Deals

-

Amgen gives up on its once-prized eczema drug

The decision comes more than a year after disappointing initial Phase 3 results and casts further doubt on a class of autoimmune drugs thought to be challengers to treatments like Dupixent.

By Jonathan Gardner • Jan. 30, 2026 -

China competition

AstraZeneca leans into obesity, striking wide-ranging alliance with China’s CSPC

The deal, which involves up to eight “next-generation” weight loss medications and could be worth more than $18 billion, ranks as the largest licensing pact of its kind since the start of 2025, according to BioPharma Dive data.

By Ben Fidler • Jan. 30, 2026 -

Bristol Myers buys into Janux’s ‘masked’ T cell engagers

Worth up to $850 million, the partnership provides “further validation” for Janux at a time of heightened investor scrutiny regarding the potential of its top drug, one analyst wrote.

By Delilah Alvarado • Jan. 22, 2026 -

GSK to buy Rapt in $2.2B deal for food allergy drug

The deal is the first for new CEO Luke Miels as the British drugmaker looks to overcome pressure on its HIV and vaccines businesses.

By Kristin Jensen • Jan. 20, 2026 -

Boston Scientific to acquire Penumbra for $14.5B

With the planned purchase, Boston Scientific will gain a portfolio of devices to remove clots from blood vessels.

By Elise Reuter • Jan. 15, 2026 -

Obesity drugs

Alveus launches with $160M to advance MariTide-like obesity drug

The hefty funding will fuel Phase 2 testing of a drug with a similar mechanism to Amgen’s closely watched obesity drug, as well as an amylin-targeting weight loss medicine.

By Jonathan Gardner • Jan. 8, 2026 -

Lilly snaps up Ventyx for $1.2B in pursuit of oral immune drugs

The buyout is a bet by Lilly on an increasingly popular drug target known as NLRP3 inflammasomes, which are implicated in an array of conditions.

By Jonathan Gardner • Updated Jan. 8, 2026 -

Emerging biotech

Amgen buys protein-degrading startup Dark Blue for up to $840M

The deal hands Amgen a drug that destroys two proteins known to drive certain types of acute myeloid leukemia, a profile that could set it apart from current medications.

By Gwendolyn Wu • Jan. 6, 2026 -

BioMarin to buy rare disease drugmaker Amicus for $4.8B

Analysts said the deal makes sense for BioMarin, as it offers a late-stage clinical asset as well as two marketed therapies that generated nearly $450 million over the first nine months of this year.

By Jacob Bell • Dec. 19, 2025 -

Emerging biotech

Sobi snaps up gout drug in $950M deal for startup Arthrosi

The deal revolves around a drug Sobi claimed could become the “therapy of choice” for people whose gout symptoms persist despite initial therapy.

By Ben Fidler • Dec. 14, 2025 -

China competition

Pfizer dips into China for another try at an obesity pill

A potentially $2 billion deal with a subsidiary of Shanghai-based Fosun Pharma gives Pfizer a new chance at an oral weight loss medication, an area where its internal research has struggled.

By Kristin Jensen • Dec. 9, 2025 -

Emerging biotech

The ‘clever’ tool increasingly getting bigger biotech deals signed

A decades-old way to bridge buyers and sellers on price, contingent value rights have recently seen an uptick in use due to a turbulent biotech market.

By Jacob Bell • Dec. 2, 2025 -

Gene editing

Regeneron inks gene editing deal with startup Tessera

The big biotech, which has made genetic medicine a focus in recent years, is paying Tessera $150 million for rights to a potential one-and-done treatment for alpha-1 antitrypsin deficiency.

By Delilah Alvarado • Dec. 1, 2025 -

Gilead scoops up a preclinical cancer program

The company, which invested heavily in oncology in recent years, has now put more than $400 million on the table to access a Sprint Bioscience drug targeting “TREX1.”

By Kristin Jensen • Nov. 25, 2025 -

Emerging biotech

Biogen strikes deal with Versant-backed biotech to expand immune portfolio

Newly launched Dayra Therapeutics has agreed to identify for Biogen "oral macrocycle candidates" that go after "high-priority immunological targets."

By Delilah Alvarado • Nov. 24, 2025 -

GSK, Anaptysbio sue each other over Jemperli revenue

As Anaptysbio seeks to split off a royalty business, both companies claim the other breached contracts surrounding development of the cancer immunotherapy.

By Jonathan Gardner • Nov. 21, 2025 -

Abbott to acquire Exact Sciences for about $21B

The purchase would give Abbott access to cancer screening tests including Cologuard and blood tests for multi-cancer early detection.

By Elise Reuter , Susan Kelly • Nov. 20, 2025 -

J&J adds to pharma’s M&A spree with $3B buyout of startup Halda

The deal gives J&J access to a pipeline of drugs designed to “hold and kill” tumors, led by a prostate cancer medicine that’s shown promise in early-stage testing.

