Deals: Page 12

-

Novartis, continuing revamp, sells eye drugs to Bausch + Lomb for up to $2.5B

An agreement to divest the dry eye disease treatment Xiidra and a few other medicines adds to the Swiss pharma's yearslong push to slim down from the healthcare conglomerate it once was.

By Jonathan Gardner • June 30, 2023 -

Lilly to acquire cancer antibody drug startup Emergence

The yet-to-be-announced deal for the German biotech is the latest move by Lilly to bulk up its oncology business, adding a drug in early development for solid tumors.

By Gwendolyn Wu , Ben Fidler • June 29, 2023 -

Lilly takes over partner working on cell therapies for diabetes

Sigilon Therapeutics, a biotech that’s been collaborating with Lilly since 2018, has agreed to be bought for up to $310 million in the pharma’s second announced buyout this month.

By Jacob Bell • June 29, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

FTC proposes updates to merger review that could slow healthcare dealmaking

A new rule proposed by antitrust regulators would ask companies to provide additional information about planned mergers to help the Federal Trade Commission keep pace with increased deal volume and complexity.

By Emily Olsen • June 28, 2023 -

Talaris, Tourmaline to combine in biotech’s latest reverse merger

The deal is the latest in a recent string of reverse mergers, which are enabling startups to sidestep initial public offerings in a difficult funding climate.

By Kristin Jensen • June 22, 2023 -

Lilly to buy oral immune drug developer Dice Therapeutics for $2.4B

The deal signals pharma’s continued interest in pills for inflammatory conditions, which are meant to approach the potency of injectable therapies.

By Ben Fidler • June 20, 2023 -

Coherus doubles down on immuno-oncology with latest deal

Known for its work in biosimilars, Coherus will acquire two drugs in testing for cancer through a roughly $65 million buyout of Surface Oncology.

By Jacob Bell • June 16, 2023 -

Pfizer refiles Seagen deal paperwork with regulators

Andrew Berens, an analyst at SVB Securities, noted Wednesday’s refiling could be a strategy to provide the FTC with more information, but sidestep a more onerous “second request.”

By Ned Pagliarulo • Updated June 14, 2023 -

Novartis to acquire kidney disease biotech Chinook for up to $3.5B

The Swiss pharma is betting that two experimental drugs the biotech has developed for IgA nephropathy will succeed in late-stage testing, one of which will deliver results later this year.

