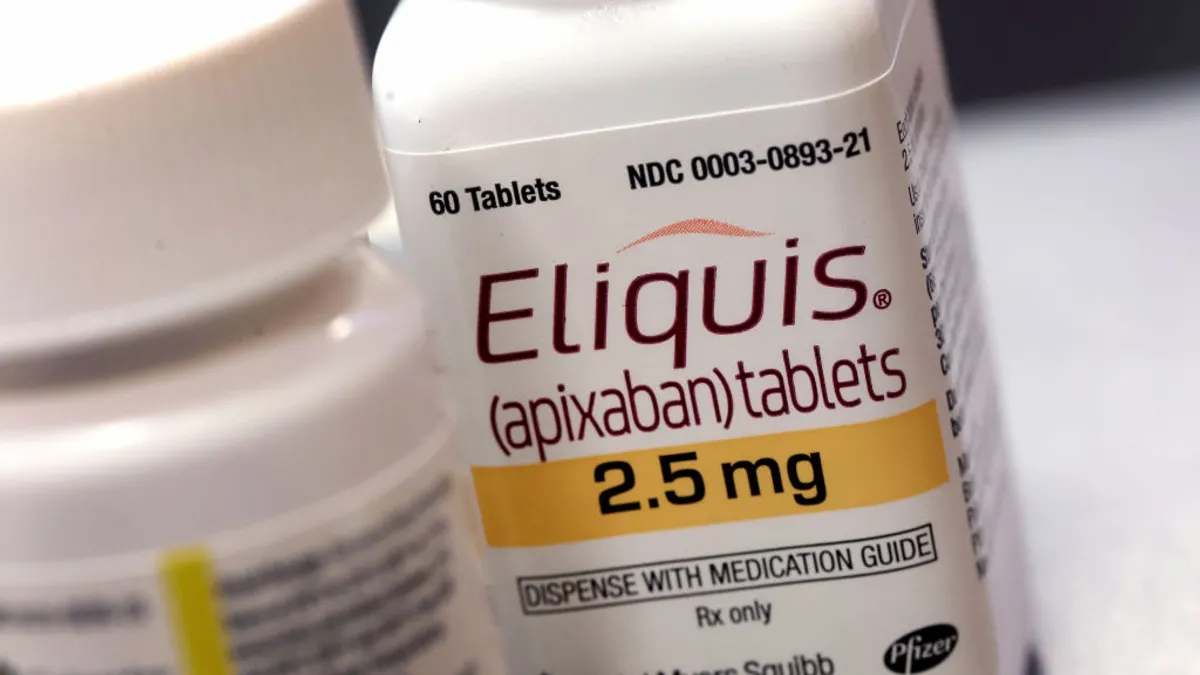

Bristol Myers Squibb and Pfizer will begin offering their top-selling heart medicine Eliquis through a new online service at a discounted price — the latest example of pharmaceutical companies establishing direct-to-consumer options to bypass traditional drug distribution channels.

The two companies, which sell the blood-thinning drug through a longstanding joint venture, said Thursday that they’ll offer it at a discount of over 40% to people who are uninsured, underinsured or pay for the medicine out of pocket. The service distributing the medication, Eliquis 360 Support, will begin making shipments to U.S. patients on Sept. 8.

A 30-day supply of Eliquis currently has a list price of $606, but would cost $346 per month under the new program, according to a report from the Wall Street Journal.

Since its approval in 2012, Eliquis has been one of the world’s best-selling drugs, used to reduce the risk of clots and strokes in people with a variety of heart problems. Combined worldwide sales for Bristol Myers and Pfizer surpassed $20 billion last year.

Settlement deals have also delayed the entry of generic competitors, keeping its list price high until at least 2026, when key patents in the U.S. and Europe are set to expire.

The drug’s profile made it a target of the federal government under the Biden administration, which, through the Inflation Reduction Act, bestowed Medicare the authority to negotiate prices for some prescription medications. As a result of those talks, Eliquis’ Medicare list price will be cut to $231 — lower than the companies’ newly offered discount — next year.

The Journal reported that Thursday’s announcement was driven by more government pressure, this time from the Trump administration, which has made drug prices a target and, through an executive order, called on the industry to offer medicines directly to patients at lower costs. However, most people in the U.S. access drugs through commercial or government-backed health plans, limiting the likely reach of these direct-to-consumer programs to people willing to pay cash or without insurance.

Nonetheless, direct-to-consumer distribution channels, which sidestep insurers and pharmacy benefit managers, have been gaining momentum over the last year or so. Eli Lilly and Novo Nordisk have established online services for their obesity drugs Zepbound and Wegovy, and Pfizer last year set up a way to access savings programs for its migraine, COVID-19 and influenza medicines.

This movement is different from what it was in the past, as pharmaceutical companies are setting these channels earlier in a drug’s life cycle, rather than using them as tools to compete with lower-cost generics.