By Jonathan Gardner • Nov. 17, 2025 -

To Wall Street, a new bidding war puts Alkermes in a tough spot

Now in a tug of war with Lundbeck, Alkermes could either lose out on a marketed sleepiness drug or end up paying significantly more than it had hoped.

By Jacob Bell • Nov. 14, 2025 -

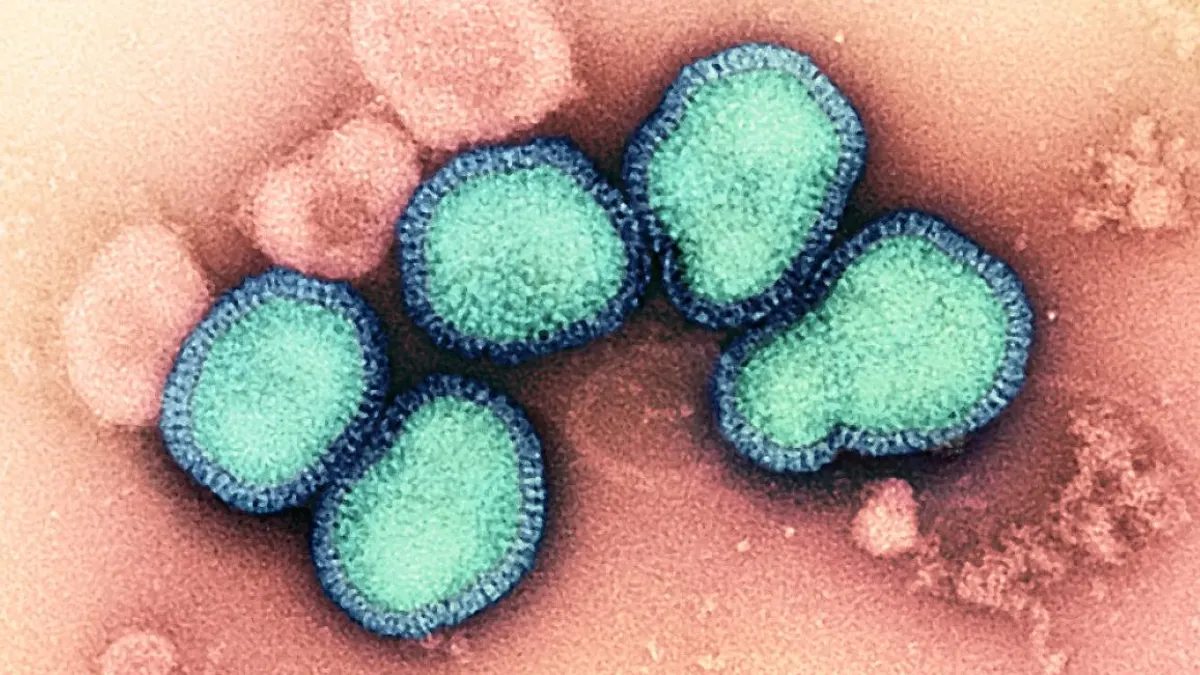

NIAID. (2023). "Influenza A virus" [Micrograph]. Retrieved from Flickr.

NIAID. (2023). "Influenza A virus" [Micrograph]. Retrieved from Flickr.

Merck stakes $9.2B on Cidara and its long-acting flu drug

The deal, one of two multibillion-dollar buyouts from Merck this year, centers around a drug that could become an alternative to vaccines for flu prevention.

By Ben Fidler • Nov. 14, 2025 -

Day One snaps up ADC maker Mersana in backloaded buyout deal

After multiple clinical setbacks and layoff rounds, Mersana accepted an offer in which the bulk of the payouts will only materialize if its main cancer drug hits a variety of milestones.

By Jonathan Gardner • Nov. 13, 2025 -

Pfizer wins bidding war for Metsera with $10B offer

The new proposal for the coveted obesity drug developer is more than double the size of Pfizer’s original bid and ends a squabble with Novo Nordisk that had resulted in lawsuits.

By Ben Fidler • Nov. 8, 2025 -

Obesity drugs

FTC signals scrutiny of Novo’s bid for Metsera

Without taking a firm position, the antitrust agency said Novo’s two-step deal structure may illegally sidestep requirements for a premerger review.

By Jonathan Gardner • Nov. 5, 2025 -

Blackstone pays Merck $700M to buy into ADC drug royalties

The deal hands Blackstone a piece of the potential future sales of an antibody-drug conjugate that could soon challenge marketed medicines from AstraZeneca and Gilead.

By Delilah Alvarado • Nov. 4, 2025 -

Obesity drugs

Metsera again chooses Novo as bidding war with Pfizer intensifies

The obesity drug developer has declared a new proposal from Novo “superior” to Pfizer’s original bid as well as an updated offer revealed Tuesday.

By Jonathan Gardner • Nov. 4, 2025