By Ben Fidler • June 12, 2023 -

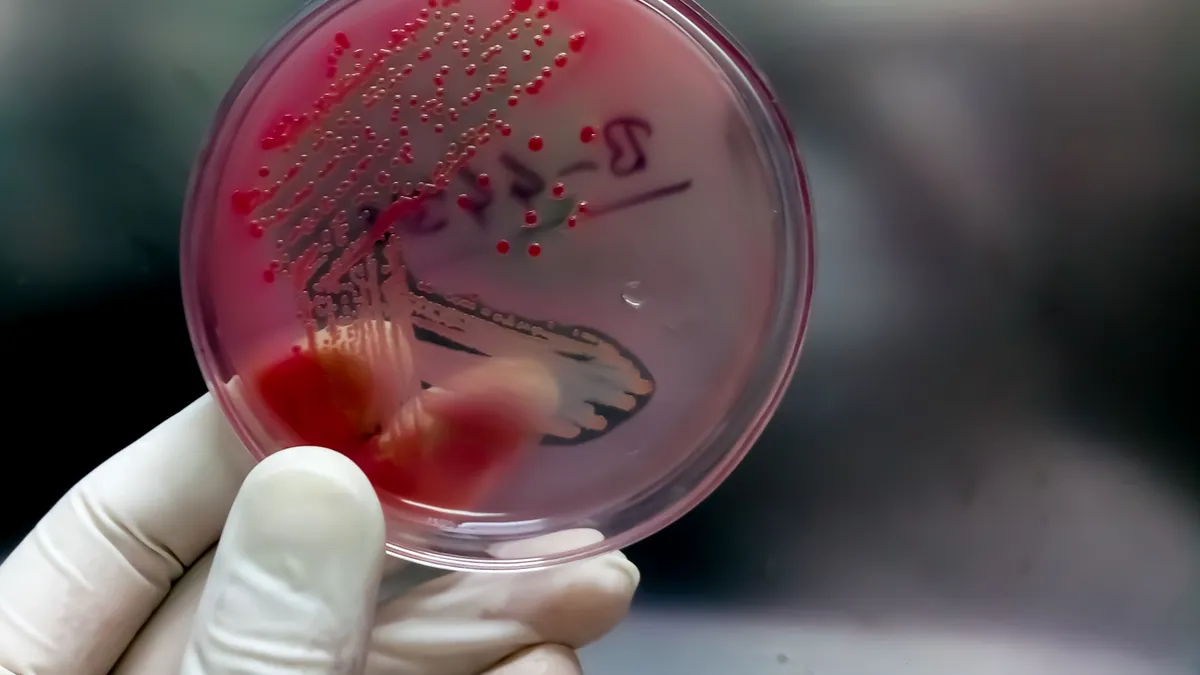

Antibiotic maker Paratek, low on cash, agrees to a buyout

Gurnet Point Capital and Novo Holdings aim to take Paratek private in a deal that highlights the challenges small biotechs face selling new antibiotics.

By Ben Fidler • June 6, 2023 -

Novo Nordisk in talks to acquire French device-maker Biocorp for $165M

Biocorp’s “smart pen” technology could improve diabetes management and potentially be used in other areas Novo works in like obesity, one analyst said.

By Elise Reuter • Updated June 6, 2023 -

Concentra bids on Atea, seeking to acquire another struggling biotech

However, Atea’s board said Tuesday they rejected the offer from Concentra, which was recently involved in the takeover of Jounce Therapeutics.

By Gwendolyn Wu • Updated May 30, 2023 -

Ironwood to buy rare disease drugmaker in billion-dollar deal

The acquisition would give Ironwood a drug in late-stage testing for a condition known as short bowel syndrome, further building out the company’s gastrointestinal-focused research.

By Jacob Bell • May 22, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

On heels of Amgen lawsuit, FTC broadens investigation of PBMs

The regulator is probing the business practices of two more drug purchasing organizations, deepening an investigation that began last year.

By Kristin Jensen • May 18, 2023 -

Biotech Scribe strikes gene editing deal with Lilly subsidiary

The California-based company now has partnerships in place with Sanofi, Biogen and Lilly’s Prevail.

By Gwendolyn Wu • May 16, 2023 -

FTC sues to block Amgen’s $27.8B deal for Horizon

The regulator’s challenge will test a more expansive view of how pharmaceutical mergers could harm consumers. Amgen remains confident it can complete the deal, however.

By Jonathan Gardner • May 16, 2023 -

Gilead expands Arcus partnership, with eye to inflammatory disease

The new deal is worth up to $1 billion, and will see the two collaborators work together on up to four inflammatory disease drug targets.

By Jonathan Gardner • May 15, 2023 -

A struggling biotech wraps its main assets into a new drug company

Cyclerion Therapeutics has struck an agreement to sell two of its experimental drugs, known as sGC stimulators, to a newly formed company in exchange for cash and equity.

By Jacob Bell • May 12, 2023 -

Pharma contractor Syneos to be taken private in $7.1B deal

The offer from a group of private equity firms comes after a series of ups and downs for Syneos, which was formed through the 2017 merger of contract research firms InVentiv Health and INC Research.

By Kristin Jensen • May 10, 2023 -

FibroGen grabs an option to buy cancer drug startup Fortis

The deal, which gives FibroGen four years to acquire Fortis at a pre-negotiated price, allows the startup to earn returns for its investors without relying on an IPO in a tough market.

