Dive Brief:

- The Food and Drug Administration has approved a new oral medication for an uncommon kind of tumor, clearing Nuvation Bio’s Ibtrozi on Wednesday for certain people whose metastatic non-small cell lung cancer has a type of alteration in the gene ROS1.

- Ibtrozi was approved based on a pair of trials showing response rates of 90% and 85%, respectively, in patients who hadn’t previously received another tyrosine kinase inhibitor. Among those who had gotten another such therapy, the rates were 52% and 62% in those trials. Responses lasted as long as around 47 months in one study, so far, and about 30 months in the other.

- The FDA’s prescribing information includes warnings and precautions for an effect on heart rhythms, liver toxicity, lung inflammation and other potential health issues. According to Nuvation, 7% of patients discontinued therapy because of side effects. Company shares fell about 10% following the approval announcement.

Dive Insight:

Nuvation is a successor, of sorts, to Medivation, which developed the prostate cancer drug Xtandi and sold to Pfizer nearly a decade ago. Nuvation is run by David Hung, Medivation’s former CEO, and like its predecessor, has been focused on therapies for tough-to-treat cancers.

But Nuvation has faced setbacks since debuting on Wall Street by merging with a special purpose acquisition company five years ago. The company scrapped its initial drug program in 2022 and changed course two years later when a second prospect disappointed. Like many other biotechnology firms, it’s seen its stock price fall significantly during a sector-wide pullback, with shares losing more than three quarters of their value since 2020.

Still, a deal Nuvation cut last year to acquire AnHeart Therapeutics has given it a chance to rebound. A drug it got in the deal, known scientifically as taletrectinib, is designed for the roughly 2% of people whose non-small cell lung cancers are ROS1-positive. Since the acquisition, Nuvation has accumulated enough data to garner approvals, first in China and now the U.S., though the drug’s commercial prospects are unclear.

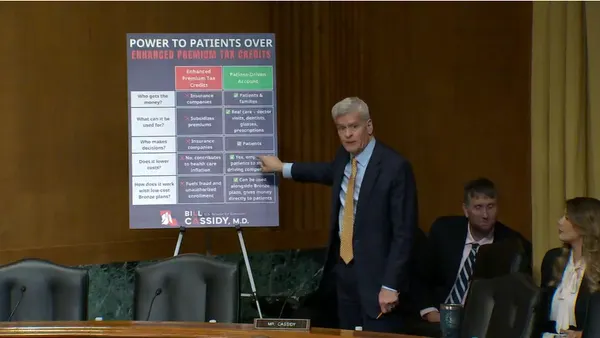

There are multiple similar drugs available for ROS1-positive lung cancers, among them Pfizer’s Xalkori, Roche’s Rozlytrek and Bristol Myers Squibb’s Augtyro. And though Roche and Bristol Myers acquired both their medicines in high-priced acquisitions, they haven’t yielded significant sales: Rozlytrek generated about 134 million Swiss francs in 2024, while Augtyro pulled in just $38 million. Investors “are generally skeptical” about the commercial opportunity “given a number of agents that have had limited success,” wrote Leerink Partners analyst Andrew Berens, in a January note to clients.

For its part, Nuvation believes Ibtrozi could become “a new standard for what targeted therapies can achieve” in ROS1-positive lung cancer, Hung said in a statement, noting the drug’s “high response rates with sustained durability.” Ibtrozi has also shown the ability to help people whose cancer has spread to the brain, a leading cause of disease progression, the company said.

In a research note on Wednesday, RBC Capital Markets analyst Leonid Timashev estimated peak yearly sales of the drug could reach nearly $640 million. Based on conversations with physicians, it “could be positioned well, and ahead of Augtyro,” he wrote, adding that Wednesday’s sell off in shares was “overdone on any potential launch and label optics concerns.”

“We’ll look to [Nuvation] to execute if David can beat Goliath,” wrote Jefferies analyst Michael Yee, in a separate note, adding that the Ibtrozi’s study results look “best-in-class.”