Dive Brief:

- The Food and Drug Administration is expected to decide on approval of Eli Lilly’s obesity pill orforglipron in the second quarter of 2026, Lilly CEO David Ricks said Tuesday, giving it a chance to quickly follow to market an oral version of Wegovy that rival Novo Nordisk launched last week.

- The FDA granted Lilly a “national priority” voucher for orforglipron that could significantly accelerate the agency’s evaluation. While no statutory deadline exists under that program because it’s never been authorized by Congress, Ricks said he expects a “rapid review” that is “moving at pace.”

- A second-quarter launch would be well-timed for Lilly to begin selling orforglipron to the millions of people enrolled in Medicare, which will have broad access to obesity medications beginning in April.

Dive Insight:

After trailing Novo for years in the obesity drug market, Lilly took a clear lead in 2025 by gaining approval of a shot called Zepbound. Combined sales of Zepbound and the version marketed separately in diabetes as Mounjaro were the most of any pharmaceutical product through the first nine months of the year, helping Lilly become the first drugmaker to achieve a trillion-dollar valuation.

Novo aims to close the gap with its Wegovy pill, data for which it had sat on for two years before ultimately making a submission. The FDA voucher granted to orforglipron, though, could shave the advantage Novo earned down to just a few months.

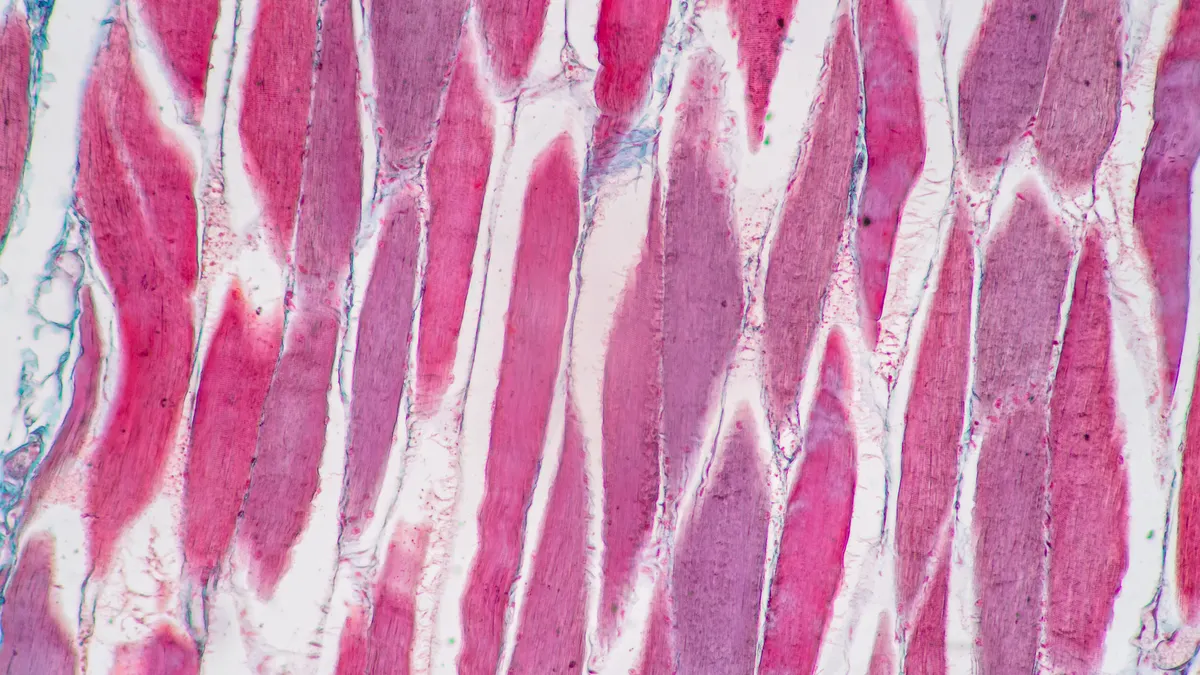

Speaking during a fireside chat at the J.P. Morgan Healthcare Conference, Ricks said he expects the oral drugs to have a slightly different user base than injectable GLP-1 medicines like Zepbound and Wegovy. While the pills may be a primary intervention for people who don’t want to inject themselves, they could also boost adherence and help people who’ve already lost weight maintain their results, he said.

GLP-pills may also be an important solution in countries where it might be difficult to supply therapies that — like Zepbound and Wegovy — must be packaged, shipped and stored at cold temperatures, he said.

Online cash-pay services will also be essential in the sales push for orforglipron, Ricks said. Lilly’s online pharmacy served 1 million people in 2025, driven by those who want better control over how they get their drugs as well as price transparency. That service has been launched in the U.K., and Lilly has additional plans to expand it internationally.

“That started as a series of solutions to problems that actually no longer exist,” Ricks said of the direct-to-consumer channel. “The average patient in our first set of studies on [Zepbound] had tried over 30 diet and exercise interventions in their adult life, and to be told that one more time when they know there's a solution available is very disappointing. So patients doctor shop, including online for telehealth solutions, and we wanted to upgrade that experience.”