By Gwendolyn Wu • May 9, 2023 -

Gilead acquires San Diego startup for early-stage cancer, immune drugs

The buyout of privately held XinThera continues a string of recent acquisitions of smaller biotechs by Gilead and hands it a group of drug prospects that could begin clinical testing later this year.

By Ned Pagliarulo • May 9, 2023 -

Roche pays China-based biotech $70M for a new HER2 drug

The drug, currently in Phase 1, is an oral medicine designed to cross the blood-brain barrier and better treat HER2 tumors that have spread to the brain.

By Jonathan Gardner • May 9, 2023 -

Recursion to acquire two Canadian drug discovery startups

The company agreed to buy Cyclica and Valence after winnowing down a list of more than 100 potential takeover targets, its CEO told BioPharma Dive.

By Gwendolyn Wu • May 8, 2023 -

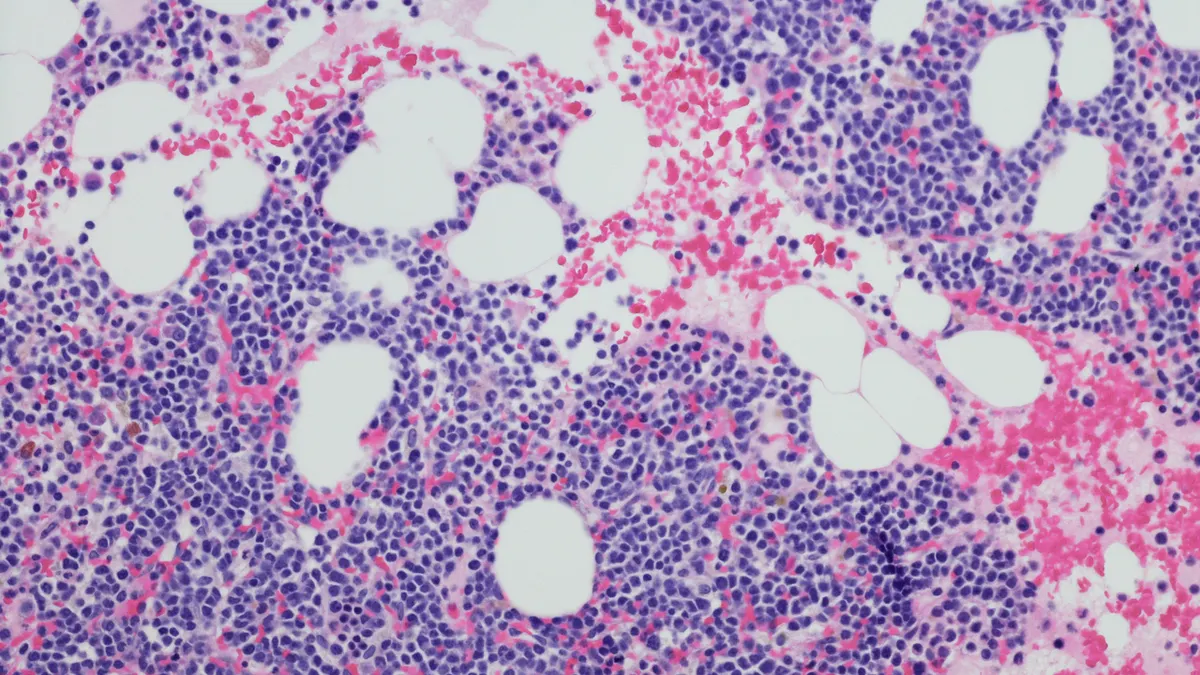

J&J, building on CAR-T success, strikes another cell therapy deal

Fresh off its success with the multiple myeloma treatment Carvykti, J&J is paying Cellular Biomedicine Group $245 million upfront for rights to two experimental cell therapies for blood cancer.

By Delilah Alvarado • May 2, 2023 -

Astellas to acquire eye drug developer Iveric Bio for $5.9B

Though Iveric previously rebranded as a gene therapy company, Astellas is most interested in its experimental geographic atrophy drug that’s now under regulatory review.

By Ben Fidler • May 1, 2023